Investing in stocks has long been a cornerstone of wealth building, and traditionally, investors have focused on the U.S. market. However, with the global economy becoming more interconnected, the question arises: Can you invest in stocks outside the US? The answer is a resounding yes, and this article will explore the benefits and strategies of investing in international stocks.

Diversification Beyond the U.S.

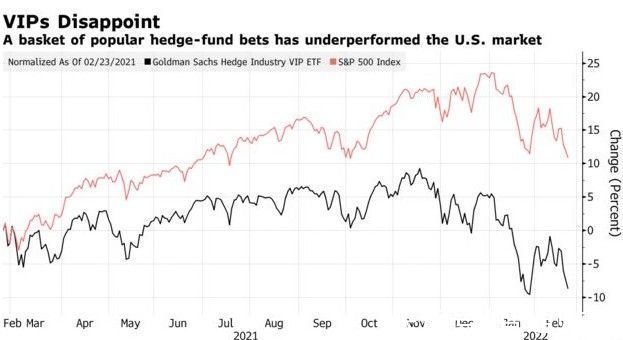

One of the primary reasons to consider investing in stocks outside the US is diversification. The U.S. stock market, while robust, is not immune to downturns. By investing in international stocks, you can spread your risk across different regions and economies, potentially reducing the impact of any single market's volatility.

Access to Global Opportunities

The global market offers a vast array of opportunities that may not be available in the U.S. Consider, for instance, the rise of technology companies in Asia or the emerging markets in Latin America. These regions often have unique growth stories and industries that can offer significant returns.

Currency Exposure

Investing in international stocks can also provide currency exposure, which can be a double-edged sword. While it can increase your risk, it also offers the potential for significant gains if the foreign currency strengthens against the U.S. dollar.

Strategies for International Stock Investing

When investing in stocks outside the US, there are several strategies to consider:

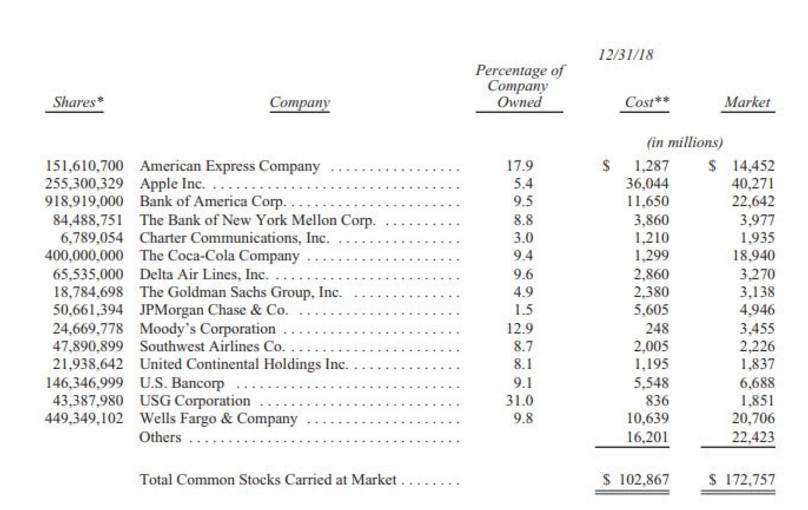

Direct Investment: This involves purchasing stocks directly in foreign markets. This can be done through a brokerage firm that offers international trading capabilities.

American Depositary Receipts (ADRs): ADRs are U.S.-traded shares representing ownership in a foreign company's stock. This is a convenient way to invest in international stocks without dealing with foreign exchanges.

International Exchange-Traded Funds (ETFs): ETFs provide exposure to a basket of international stocks. They are a cost-effective way to diversify your portfolio globally.

Mutual Funds: Mutual funds that focus on international stocks can be a good option for those who prefer a hands-off approach.

Case Study: Investing in China

Let's take a look at a case study to illustrate the potential benefits of international stock investing. Consider a tech company in China that has seen exponential growth over the past decade. By investing in this company through an ADR, an investor could have benefited significantly from its rise, despite the volatility of the Chinese stock market.

Conclusion

Investing in stocks outside the US is not only possible but can be a valuable strategy for diversifying your portfolio and accessing global opportunities. By understanding the various methods and risks involved, you can make informed decisions that align with your investment goals. Whether you choose direct investment, ADRs, ETFs, or mutual funds, the global market offers a world of possibilities for your investment portfolio.