In the fast-paced world of stock trading, understanding the market impact coefficients (MIC) is crucial for investors and traders. MIC is a critical metric that quantifies the impact of a transaction on the price of a stock. This article delves into the empirical measurement of MIC in US stocks, providing insights into how it can be utilized to make informed trading decisions.

Understanding Market Impact Coefficients

Market Impact Coefficients are a measure of the effect that a trade has on the price of a stock. A higher MIC indicates that a trade has a greater impact on the stock's price, while a lower MIC suggests that the trade has minimal effect. The MIC is calculated by dividing the difference in the price before and after the trade by the size of the trade.

Empirical Measurement of MIC in US Stocks

The empirical measurement of MIC in US stocks involves collecting data on stock prices and transaction sizes. Various studies have been conducted to estimate the MIC for different stocks and market conditions. These studies often use historical data to identify patterns and trends.

One common method for measuring MIC is to use a statistical model called the Market Impact Model. This model takes into account factors such as the size of the trade, the price of the stock, and the volatility of the stock. By analyzing historical data, researchers can estimate the MIC for a particular stock under different market conditions.

Factors Affecting MIC

Several factors can influence the MIC of a stock. These include:

- Trade Size: Larger trades typically have a greater impact on the price of a stock.

- Stock Volatility: Stocks with high volatility tend to have higher MICs.

- Market Conditions: In times of high market volatility, the MIC may increase.

Case Studies

To illustrate the importance of MIC, let's consider a few case studies:

Stock X: A stock with a low MIC of 0.01% may only cause a slight change in price after a large trade. In contrast, a stock with a high MIC of 1% may see a significant price movement.

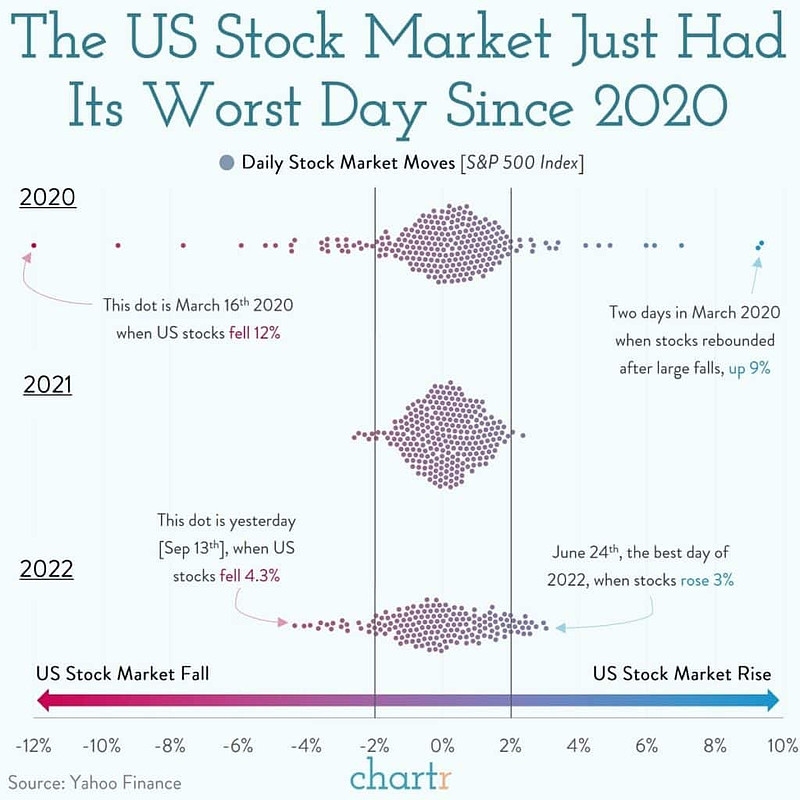

Market Volatility: During the 2020 stock market crash, the MIC for many stocks increased significantly. This was due to the high levels of volatility and uncertainty in the market.

Utilizing MIC for Trading Decisions

Understanding the MIC of a stock can help investors and traders make informed decisions. By analyzing the MIC, traders can:

- Avoid Large Price Movements: By identifying stocks with high MICs, traders can avoid making large trades that may significantly impact the stock price.

- Optimize Trade Size: Traders can optimize the size of their trades based on the MIC of the stock, minimizing the impact on price.

Conclusion

The empirical measurement of market impact coefficients in US stocks is a critical tool for investors and traders. By understanding the MIC, traders can make more informed decisions and avoid large price movements. As the stock market continues to evolve, it is essential to stay informed about the factors that affect MIC and how to utilize it effectively.