In today's fast-paced financial world, staying updated with the latest US stock prices is crucial for investors and traders. Whether you are a seasoned pro or just starting out, understanding the current market trends and price movements can significantly impact your investment decisions. This article aims to provide you with a comprehensive overview of the latest US stock prices, highlighting key trends and insights.

Understanding the Importance of Stock Prices

Stock prices are a reflection of the market's perception of a company's value. They are influenced by various factors, including the company's financial performance, industry trends, economic indicators, and geopolitical events. By keeping an eye on the latest US stock prices, investors can gain valuable insights into the market and make informed decisions.

Key Factors Influencing Stock Prices

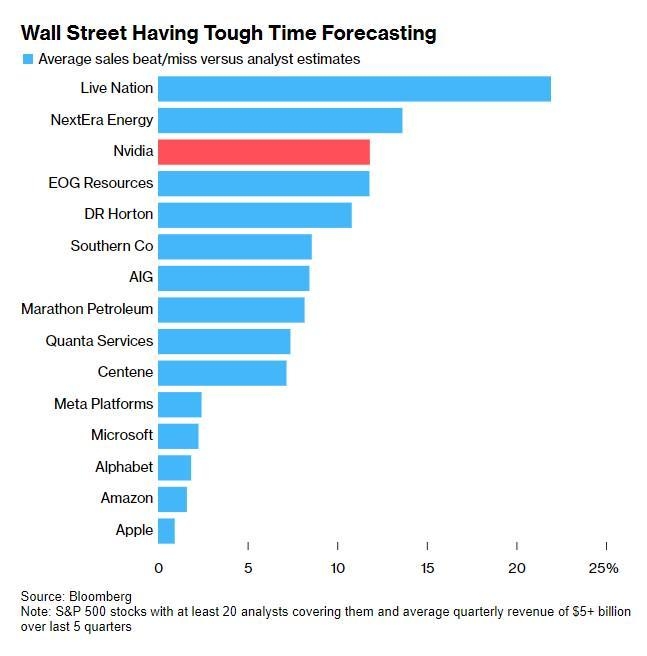

Company Performance: The financial results of a company, such as earnings reports, revenue growth, and profit margins, play a significant role in determining its stock price. Companies that consistently deliver strong performance tend to see their stock prices rise.

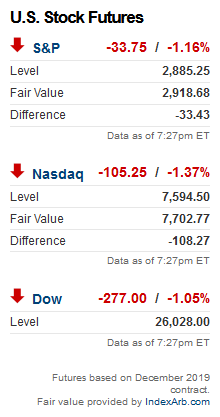

Economic Indicators: Economic indicators, such as GDP growth, unemployment rates, and inflation, can impact the overall market sentiment and, consequently, stock prices. For instance, a strong economy may lead to higher stock prices, while a weak economy may result in lower prices.

Industry Trends: Changes in industry trends can significantly impact stock prices. For example, technological advancements, regulatory changes, and shifts in consumer preferences can all influence the value of a company's shares.

Geopolitical Events: Political instability, trade wars, and other geopolitical events can create uncertainty in the market, leading to volatility in stock prices. Investors often react to these events by buying or selling stocks accordingly.

Latest US Stock Prices: Key Insights

Technology Sector: The technology sector has been a major driver of the US stock market's growth in recent years. Companies like Apple, Microsoft, and Amazon have seen their stock prices soar, making them some of the most valuable companies in the world.

Healthcare Industry: The healthcare industry has also seen significant growth, driven by advancements in medical technology and an aging population. Companies like Johnson & Johnson and Pfizer have seen their stock prices rise as a result.

Energy Sector: The energy sector has experienced volatility in recent years, due to factors such as geopolitical tensions and technological advancements. Companies like ExxonMobil and Chevron have seen their stock prices fluctuate accordingly.

Case Study: Tesla Inc.

Tesla Inc., an electric vehicle manufacturer, has become a symbol of the technology sector's growth. Its stock price has skyrocketed since its initial public offering (IPO) in 2010, driven by strong sales of its vehicles and a promising future in the electric vehicle market. However, the stock has also experienced significant volatility, reflecting the company's high-risk profile.

Conclusion

Keeping track of the latest US stock prices is essential for investors and traders looking to make informed decisions. By understanding the key factors influencing stock prices and staying updated with the latest market trends, investors can gain a competitive edge in the financial markets. Whether you are a long-term investor or a short-term trader, staying informed about the latest US stock prices is a crucial step towards achieving your investment goals.