Are you looking to diversify your investment portfolio and gain access to the dynamic US stock market? If so, trading US stocks in Hong Kong could be the perfect solution for you. Hong Kong offers a unique opportunity for international investors to trade US stocks with ease and convenience. In this article, we will explore the benefits of trading US stocks in Hong Kong, the process involved, and provide you with valuable insights to help you make informed decisions.

Why Trade US Stocks in Hong Kong?

Hong Kong is a global financial hub with a well-established and robust stock market. Here are some key reasons why you might consider trading US stocks in Hong Kong:

- Convenience: Trading US stocks in Hong Kong is straightforward and accessible. You can trade US stocks through local brokers, eliminating the need for complex international transactions.

- Regulatory Framework: Hong Kong has a strong regulatory framework that ensures fair and transparent trading practices. This provides investors with confidence and security.

- Diversification: By trading US stocks in Hong Kong, you can diversify your portfolio and gain exposure to the world's largest and most dynamic stock market.

- Competitive Costs: Trading costs in Hong Kong are generally lower compared to other international markets, making it an attractive option for investors.

How to Trade US Stocks in Hong Kong

To trade US stocks in Hong Kong, you will need to follow these steps:

- Open a Brokerage Account: Choose a reputable brokerage firm in Hong Kong that offers US stock trading services. Compare fees, customer service, and platform features to find the best fit for your needs.

- Fund Your Account: Transfer funds from your local bank account to your brokerage account. Ensure that you have enough capital to cover your investment goals.

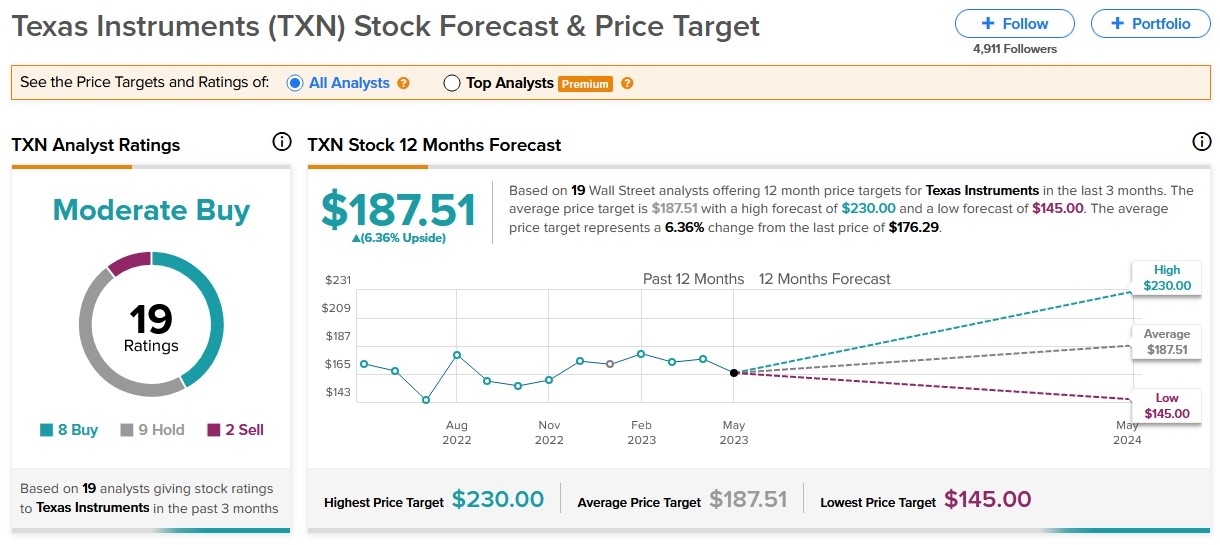

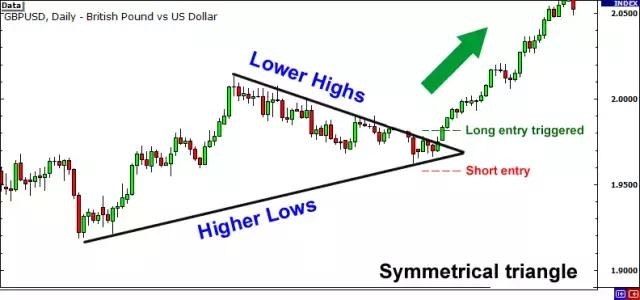

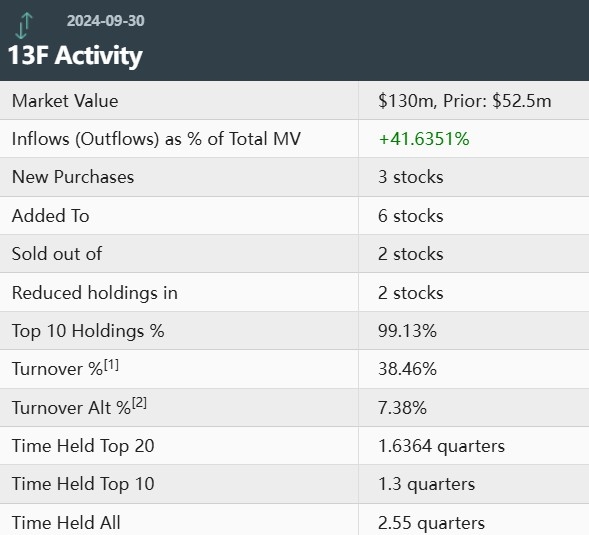

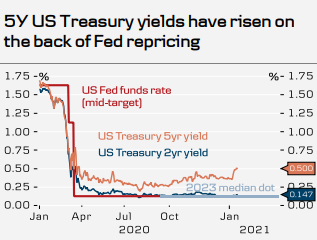

- Research and Analyze: Conduct thorough research on the US stocks you are interested in. Analyze financial statements, market trends, and other relevant factors to make informed investment decisions.

- Place Your Order: Once you have identified a stock you want to trade, place your order through your brokerage platform. You can choose from various order types, such as market orders, limit orders, and stop orders.

- Monitor Your Investments: Keep track of your investments and stay informed about market developments. Adjust your portfolio as needed to align with your investment goals.

Benefits of Trading US Stocks in Hong Kong

Trading US stocks in Hong Kong offers several benefits, including:

- Access to a Wide Range of US Stocks: Hong Kong brokers typically offer access to a wide range of US stocks, including blue-chip companies, small-cap stocks, and emerging growth companies.

- Advanced Trading Platforms: Many Hong Kong brokers provide advanced trading platforms with powerful tools and features to help you make informed investment decisions.

- Competitive Fees: Trading fees in Hong Kong are generally lower compared to other international markets, making it an affordable option for investors.

Case Study: Investing in US Tech Stocks through Hong Kong

Let's consider a hypothetical scenario where an investor wants to invest in US tech stocks. By trading US stocks in Hong Kong, the investor can gain access to leading tech companies such as Apple, Microsoft, and Google. By conducting thorough research and analyzing market trends, the investor can make informed decisions and potentially achieve significant returns on their investments.

In conclusion, trading US stocks in Hong Kong offers numerous benefits for international investors. By following the steps outlined in this article, you can easily access the dynamic US stock market and diversify your investment portfolio. Remember to conduct thorough research and stay informed about market developments to make informed investment decisions.