In the world of finance, the "US share market value" is a term that encapsulates the total worth of all publicly traded companies in the United States. This value is a critical indicator of the overall health and performance of the American economy. In this article, we will delve into what US share market value represents, how it is calculated, and its significance in the global financial landscape.

What is US Share Market Value?

The US share market value refers to the total market capitalization of all stocks listed on American stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. Market capitalization is calculated by multiplying the number of outstanding shares of a company by its current market price. This figure represents the total value of a company's equity and is often used as a measure of its size and financial health.

How is US Share Market Value Calculated?

To calculate the US share market value, you need to add up the market capitalizations of all publicly traded companies in the United States. This involves gathering data on the number of outstanding shares and the current market price for each company. For example, if Company A has 100 million outstanding shares and is currently trading at

Significance of US Share Market Value

The US share market value is a vital indicator of the overall health and performance of the American economy. It reflects the collective worth of the country's businesses and provides insights into the economic landscape. Here are some key reasons why the US share market value is significant:

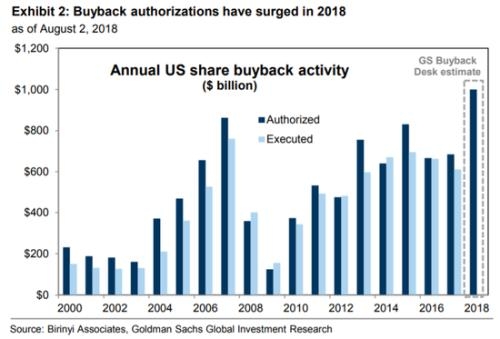

- Economic Growth: A rising US share market value often indicates economic growth and investor confidence in the American market. This can lead to increased investment, job creation, and overall economic prosperity.

- Investor Confidence: The US share market is one of the largest and most liquid in the world, attracting investors from around the globe. A strong market value can boost investor confidence and encourage further investment.

- Global Influence: The US share market has a significant impact on global financial markets. Changes in the US share market value can influence market trends and investor sentiment worldwide.

Case Study: The 2020 US Share Market Crash

One of the most notable events in the US share market was the 2020 crash, triggered by the COVID-19 pandemic. In February 2020, the S&P 500 index plummeted by nearly 30% in just a few weeks. This rapid decline was attributed to a combination of factors, including market overvaluation, economic uncertainty, and panic selling.

Despite the initial drop, the US share market quickly recovered, with the S&P 500 index bouncing back to pre-crisis levels within a few months. This rapid recovery demonstrated the resilience of the American economy and the ability of the US share market to bounce back from adverse events.

Conclusion

Understanding the US share market value is crucial for investors, economists, and anyone interested in the global financial landscape. By analyzing market capitalization, investors can gain insights into the overall health and performance of the American economy and make informed investment decisions. As the world's largest stock market, the US share market value continues to play a vital role in shaping the global financial landscape.