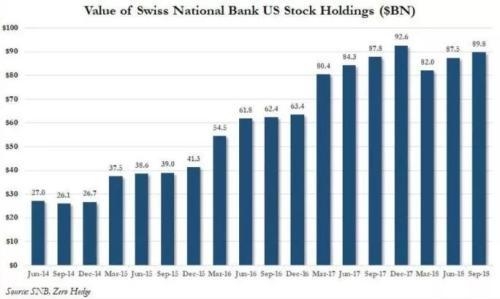

In recent years, the US stock market has experienced significant fluctuations, leaving investors questioning how much value has been lost. This article delves into the impact of market volatility and provides insights into the potential losses faced by investors. By examining historical data and current market trends, we aim to shed light on the extent of the losses and help investors navigate the complexities of the stock market.

Understanding Stock Market Losses

The stock market is inherently unpredictable, and losses can occur for various reasons. These reasons include economic downturns, political instability, company-specific issues, and overall market sentiment. To gauge the extent of losses, it is crucial to consider the following factors:

Market Indices: Key market indices, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, provide a snapshot of the overall market performance. Analyzing these indices can help determine the overall loss in the stock market.

Sector Performance: Different sectors of the market may experience varying degrees of losses. By analyzing sector performance, investors can identify industries that have been most affected and understand the broader impact on the market.

Company-Specific Losses: Individual companies may face losses due to various factors, such as poor financial performance, regulatory issues, or product recalls. Examining company-specific losses can provide insights into the overall market impact.

Historical Perspective

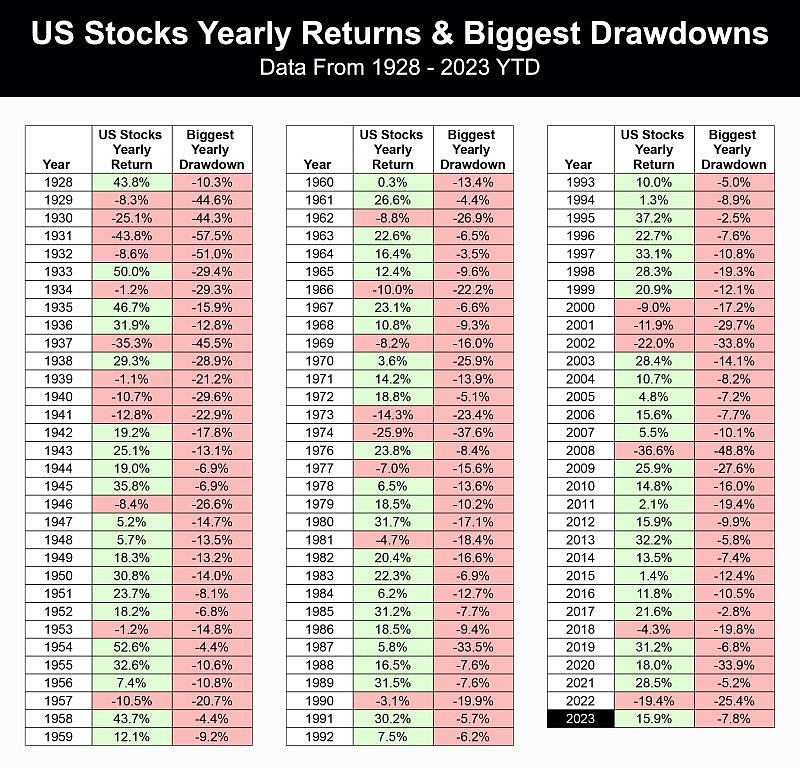

To understand the extent of stock market losses, it is essential to look back at historical data. The following are some notable periods of market losses:

2008 Financial Crisis: The 2008 financial crisis resulted in one of the most significant stock market losses in history. The S&P 500 plummeted by approximately 57% from its peak in October 2007 to its trough in March 2009.

2020 COVID-19 Pandemic: The COVID-19 pandemic caused a sharp decline in the stock market, with the S&P 500 falling by approximately 34% from its peak in February 2020 to its trough in March 2020.

2021 Tech Stock Bubble Burst: The bursting of the tech stock bubble in 2021 resulted in significant losses for investors, particularly in sectors such as technology and communication services.

Current Market Trends

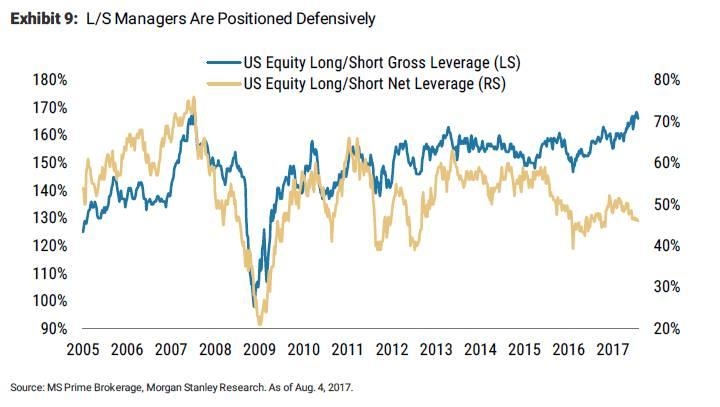

As of now, the US stock market has experienced a mixed bag of performance. While certain sectors have seen strong growth, others have faced significant losses. Some key trends to consider include:

Inflation Concerns: Rising inflation has raised concerns about the future of the US stock market. Investors are closely monitoring the Federal Reserve's monetary policy to gauge its impact on the market.

Geopolitical Tensions: Tensions between major economies, such as the US and China, have contributed to market volatility and potential losses.

Sector Rotation: Investors have been shifting their focus from growth sectors, such as technology and consumer discretionary, to value sectors, such as financials and real estate.

Case Study: Tesla (TSLA)

One notable example of stock market losses is Tesla (TSLA). Despite being one of the most successful companies in the electric vehicle industry, Tesla has faced significant losses in recent years. In the first quarter of 2021, the company reported a net loss of $528 million. This loss was primarily due to a decrease in vehicle production and higher costs associated with ramping up production at its new Shanghai factory.

Conclusion

The US stock market has experienced various periods of losses throughout history. By analyzing market indices, sector performance, and company-specific losses, investors can gain a better understanding of the extent of the losses. As the market continues to evolve, it is crucial for investors to stay informed and adapt their strategies accordingly.