As we approach April 2025, investors are on the lookout for the best US stocks to buy. With the stock market constantly evolving, it's crucial to stay informed and make strategic investments. This article will provide you with a comprehensive guide to identify the best US stocks to buy in April 2025.

Technology Stocks: The Future is Now

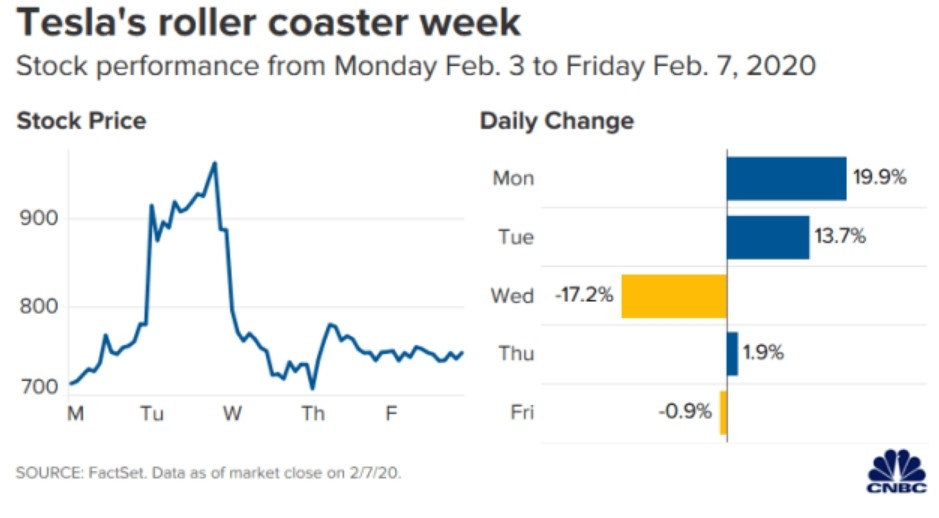

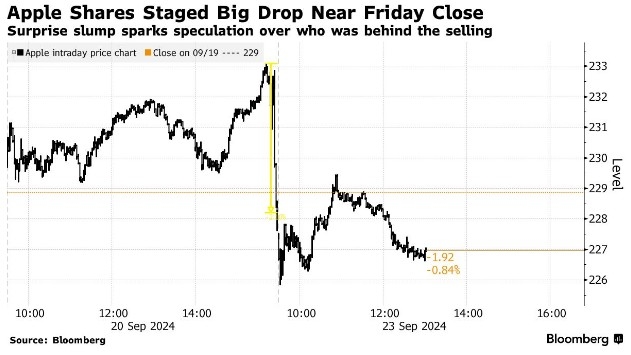

Technology stocks have always been a popular choice for investors, and the trend is expected to continue in April 2025. One of the top picks in this sector is Apple Inc. (AAPL). The company has a strong presence in the smartphone, computer, and wearable tech markets, and it continues to innovate and expand its product line. Another promising technology stock is Tesla, Inc. (TSLA), which is leading the electric vehicle revolution. With increasing demand for electric vehicles and a growing global market, Tesla is well-positioned for significant growth in the coming years.

Healthcare Stocks: Nurturing the Future

The healthcare sector is another area where investors can find promising opportunities in April 2025. One of the best stocks to consider is Johnson & Johnson (JNJ), a leader in the pharmaceutical and consumer healthcare industries. The company has a diverse portfolio of products and a strong reputation for innovation. Another healthcare stock worth considering is Amgen Inc. (AMGN), which is a global leader in biotechnology and has a pipeline of promising drug candidates.

Consumer Goods Stocks: Meeting the Needs of the Masses

Consumer goods stocks have always been a stable investment choice, and that trend is expected to continue in April 2025. One of the top picks in this sector is Procter & Gamble (PG), a company known for its diverse portfolio of consumer brands, including Gillette, Pampers, and Tide. Another consumer goods stock to consider is Coca-Cola Co. (KO), which is a global leader in the beverage industry and has a strong brand presence worldwide.

Energy Stocks: Powering the Future

The energy sector is also a promising area for investment in April 2025. One of the best stocks to consider is Exxon Mobil Corp. (XOM), a leading oil and gas company with a strong presence in the global energy market. Another energy stock worth considering is Chevron Corp. (CVX), which is a global energy company with operations in oil and gas exploration, production, and refining.

Case Study: Amazon.com, Inc. (AMZN)

To provide a real-world example, let's take a look at Amazon.com, Inc. (AMZN). The e-commerce giant has been a powerhouse in the retail industry, with a market capitalization of over $1 trillion. Its vast product range, strong brand presence, and innovative business model have contributed to its success. As the world continues to shift towards online shopping, Amazon is well-positioned for continued growth in the coming years.

In conclusion, as we approach April 2025, investors should consider a diverse range of stocks across various sectors. By focusing on technology, healthcare, consumer goods, and energy stocks, investors can create a well-diversified portfolio that has the potential to generate significant returns. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.