Investing in US stocks can be a lucrative opportunity for Canadian investors. With the United States being the world's largest economy, it offers a wide array of investment options. This article will explore the process of Canadian investors investing in US stocks, including the benefits, risks, and key considerations to keep in mind.

Understanding the US Stock Market

The US stock market is one of the most robust and diversified in the world. It offers a wide range of investment opportunities across various sectors, including technology, healthcare, finance, and more. The two primary exchanges where US stocks are traded are the New York Stock Exchange (NYSE) and the NASDAQ.

Benefits of Investing in US Stocks

- Diversification: Investing in US stocks allows Canadian investors to diversify their portfolios, reducing their exposure to the domestic market's volatility.

- Access to Top Companies: The US market is home to many of the world's largest and most successful companies, such as Apple, Microsoft, and Amazon.

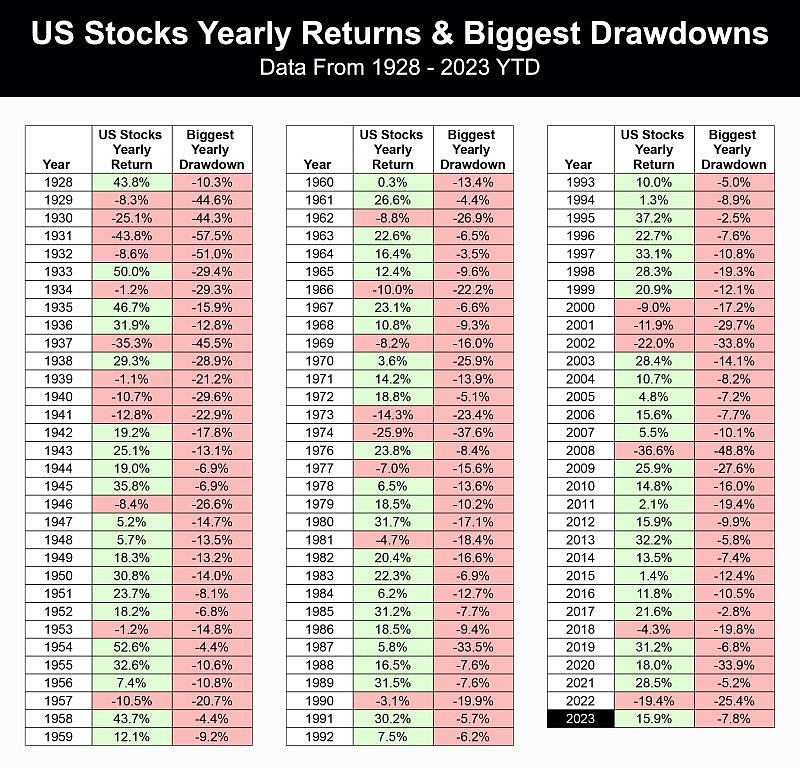

- Potential for High Returns: The US stock market has historically provided strong returns, making it an attractive option for long-term investors.

- Ease of Access: Investing in US stocks has become increasingly accessible for Canadian investors, thanks to advancements in technology and regulatory changes.

How to Invest in US Stocks from Canada

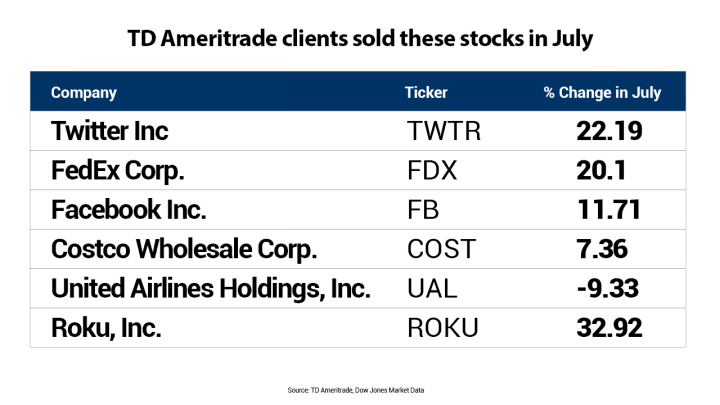

- Open a Brokerage Account: The first step is to open a brokerage account with a firm that offers access to US stocks. Some popular options for Canadian investors include TD Ameritrade, Charles Schwab, and E*TRADE.

- Research and Select Stocks: Conduct thorough research to identify stocks that align with your investment goals and risk tolerance. Consider factors such as the company's financial health, market position, and growth prospects.

- Convert Canadian Dollars to US Dollars: You will need to convert your Canadian dollars to US dollars to purchase US stocks. This can be done through your brokerage account or a currency exchange service.

- Place a Trade: Once you have identified the stocks you wish to purchase, you can place a trade through your brokerage account.

Risks to Consider

- Currency Fluctuations: The exchange rate between the Canadian dollar and the US dollar can impact the value of your investments. A weaker Canadian dollar can increase the cost of US stocks, while a stronger Canadian dollar can decrease the value of your returns.

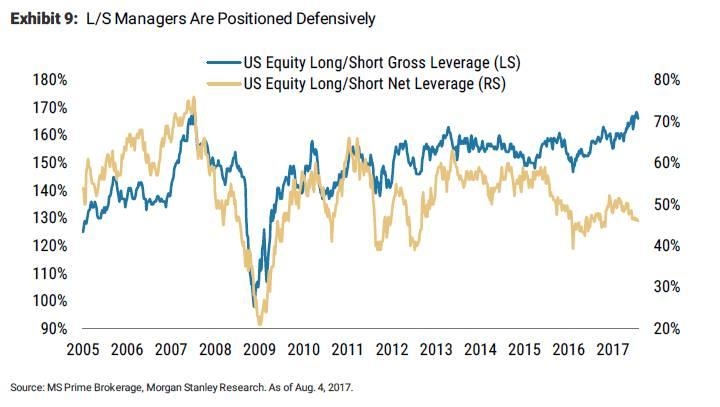

- Market Volatility: The US stock market can be volatile, and prices can fluctuate rapidly. This can result in significant gains or losses for Canadian investors.

- Tax Implications: Canadian investors need to be aware of the tax implications of investing in US stocks. While capital gains are taxed in Canada, they may be subject to additional taxes in the US.

Case Study: Investing in Apple Inc.

Consider a Canadian investor who decides to invest in Apple Inc. after thorough research. The investor converts

If Apple's stock price increases to

Conclusion

Investing in US stocks can be a valuable addition to a Canadian investor's portfolio. By understanding the process, benefits, and risks, Canadian investors can make informed decisions and potentially achieve significant returns. It is crucial to conduct thorough research and consult with a financial advisor to ensure that investing in US stocks aligns with your investment goals and risk tolerance.