Introduction: The global economy is a complex web of interconnected markets, and the recent imposition of tariffs by the United States has sparked concerns among investors worldwide. One of the countries closely monitoring these developments is Denmark, a nation with a robust stock market. This article delves into whether Denmark stocks are affected by US tariffs and the potential consequences of this trade tension.

Understanding Denmark's Stock Market: Denmark, known for its stable economy and high standard of living, has a well-developed stock market. The Copenhagen Stock Exchange (CSE) is the country's primary stock market, where a variety of companies, including some with significant exposure to international trade, are listed.

Impact of US Tariffs on Denmark Stocks: The United States has imposed tariffs on various goods, including steel and aluminum, as well as on certain products from China. These tariffs have had a ripple effect on global markets, including Denmark's stock market.

Direct and Indirect Impacts: Denmark's stocks are affected by US tariffs in two primary ways: directly and indirectly.

Direct Impact:

- Exporters: Danish companies that export goods to the United States face higher costs due to the tariffs. This can lead to a decrease in their profits and, consequently, their stock prices.

- Importers: On the flip side, Danish companies that import goods from the United States may benefit from the tariffs, as they can charge higher prices for their products in the US market.

Indirect Impact:

- Global Supply Chain: Denmark's companies, like those in many other countries, are part of global supply chains. Tariffs imposed by the US can disrupt these chains, leading to increased costs and decreased efficiency.

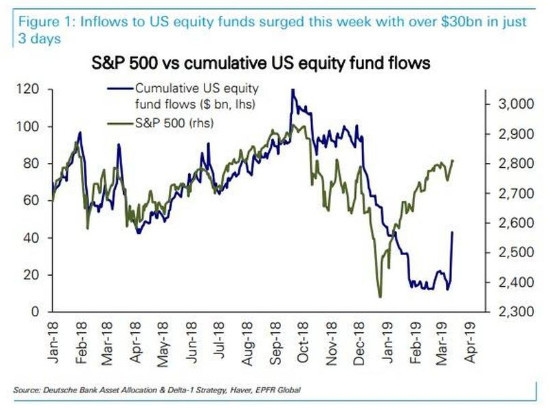

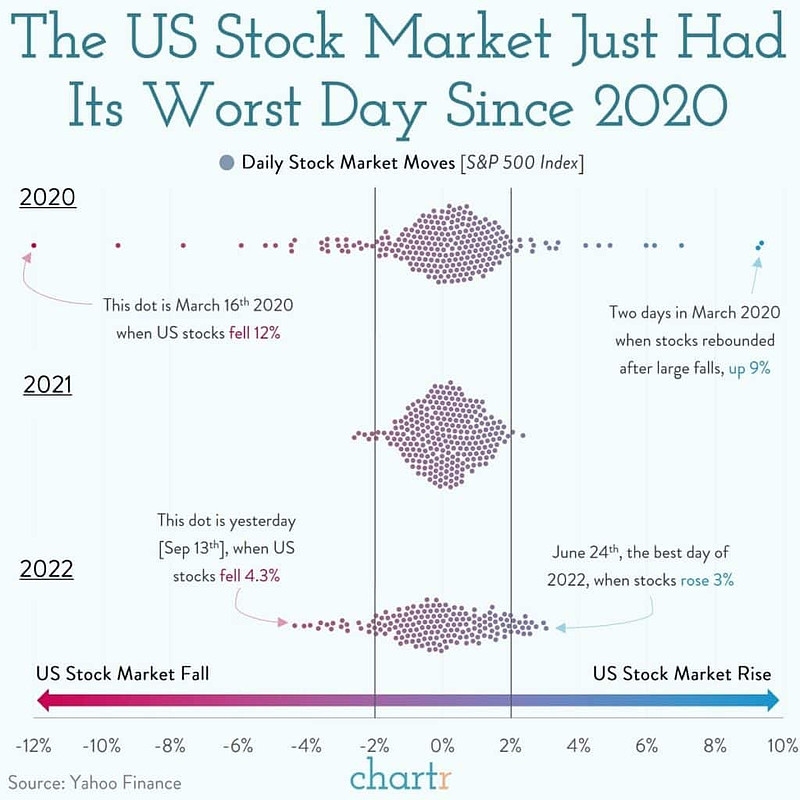

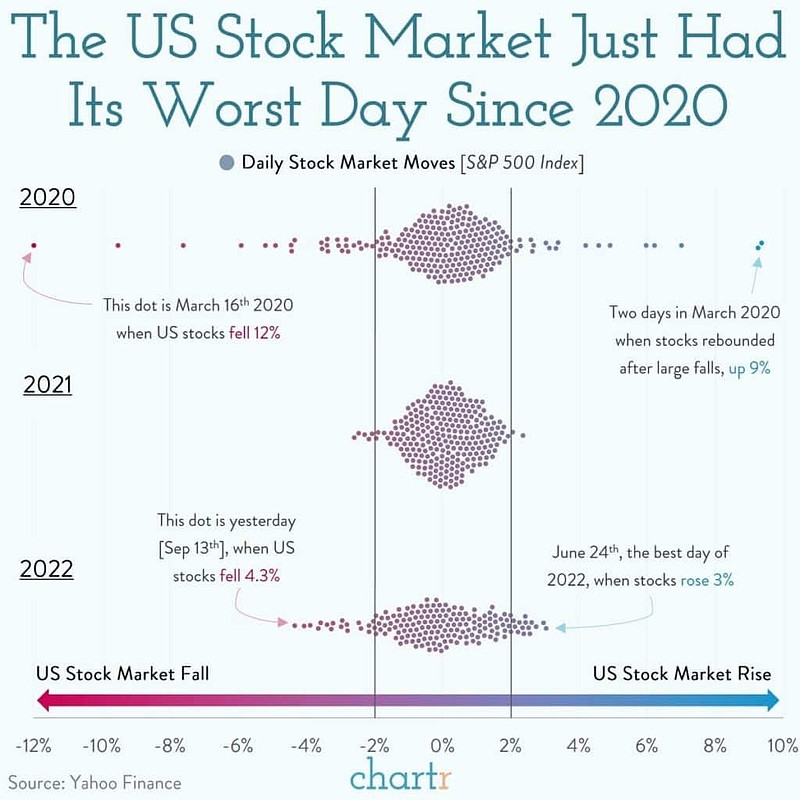

- Investor Sentiment: The uncertainty surrounding trade tensions can lead to volatility in the stock market, as investors may become cautious and adjust their portfolios accordingly.

Case Studies: Several Danish companies have been impacted by US tariffs. One such example is Vestas Wind Systems, a leading wind turbine manufacturer. The company exports a significant portion of its products to the United States, and the imposition of tariffs on steel and aluminum has increased its production costs.

Another example is Novo Nordisk, a global leader in diabetes care. While Novo Nordisk is not directly affected by US tariffs, the company's share price has been impacted by investor concerns regarding the global economic environment and trade tensions.

Conclusion: In conclusion, Denmark stocks are indeed affected by US tariffs. The direct and indirect impacts of these tariffs can be seen in the performance of Danish companies and the broader stock market. As trade tensions continue to escalate, it is crucial for investors to stay informed and monitor the potential consequences of these developments.