The futures market in the United States is a crucial component of the global financial landscape. It provides a platform for investors and traders to speculate on the future price of assets, from commodities to stocks and currencies. In this article, we'll delve into the latest updates on US futures, highlighting key trends and insights.

Trends in US Futures Market

The US futures market has been experiencing significant shifts in recent months. One of the most notable trends is the growing popularity of cryptocurrency futures. With the surge in cryptocurrency prices, more investors are turning to futures as a way to gain exposure to the market without owning the actual cryptocurrency. Bitcoin futures, in particular, have gained traction, with platforms like CME Group and Bakkt offering trading options.

Another trend is the increasing use of machine learning and artificial intelligence in futures trading. These technologies are helping traders analyze vast amounts of data to make informed trading decisions. By utilizing advanced algorithms, traders can identify patterns and predict market movements more accurately.

Analysis of Key Futures Markets

The US futures market covers a wide range of assets, each with its unique characteristics. Let's take a closer look at some of the key markets:

Commodities: The commodity futures market includes trading in energy, agricultural, and metals futures. One of the most actively traded commodity futures is crude oil. In recent months, oil futures have seen a volatile trading pattern, reflecting global supply and demand concerns.

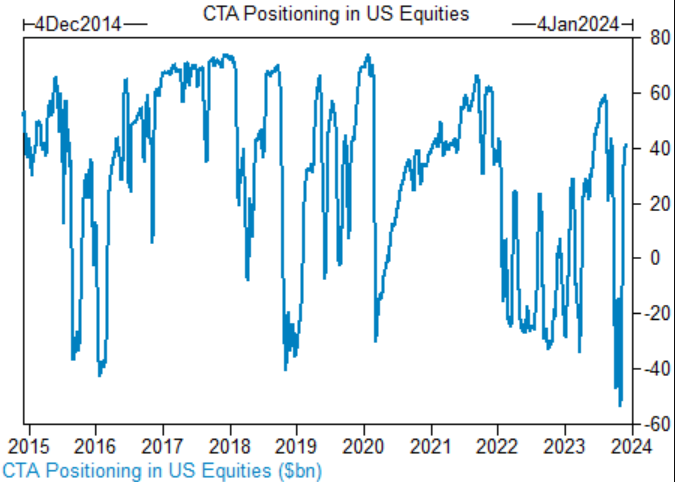

Stocks: Stock futures are popular among investors looking to gain exposure to the stock market without owning actual shares. The S&P 500 futures are a benchmark for the overall performance of the US stock market. As of late, the S&P 500 futures have been reflecting the broader market trends, with periods of both gains and losses.

Currency: Currency futures allow traders to speculate on the value of one currency against another. The US dollar futures market is one of the most liquid and active markets. Factors such as trade policy, interest rates, and economic data releases can significantly impact currency futures prices.

Case Studies: Impact of Economic Data on Futures Markets

Economic data releases play a crucial role in shaping futures markets. Here are two case studies that illustrate this impact:

Nonfarm Payroll Data: The monthly nonfarm payroll report is a key indicator of the US labor market's health. When the report shows stronger job creation, it often leads to an increase in stock futures prices. Conversely, weaker job numbers can cause a decline in futures prices.

Interest Rate Decisions: The Federal Reserve's interest rate decisions can have a significant impact on futures markets. When the Fed raises rates, it often leads to a stronger dollar and a decrease in stock futures prices. On the other hand, lower interest rates can boost futures prices as investors seek higher returns.

In conclusion, the US futures market is a dynamic and ever-evolving landscape. Understanding the key trends and factors that influence futures prices can help investors make informed trading decisions. As the market continues to evolve, it will be essential to stay updated on the latest developments and analysis.