Introduction:

Investing in stocks with strong momentum can be a highly profitable strategy, especially when it comes to large-cap companies. These stocks have shown significant growth in a short period and have the potential to continue rising. In this article, we will discuss the best momentum stocks in the US large-cap space that have experienced recent gains. By understanding these stocks, investors can make informed decisions and capitalize on their potential for further growth.

Understanding Momentum Stocks:

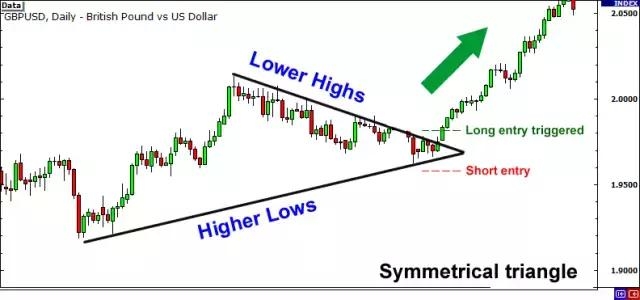

Momentum stocks are shares of companies that have seen rapid increases in price and volume over a short period. These stocks often experience high trading volumes, and their price tends to move in one direction—up. Investors are attracted to momentum stocks because of their potential for significant returns.

Criteria for Selecting the Best Momentum Stocks:

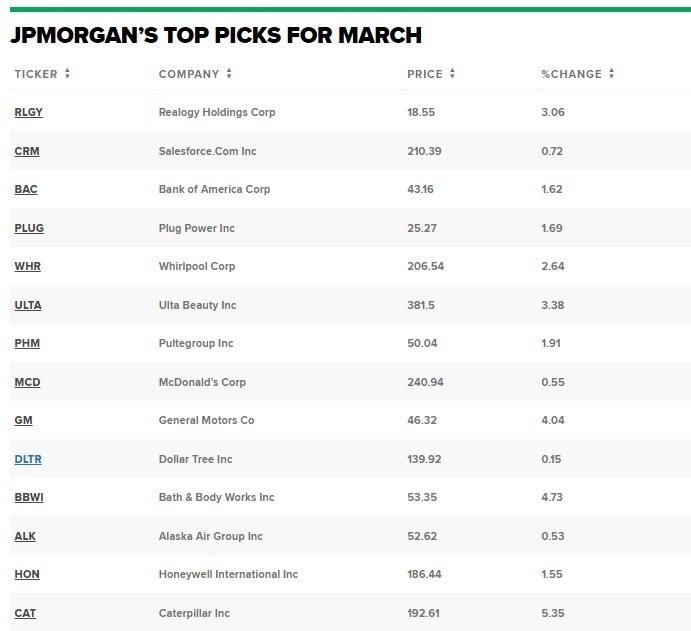

When identifying the best momentum stocks, we considered several factors, including recent performance, market capitalization, and industry trends. We focused on large-cap companies, which are generally considered to be more stable and less volatile than smaller companies.

Top Momentum Stocks in the US Large Cap Space:

Tesla (TSLA): As the leading electric vehicle (EV) manufacturer, Tesla has seen a remarkable rise in its stock price over the past few years. With the growing demand for EVs and the company's expansion into new markets, Tesla continues to be a top momentum stock.

NVIDIA (NVDA): NVIDIA is a leader in the graphics processing unit (GPU) market and has experienced significant growth in its stock price. The increasing demand for GPUs in the gaming, AI, and data center markets has driven NVIDIA's stock to new heights.

Adobe (ADBE): Adobe is a leader in digital marketing and content creation tools. With the rise of digital transformation and remote work, Adobe's stock has seen strong momentum, driven by the increasing demand for its products.

Meta Platforms (META): As the parent company of Facebook, Instagram, and WhatsApp, Meta has experienced significant growth in its stock price. The company's expansion into the metaverse and other emerging technologies has made it a top momentum stock.

Amazon (AMZN): Amazon remains a dominant player in the e-commerce and cloud computing markets. With its continuous expansion into new areas and the growing demand for its services, Amazon's stock has seen significant momentum.

Case Study: Tesla (TSLA)

Tesla's stock has seen a remarkable rise in recent years, from around

- Innovative Electric Vehicles: Tesla's innovative electric vehicles have captured the market's attention and have been well-received by consumers.

- Expanding Production: The company has been successful in expanding its production capacity, leading to increased sales and revenue.

- Growth in the EV Market: The growing demand for electric vehicles has provided a strong tailwind for Tesla's stock.

Conclusion:

Incorporating momentum stocks into your investment portfolio can be a highly effective strategy. By focusing on large-cap companies with strong recent gains, investors can capitalize on the potential for further growth. As always, it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.