In the world of finance, the average U.S. stock market growth rate is a key metric that investors and financial analysts closely monitor. This rate provides a snapshot of the overall performance of the stock market, giving investors insights into potential opportunities and risks. In this article, we'll delve into what the average U.S. stock market growth rate represents, its historical trends, and how it impacts investors.

What is the Avg US Stock Market Growth Rate?

The average U.S. stock market growth rate refers to the compounded annual growth rate (CAGR) of the major stock market indices, such as the S&P 500, over a specific period. This rate is calculated by dividing the final value of the index by the initial value and then raising that figure to the power of one divided by the number of years in the period, and finally subtracting one. This formula allows us to determine the average annual return an investor would have received if they had invested in the stock market during that period.

Historical Trends

Historically, the U.S. stock market has demonstrated a strong growth rate. Over the past century, the S&P 500 has returned an average annual growth rate of approximately 7-8%. However, this rate can vary significantly depending on the time frame and market conditions.

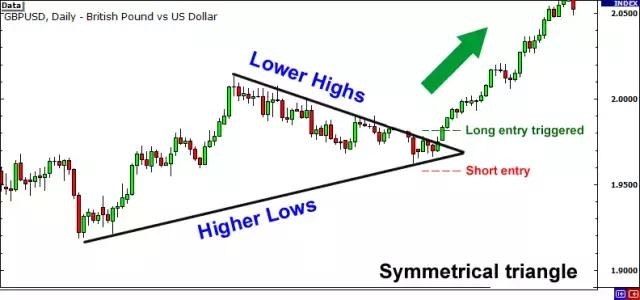

For instance, during the 20th century, the U.S. stock market experienced several bull markets and bear markets. The dot-com bubble of the late 1990s and the financial crisis of 2008 are two notable periods where the stock market saw significant volatility.

Impact on Investors

Understanding the average U.S. stock market growth rate is crucial for investors as it helps them make informed decisions about their investment strategies. By knowing the historical growth rate, investors can:

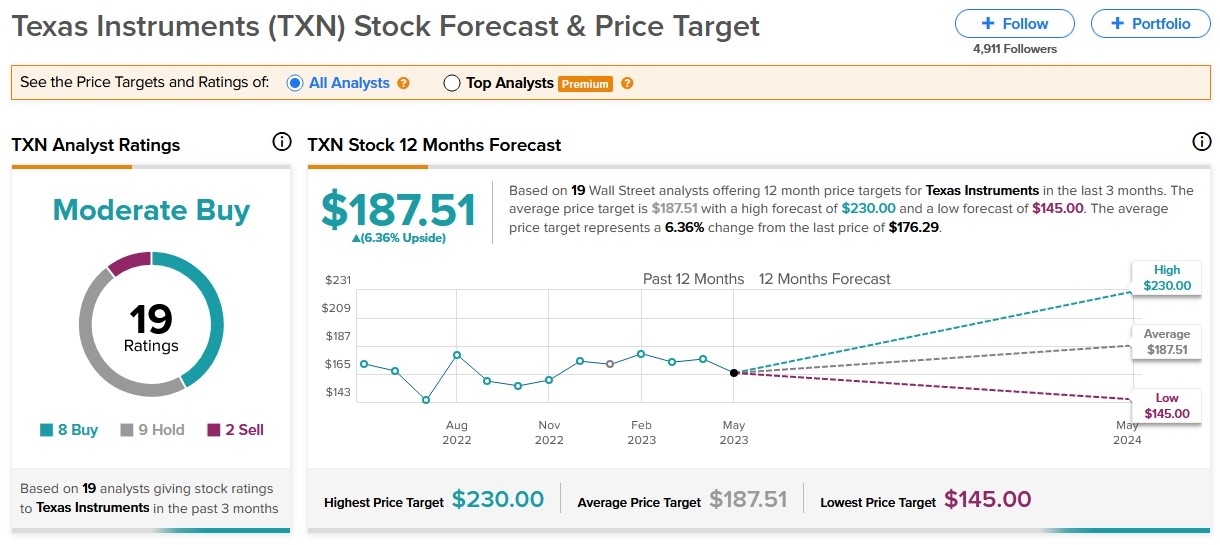

Assess the Potential for Returns: Investors can use the historical growth rate as a benchmark to evaluate the potential returns of their investments. A stock with a higher growth rate than the market average may offer more significant returns, but it also comes with increased risk.

Plan for Retirement: Retirees and those saving for retirement need to understand the average growth rate to ensure they can generate sufficient income from their investments.

Make Informed Decisions: Investors can use the historical growth rate to compare different investment options and select the ones that align with their risk tolerance and financial goals.

Case Studies

To illustrate the impact of the average U.S. stock market growth rate, let's consider two case studies:

Investing in the S&P 500: Suppose an investor invested

10,000 in the S&P 500 in 1920. If we assume an average annual growth rate of 7%, the value of their investment would have grown to approximately 1.6 million by 2020.Investing in a Dividend Stock: Let's say an investor bought a dividend-paying stock with a 2% growth rate. Over a 30-year period, the investor would have seen their investment grow from

10,000 to approximately 314,000, assuming a 3% dividend yield.

Conclusion

In conclusion, the average U.S. stock market growth rate is a vital metric for investors and financial analysts. By understanding the historical trends and the impact of this rate on investment returns, investors can make informed decisions and plan for their financial future.