The recent economic downturn has left many investors questioning whether the stock market has fully recovered. With the global economy facing unprecedented challenges, it's essential to understand the current state of the market and its potential for growth. In this article, we'll delve into the factors contributing to the stock market's recovery and provide insights into the future outlook.

Market Performance

Since the peak of the pandemic-induced market crash in March 2020, the stock market has shown remarkable resilience. The S&P 500, a widely followed benchmark index, has surged over 100% since its lowest point. This recovery can be attributed to several factors, including:

- Monetary Policy: The Federal Reserve has implemented unprecedented measures to support the economy, including interest rate cuts and quantitative easing. These policies have helped stabilize financial markets and encourage investment.

- Government Stimulus: The government's stimulus packages have provided much-needed relief to businesses and individuals, boosting consumer spending and corporate earnings.

- Vaccine Rollout: The successful rollout of COVID-19 vaccines has led to a gradual reopening of the economy, which has positively impacted corporate earnings and consumer confidence.

Sector Performance

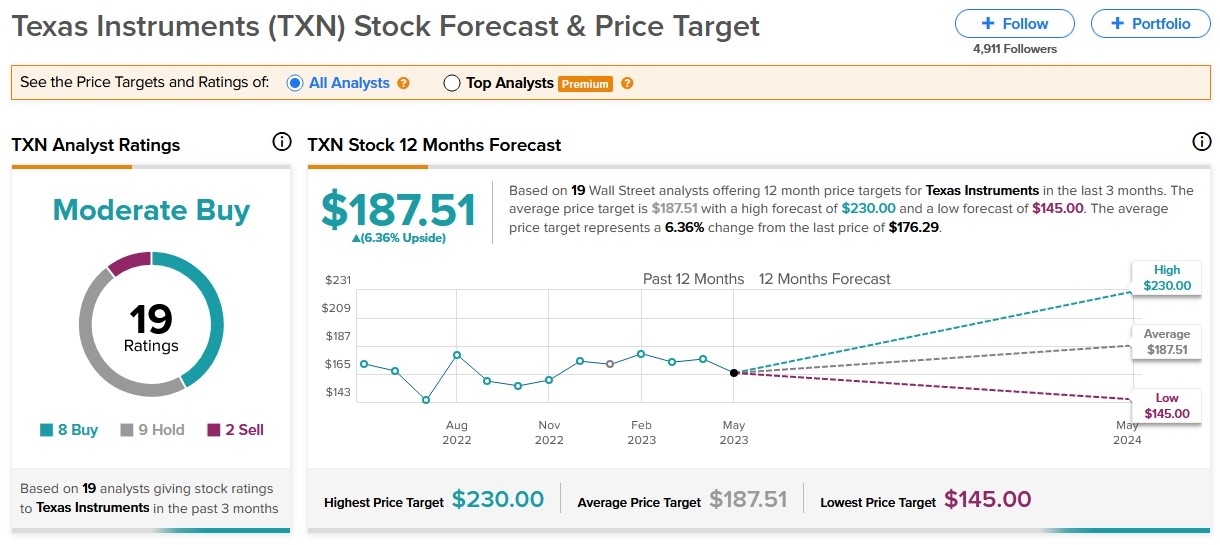

While the overall market has recovered, certain sectors have outperformed others. Tech stocks, for example, have seen significant gains, driven by strong demand for technology products and services during the pandemic. Tech giants like Apple, Microsoft, and Amazon have seen their share prices soar, contributing to the overall market's recovery.

On the other hand, sectors like energy and financials have struggled to recover. The energy sector has been hit hard by the decline in oil prices, while the financial sector has faced challenges due to the low-interest-rate environment.

Market Valuations

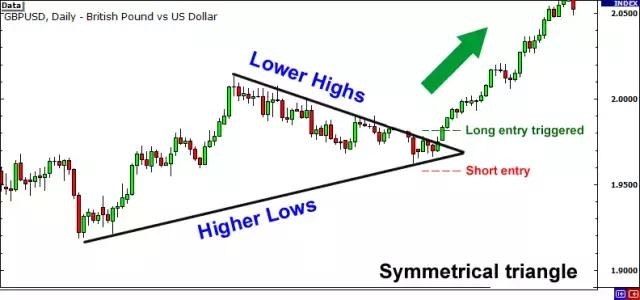

Despite the strong recovery, some investors are concerned about the market's valuations. The S&P 500 is currently trading at a price-to-earnings (P/E) ratio of around 22, which is above its long-term average of around 15. This suggests that the market may be overvalued, and investors should be cautious.

Future Outlook

The future of the stock market remains uncertain. While the economic recovery is well underway, there are still several risks that could hinder the market's growth. These include:

- COVID-19 Variants: The emergence of new variants of the virus could lead to another wave of infections and economic disruptions.

- Inflation: The Federal Reserve's aggressive monetary policy could lead to higher inflation, which could erode the purchasing power of investors.

- Geopolitical Tensions: Tensions between the United States and China, as well as other geopolitical issues, could impact global markets.

Conclusion

While the stock market has shown remarkable resilience in the face of the pandemic, investors should remain cautious. The market's recovery is driven by several factors, including monetary policy, government stimulus, and the successful rollout of vaccines. However, there are still risks that could hinder the market's growth. As always, it's important for investors to conduct thorough research and consider their risk tolerance before making investment decisions.