In the ever-evolving landscape of the stock market, small cap growth stocks have emerged as a beacon of potential for investors seeking high returns. These stocks, representing companies with a market capitalization of less than $2 billion, often offer substantial growth prospects. This article delves into the latest news surrounding US small cap growth stocks, highlighting key developments and potential investment opportunities.

Rising Stars in the Small Cap Space

One of the most notable recent developments in the small cap growth sector is the rise of several emerging companies. Companies like Bolt Threads and Covestro have been making headlines with their innovative products and impressive growth trajectories. Bolt Threads, a pioneer in sustainable spider silk technology, has seen a surge in investor interest due to its groundbreaking advancements. Similarly, Covestro, a leading developer of high-performance materials, has been attracting attention for its potential in the renewable energy sector.

Market Trends and Analysis

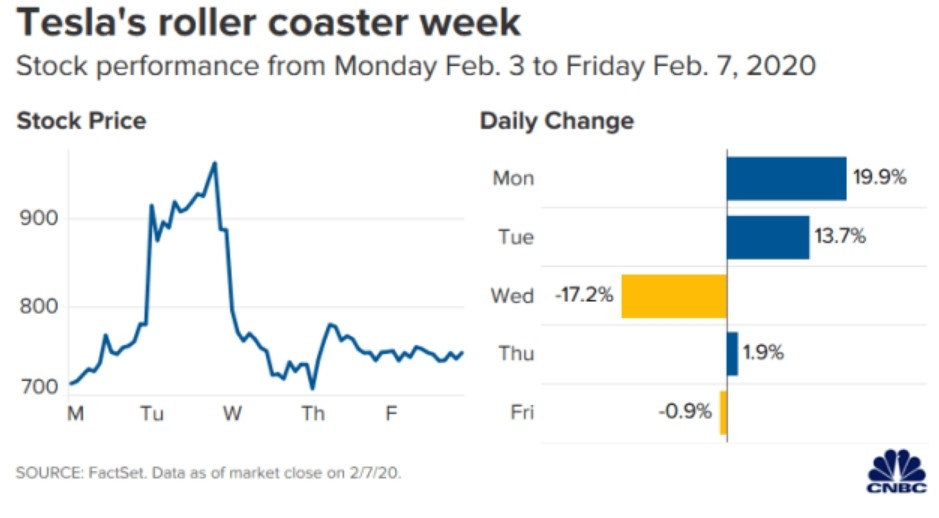

Several market trends are shaping the small cap growth landscape. One such trend is the increasing interest in sustainable and eco-friendly technologies. Companies like Tesla and NVIDIA have demonstrated the potential of green technologies to drive growth. Tesla, known for its electric vehicles, has been a leader in this space, and its recent partnership with Toyota has further solidified its position. NVIDIA, on the other hand, has been making waves in the AI and renewable energy sectors, offering substantial growth prospects.

Investment Opportunities and Risks

Investing in small cap growth stocks can be lucrative, but it also comes with its own set of risks. These stocks are generally more volatile than their larger counterparts and may be subject to regulatory and market risks. However, for investors willing to take on the risk, the potential rewards can be substantial.

One of the key investment opportunities in the small cap growth space is the tech sector. Companies like Shopify and Square have been offering substantial growth prospects. Shopify, a leading e-commerce platform, has seen a surge in demand due to the increasing trend of online shopping. Similarly, Square, known for its mobile payment solutions, has been making significant strides in the tech space.

Case Study: Shopify

To illustrate the potential of small cap growth stocks, let's take a closer look at Shopify. Founded in 2006, Shopify has grown to become a leading e-commerce platform, offering a range of services to online retailers. Its market capitalization currently stands at around $150 billion, a significant increase from its initial days. This growth can be attributed to its innovative approach to e-commerce and its ability to adapt to changing market trends.

In conclusion, US small cap growth stocks present a unique opportunity for investors seeking high returns. With the right research and analysis, these stocks can be a valuable addition to any investment portfolio. However, it is important to conduct thorough research and understand the associated risks before investing.