The election season is always a hot topic in the United States, and its impact on the stock market is a subject of intense scrutiny. The election results can sway investor sentiment, drive market trends, and shape the economic landscape. In this article, we'll delve into the potential outcomes for the US stock market following an election, analyzing the various factors that could influence its trajectory.

Post-Election Sentiment: The Psychological Factor

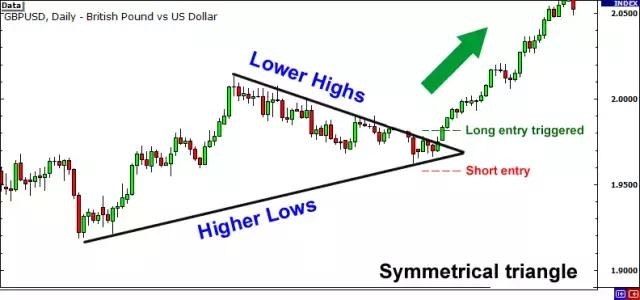

One of the most significant impacts of an election on the stock market is the shift in investor sentiment. Historically, market reactions to election outcomes have varied. In some instances, investors have shown optimism, leading to bullish trends; in others, uncertainty and fear have dominated, causing volatility and corrections.

For example, the 2016 election, where Donald Trump won the presidency, was followed by a record-breaking bull market. Investors were hopeful about the potential for tax cuts, regulatory rollbacks, and infrastructure spending under a Trump administration. Conversely, the 2008 election, which saw Barack Obama's victory, was followed by market uncertainty and a decline in stock prices due to the global financial crisis.

Economic Policies: The Policy Factor

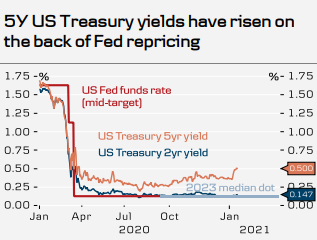

The policies and initiatives proposed by the winning candidate can have a profound impact on the stock market. For instance, tax policies, trade agreements, and regulatory reforms are key areas where the administration can influence market dynamics.

A pro-growth agenda, such as tax cuts and deregulation, often boosts investor confidence and can lead to growth in stock prices. On the other hand, protectionist policies or higher taxes can create uncertainty and potentially hamper economic growth, leading to market corrections.

Market Sector Impact: The Sector Factor

Different sectors of the economy may react differently to election outcomes. For instance, technology stocks often perform well under a pro-business administration, while energy stocks might benefit from pro-energy policies.

Historical Case Studies: The Power of Historical Data

To understand the potential impact of the upcoming election on the stock market, it's useful to look at historical data. The 2016 election, where Donald Trump won, is a prime example of how a candidate's economic policies can drive market trends. During his presidency, the S&P 500 Index saw significant gains, driven by tax cuts and regulatory rollbacks.

Similarly, the 2008 election, which saw Barack Obama's victory, was followed by a period of market uncertainty and volatility. Despite this, the stock market eventually recovered and reached new highs over the following years.

Conclusion: Navigating the Uncertainty

The relationship between the US stock market and the election season is complex and multifaceted. While the election can create uncertainty and volatility, it can also present opportunities for growth and investment. By understanding the various factors at play, investors can better navigate the post-election landscape and make informed decisions.

As the election season approaches, it's essential to stay informed and vigilant. Whether the outcome is a win for one party or the other, the stock market will continue to evolve, reflecting the changing economic and political landscape.