The recent US stock falls have left investors and market analysts alike scratching their heads. With the S&P 500 dropping by over 2% in a single trading session, it's clear that the market is experiencing some turbulent times. This article delves into the reasons behind the stock falls, their impact on the market, and potential recovery scenarios.

Reasons for the Stock Falls

Several factors have contributed to the recent US stock falls. The most significant among them include:

- Inflation Concerns: The Federal Reserve's recent decision to raise interest rates to combat inflation has created uncertainty in the market. Investors are worried that higher interest rates will slow down economic growth and negatively impact corporate earnings.

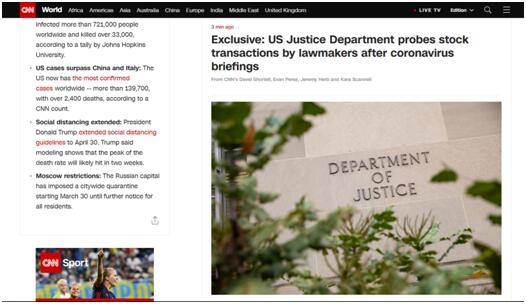

- Global Economic Concerns: The ongoing trade tensions between the US and China, along with economic slowdowns in other parts of the world, have added to the market's uncertainty.

- Tech Stocks: The tech sector, which has been a major driver of the stock market's growth over the past few years, has experienced a significant pullback. This has had a ripple effect on the broader market.

Impact of the Stock Falls

The recent US stock falls have had a significant impact on the market. Some of the key impacts include:

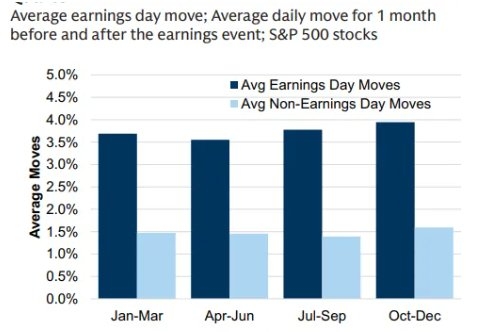

- Market Volatility: The stock market has become increasingly volatile, with sharp ups and downs in stock prices.

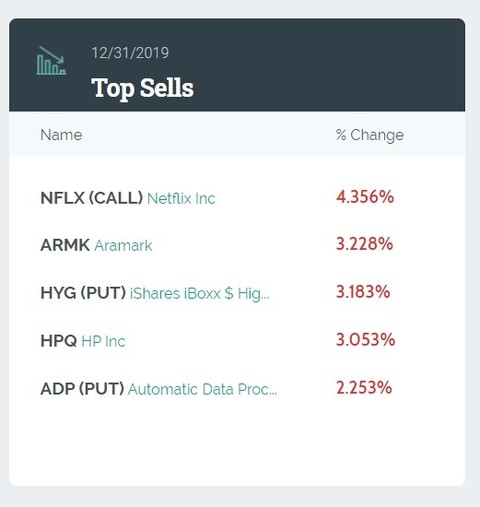

- Losses for Investors: Investors who held stocks during the recent falls have seen their portfolios decline in value.

- Economic Concerns: The stock market is often considered a leading indicator of economic health. The recent falls have raised concerns about the overall economic outlook.

Potential Recovery Scenarios

Despite the recent US stock falls, there are several potential recovery scenarios:

- Economic Growth: If the economy continues to grow, corporate earnings will likely improve, leading to a rebound in stock prices.

- Interest Rate Cuts: If the Federal Reserve decides to cut interest rates, it could boost investor confidence and lead to a market recovery.

- Tech Sector Recovery: A rebound in the tech sector could have a positive impact on the broader market.

Case Study: The 2008 Financial Crisis

One of the most significant US stock falls in history occurred during the 2008 financial crisis. The S&P 500 dropped by over 50% in just 18 months. However, the market eventually recovered, and the S&P 500 reached an all-time high in 2013.

The key lesson from the 2008 financial crisis is that while stock market falls can be devastating, they can also be a buying opportunity. Investors who had the patience to ride out the storm ended up making significant profits.

Conclusion

The recent US stock falls have been a wake-up call for investors. However, it's important to remember that market volatility is a normal part of investing. By understanding the reasons behind the stock falls and potential recovery scenarios, investors can make more informed decisions and navigate the market's ups and downs with greater confidence.