In recent weeks, there has been a surge of speculation about the potential for a US stock market crash. With the COVID-19 pandemic continuing to impact global markets, investors are on edge, wondering whether the worst is yet to come. This article delves into the current state of the US stock market, analyzing the factors that could lead to a crash and providing insights into how investors can navigate these turbulent times.

The Current State of the US Stock Market

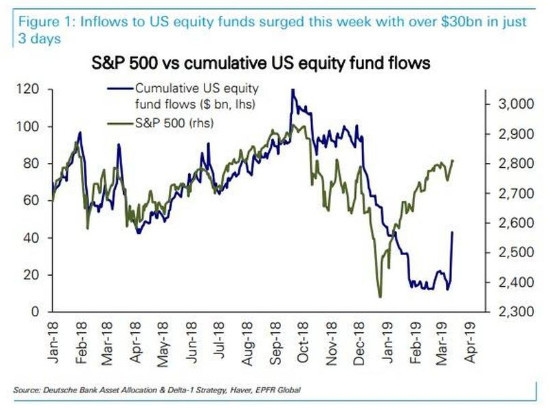

As of early 2021, the US stock market has shown remarkable resilience in the face of the pandemic. The S&P 500, a widely followed index of large-cap stocks, has reached record highs, despite the economic challenges posed by the COVID-19 crisis. However, some experts argue that the market's current rally is unsustainable and that a crash could be imminent.

Factors Contributing to Concerns of a Stock Market Crash

Several factors are contributing to the fears of a US stock market crash:

Economic Uncertainty: The pandemic has caused unprecedented economic uncertainty, with businesses struggling to survive and unemployment rates skyrocketing. This uncertainty could lead to a decrease in consumer spending and a subsequent decline in corporate earnings.

Record High Debt Levels: The US government and corporations have accumulated record-high levels of debt to finance stimulus measures and support the economy. This debt could become unsustainable if the economy does not recover as expected.

Inflation Concerns: As the economy begins to reopen, there are concerns that inflation could rise, eroding the purchasing power of investors' portfolios.

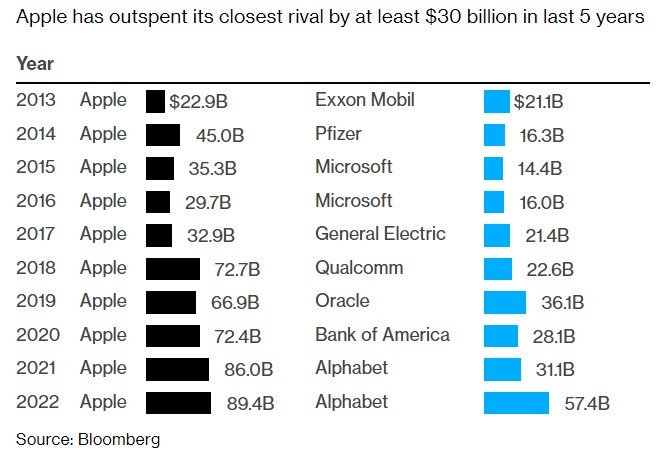

Market Valuations: The current valuations of some stocks are considered to be overinflated, particularly in the technology sector. This could lead to a correction if investors begin to question the sustainability of these valuations.

Navigating the Turbulent Times

Despite the concerns, there are ways investors can navigate the turbulent times:

Diversification: Diversifying your portfolio across various asset classes can help mitigate the risk of a stock market crash. This includes investing in bonds, real estate, and other alternative assets.

Focus on Quality: Investing in high-quality companies with strong fundamentals can help protect your portfolio during market downturns.

Stay Informed: Keeping up with the latest economic and market news can help you make informed decisions and adjust your portfolio as needed.

Long-Term Perspective: It's important to maintain a long-term perspective and not panic sell during market downturns. Historically, the stock market has recovered from crashes and continued to grow over time.

Case Study: The 2008 Financial Crisis

A prime example of a stock market crash is the 2008 financial crisis. The crisis was triggered by the collapse of the housing market and the subsequent failure of major financial institutions. The S&P 500 fell by nearly 50% from its peak in October 2007 to its trough in March 2009. However, the market eventually recovered and reached new highs by the end of 2013.

The 2008 financial crisis serves as a reminder that stock market crashes are a normal part of the market cycle. While the current market conditions are uncertain, history suggests that the market will eventually recover.

In conclusion, while there are concerns about a potential US stock market crash, it's important to remain informed and take a long-term perspective. By diversifying your portfolio, focusing on quality, and staying informed, you can navigate the turbulent times and protect your investments.