Embarking on the journey to invest in US stocks can be a daunting task, especially for those new to the stock market. However, one powerful tool that can streamline this process is a 401(k) plan. In this article, we will explore how to effectively invest in US stocks using your 401(k) and why it might be the best option for your retirement savings.

Understanding Your 401(k) Plan

A 401(k) is a tax-deferred retirement savings plan offered by many employers. It allows employees to contribute a portion of their pre-tax income to the plan, which grows tax-free until withdrawal. This means that your contributions are not taxed until you make withdrawals in retirement, potentially saving you a significant amount of money on taxes over time.

The Advantages of Investing in US Stocks Through a 401(k)

Tax Advantages: As mentioned earlier, contributions to a 401(k) are made with pre-tax dollars, reducing your taxable income in the current year. This can lead to substantial tax savings, especially if you're in a high tax bracket.

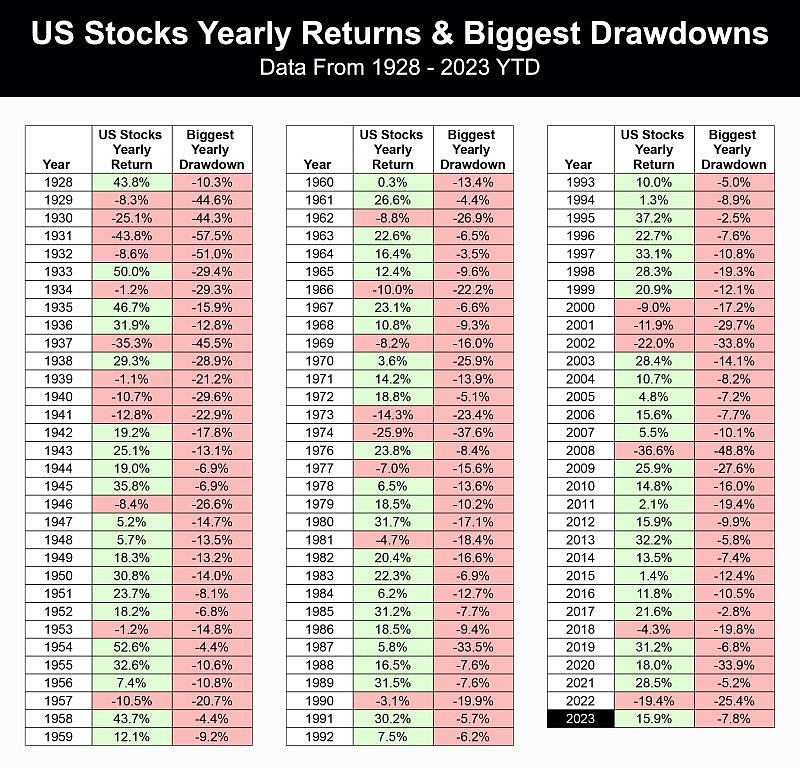

Potential for High Returns: Historically, investing in US stocks has been a powerful way to grow wealth. The S&P 500, for example, has returned an average of around 10% annually over the past century.

Diversification: Many 401(k) plans offer a variety of mutual funds and ETFs that allow you to diversify your portfolio across different sectors and asset classes. This can help reduce risk and potentially increase returns.

Automatic Contributions: One of the best features of a 401(k) is the ability to set up automatic contributions. This ensures that you consistently invest a portion of your income without having to remember to do so manually.

Employer Match: Many employers offer a match on the contributions you make to your 401(k). This is essentially free money, as the employer is contributing to your retirement savings on your behalf.

How to Invest in US Stocks Using Your 401(k)

Research Your Plan's Options: Review the available investment options in your 401(k) plan. Look for funds that focus on US stocks, such as index funds, sector funds, or actively managed funds.

Determine Your Allocation: Decide how much of your 401(k) you want to allocate to US stocks. This will depend on your risk tolerance, investment goals, and time horizon. A common approach is to allocate a portion of your portfolio to US stocks and the rest to bonds or other asset classes.

Choose Your Investments: Select the specific funds or ETFs that you want to invest in. Consider factors such as fees, performance history, and investment strategy.

Monitor Your Investments: Regularly review your investments and make adjustments as needed. This may involve rebalancing your portfolio to maintain your desired allocation or switching to different funds if you believe they offer better opportunities.

Stay Committed: The key to successful investing is consistency. Stay committed to your 401(k) plan and your investment strategy, even during periods of market volatility.

Case Study: Sarah's 401(k) Journey

Sarah, a 35-year-old software engineer, has been contributing to her 401(k) plan for the past five years. She has allocated 60% of her plan to US stocks, with the remainder in bonds and international funds. As a result, her portfolio has grown significantly, and she is on track to achieve her retirement goals.

By investing in US stocks through her 401(k) plan, Sarah has taken advantage of the tax benefits, potential for high returns, and automatic contributions. She has also diversified her portfolio to reduce risk and stay committed to her investment strategy.

In conclusion, investing in US stocks using your 401(k) plan can be a powerful tool for building wealth and achieving your retirement goals. By understanding the advantages of a 401(k), choosing the right investments, and staying committed to your strategy, you can potentially grow your savings and secure a comfortable retirement.