Introduction: In the dynamic world of stock markets, understanding the average stock prices is crucial for investors and traders. The average stock prices in the US reflect the overall market trends and can provide valuable insights into the economic health of the country. In this article, we will delve into the factors that influence average stock prices, analyze the historical trends, and discuss the current market landscape.

Understanding Average Stock Prices: The average stock price is calculated by dividing the total market capitalization of all stocks by the total number of shares outstanding. It serves as a benchmark to gauge the overall performance of the stock market. The average stock price in the US can vary widely across different sectors and industries.

Factors Influencing Average Stock Prices: Several factors influence the average stock prices in the US. Here are some of the key factors:

Economic Indicators: Economic indicators such as GDP growth, inflation rates, and unemployment rates play a crucial role in determining the average stock prices. A strong economy with low inflation and low unemployment tends to drive up stock prices.

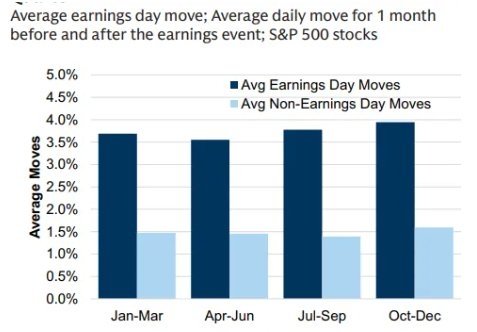

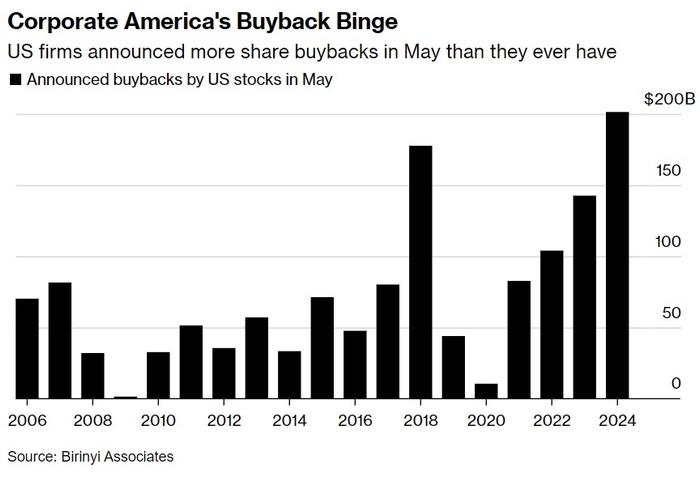

Corporate Earnings: The financial performance of companies significantly impacts the average stock prices. Positive earnings reports, revenue growth, and increased profitability can lead to higher stock prices.

Market Sentiment: Investor sentiment plays a vital role in determining stock prices. Factors such as political stability, geopolitical events, and market trends can influence investor confidence and, subsequently, the average stock prices.

Interest Rates: Interest rates set by the Federal Reserve can impact the average stock prices. Higher interest rates can lead to increased borrowing costs for companies, affecting their profitability and, in turn, stock prices.

Historical Trends: Over the past few decades, the average stock prices in the US have witnessed significant fluctuations. Here are some notable trends:

1980s: The 1980s were marked by a bull market, with the average stock prices rising significantly. The introduction of new technologies and deregulation played a significant role in driving up stock prices.

1990s: The dot-com bubble in the late 1990s led to a surge in average stock prices, particularly in the technology sector. However, the bubble burst in 2000, resulting in a sharp decline in stock prices.

2000s: The 2000s witnessed a recovery in the stock market, driven by factors such as low interest rates and strong corporate earnings. The average stock prices reached new highs in 2007 before the global financial crisis hit.

2010s: The 2010s were characterized by a bull market, with the average stock prices reaching record highs. Factors such as low inflation, low unemployment, and strong corporate earnings contributed to the market's growth.

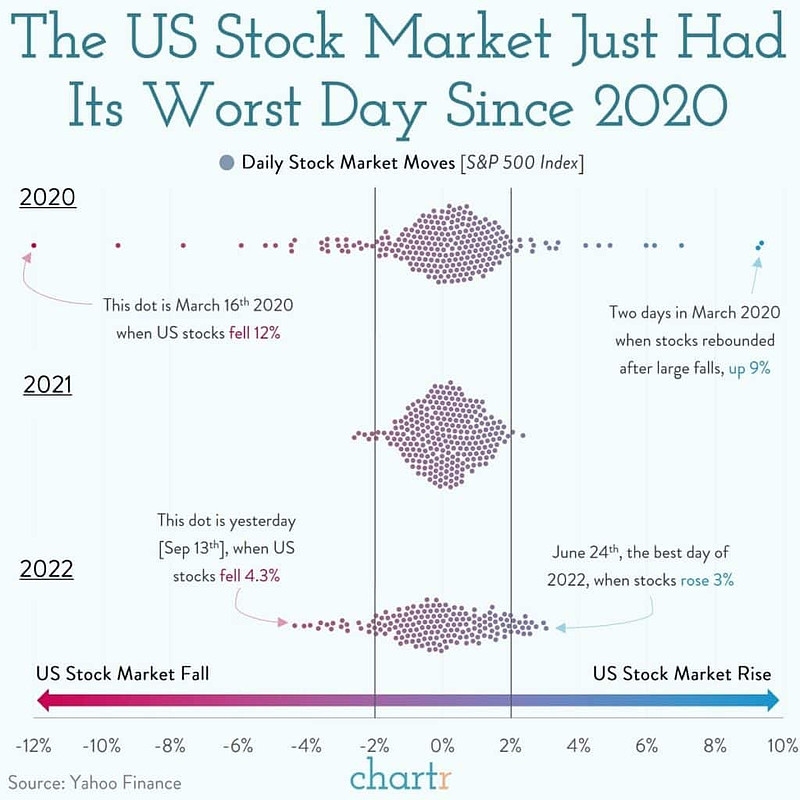

Current Market Landscape: As of now, the US stock market is experiencing a period of volatility. The average stock prices have been fluctuating due to various factors, including geopolitical tensions, rising interest rates, and concerns about economic growth. However, the overall market remains strong, with several sectors performing well.

Conclusion: Understanding the average stock prices in the US is essential for investors and traders. By analyzing the factors influencing stock prices, historical trends, and the current market landscape, investors can make informed decisions. As the stock market continues to evolve, staying updated with the latest trends and factors impacting average stock prices is crucial for long-term success.