Introduction

In recent years, the trend of foreign companies purchasing US stocks has surged, marking a significant shift in global investment patterns. This article delves into the reasons behind this trend, its impact on the US stock market, and the benefits it offers to both investors and the economy at large.

Reasons for the Surge

- Strong Economic Performance: The US economy has been consistently performing well, with low unemployment rates and robust growth. This has attracted foreign investors seeking profitable investment opportunities.

- Attractive Valuations: Despite the strong performance, many US stocks are still trading at attractive valuations, making them an appealing target for foreign investors.

- Diversification: Foreign companies are increasingly looking to diversify their investment portfolios to mitigate risks. Investing in US stocks offers a chance to diversify into a different market with different economic cycles and growth prospects.

Impact on the US Stock Market

The influx of foreign investment has had a positive impact on the US stock market. Here’s how:

- Increased Liquidity: Foreign investors bring substantial capital into the US stock market, increasing liquidity and making it easier for companies to raise funds.

- Higher Stock Prices: The increased demand for US stocks drives up their prices, benefiting existing shareholders.

- Greater Competition: The entry of foreign companies into the US stock market adds to the competition, pushing US companies to innovate and improve their performance.

Benefits to Investors and the Economy

- Higher Returns: Foreign investors can benefit from the strong performance of US stocks, potentially leading to higher returns.

- Job Creation: The inflow of foreign investment can lead to increased business activities, which in turn can create jobs.

- Economic Growth: The increased investment in the US stock market can stimulate economic growth and contribute to the overall prosperity of the country.

Case Studies

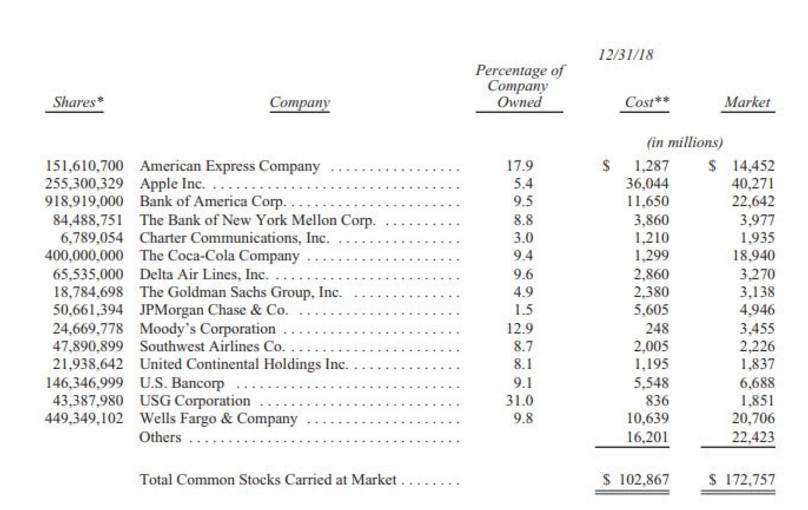

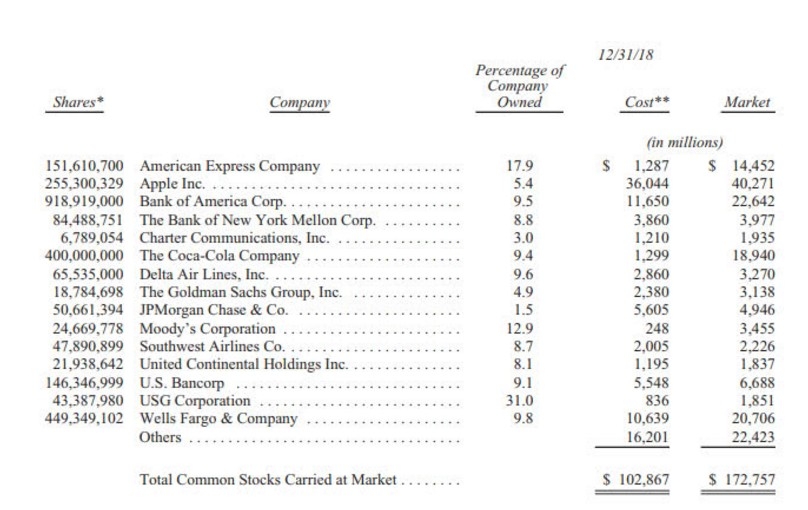

- Billionaire Warren Buffett: In 2011, Buffett’s Berkshire Hathaway invested $26 billion in Bank of America. This investment was driven by Buffett’s confidence in the US economy and the attractive valuation of Bank of America.

- Chinese Tech Giant Tencent: In 2016, Tencent became the largest shareholder of US-based video gaming company, Epic Games. This investment was part of Tencent’s strategy to diversify its investment portfolio and gain a foothold in the global gaming market.

Conclusion

The trend of foreign companies buying US stocks is a testament to the strength and resilience of the US economy. As long as the US continues to perform well and offer attractive investment opportunities, this trend is likely to continue. Investors and the economy at large can expect to reap the benefits of this growing trend.