In the bustling financial world, the US stock market stands as a beacon of continuous activity, operating 22 hours a day. This relentless rhythm sets it apart from other markets, making it a crucial hub for global investors. Let's delve into the fascinating world of the US stock market and understand its 22-hour operation.

Understanding the 22-Hour Cycle

The US stock market operates from 9:30 AM to 4:00 PM Eastern Time (ET) during weekdays. However, the trading doesn't stop there. The pre-market and after-hours sessions extend the trading hours, allowing investors to engage in buying and selling stocks outside the regular trading hours.

Pre-Market Session (4:00 AM to 9:30 AM ET)

The pre-market session, also known as the pre-open session, begins at 4:00 AM ET and ends at 9:30 AM ET. During this period, traders can access the market and place orders before the regular trading hours. This session is particularly popular among institutional investors and high-frequency traders who want to get a head start on the day's trading.

After-Hours Session (4:00 PM to 8:00 PM ET)

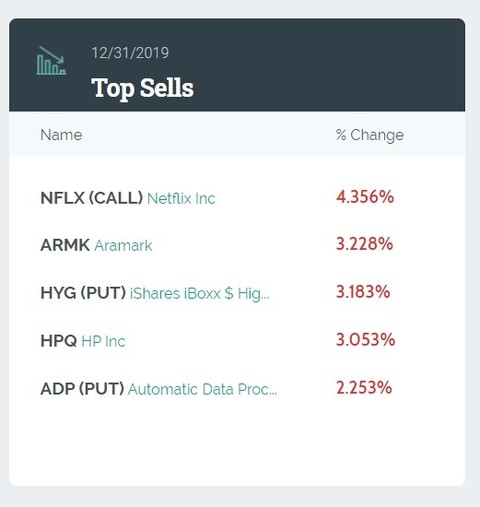

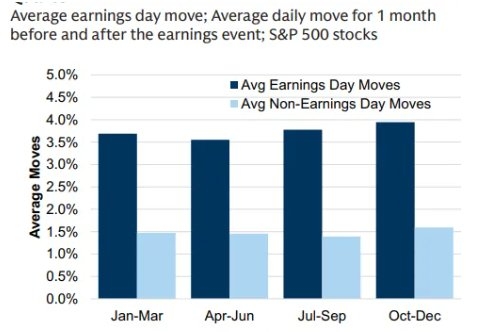

The after-hours session starts immediately after the regular trading hours end at 4:00 PM ET and continues until 8:00 PM ET. This session allows investors to trade stocks outside the regular trading hours, providing flexibility and convenience. Many companies release their earnings reports during this period, and investors can react to the news immediately.

Why 22 Hours?

The 22-hour trading cycle of the US stock market is designed to cater to the needs of investors worldwide. It ensures that investors from different time zones can access the market at their convenience. This continuous operation also helps in maintaining liquidity and stability in the market.

Benefits of 22-Hour Trading

- Increased Liquidity: The extended trading hours ensure that there is always a market for buying and selling stocks, even outside the regular trading hours.

- Global Access: Investors from different parts of the world can access the US stock market at their convenience, making it a truly global market.

- Better Price Discovery: The continuous trading allows for better price discovery, as more investors participate in the market.

- Investor Convenience: The 22-hour trading cycle provides flexibility to investors, allowing them to trade at their preferred time.

Case Study: Pre-Market Gains

A recent case study highlighted the benefits of the pre-market session. A company, which was expected to announce strong earnings, saw its stock surge in the pre-market session. As the regular trading hours began, the stock continued to rise, resulting in significant gains for investors who participated in the pre-market session.

Conclusion

The US stock market's 22-hour operation is a testament to its commitment to serving investors worldwide. This continuous trading cycle ensures liquidity, global access, and better price discovery. As the financial world becomes more interconnected, the 22-hour trading cycle of the US stock market will continue to play a crucial role in shaping the global financial landscape.