The stock market is a dynamic and complex landscape, where the prices of stocks can fluctuate significantly based on various factors. Among these stocks, the US Steel stock price is of particular interest to investors and industry analysts alike. This article aims to provide a comprehensive overview of the US Steel stock price, examining its trends, influences, and future prospects.

What is US Steel?

To understand the stock price, it is crucial to first understand the company itself. US Steel (NYSE: X), founded in 1901, is one of the world's leading steel producers. The company operates in North America and Europe, providing a wide range of steel products for various industries, including automotive, construction, and energy.

Factors Influencing the US Steel Stock Price

The stock price of any company is influenced by a variety of factors, and US Steel is no exception. Here are some of the key factors that can impact the stock price:

1. Economic Conditions

The global economic environment plays a significant role in determining the stock price. When the economy is growing, demand for steel typically increases, leading to higher prices and profits for US Steel. Conversely, in times of economic downturn, demand for steel tends to decrease, which can negatively impact the company's performance and, subsequently, its stock price.

2. Steel Industry Trends

The steel industry itself is subject to fluctuations due to changes in supply and demand. Influences such as overcapacity, tariffs, and trade disputes can significantly impact the industry's performance, and by extension, the stock price.

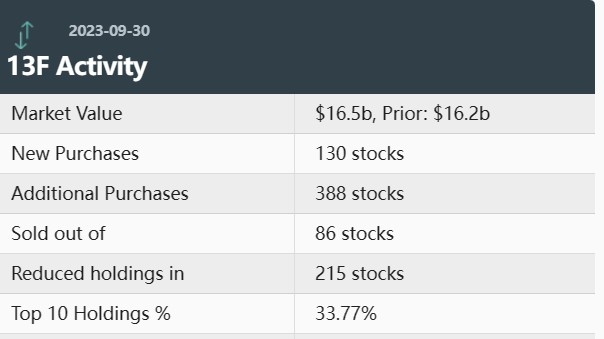

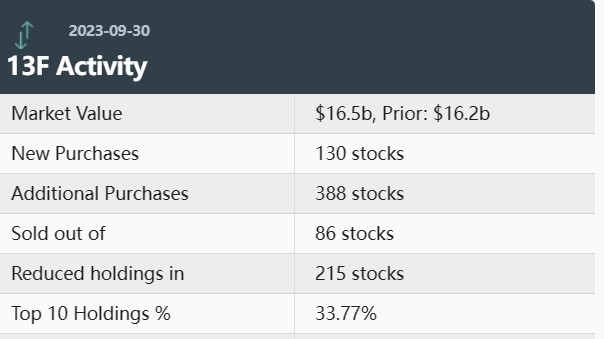

3. Company Performance

The financial performance of US Steel, including its revenue, earnings, and dividend payments, is a crucial factor in determining its stock price. Strong financial performance tends to result in a higher stock price, while poor performance can lead to a decline.

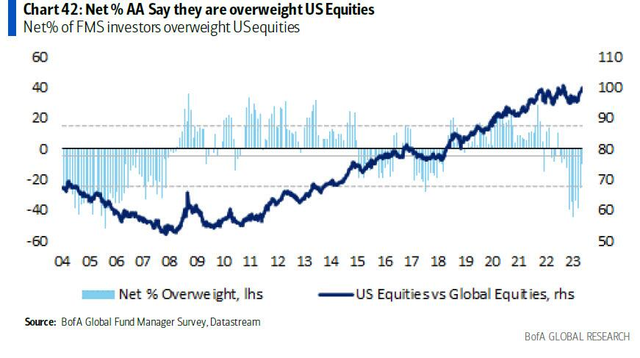

4. Market Sentiment

Market sentiment can also play a role in the stock price. Positive sentiment about the steel industry or US Steel as a company can drive the stock price higher, while negative sentiment can have the opposite effect.

Recent Trends in the US Steel Stock Price

Analyzing the recent trends in the US Steel stock price can provide valuable insights into the factors mentioned above. For instance, the stock price has shown significant volatility in recent years, reflecting the company's exposure to economic and industry-specific factors.

Case Study: The Impact of Tariffs

A notable case study is the impact of tariffs on the US Steel stock price. In 2018, the United States imposed tariffs on steel imports, which initially had a positive effect on the stock price as it protected US Steel from foreign competition. However, as the tariffs were prolonged and other countries retaliated, the stock price experienced a downward trend, reflecting the broader economic and industry-specific challenges.

Conclusion

Understanding the US Steel stock price requires considering a variety of factors, including economic conditions, industry trends, company performance, and market sentiment. By analyzing these factors, investors and industry analysts can gain valuable insights into the potential future performance of the stock. As the global economy continues to evolve, keeping a close eye on these factors will be crucial for anyone interested in investing in US Steel or the steel industry as a whole.