In today's globalized world, investors have a wide array of investment options to choose from. Two of the most popular markets for investment are Europe and the United States. In this article, we will compare European stocks with US stocks to help investors make informed decisions. We will delve into factors like market performance, growth potential, and risk factors associated with both markets.

Market Performance

European Stocks:

European stocks have been performing well in recent years, particularly in the tech and energy sectors. Countries like Germany, France, and the UK are known for their strong economies and have contributed significantly to the overall growth of the European stock market.

US Stocks:

On the other hand, the US stock market has consistently been a leader in terms of performance. It has a diverse range of sectors, including technology, healthcare, and finance, which has helped it weather economic downturns better than most other markets.

Growth Potential

European Stocks:

European stocks have significant growth potential, especially in emerging markets like Eastern Europe. The European Union has been investing heavily in infrastructure development, which is expected to drive economic growth and improve the performance of European stocks.

US Stocks:

The US stock market also has impressive growth potential. With its robust economic environment, US stocks have a higher chance of delivering high returns in the long run. However, it is important to note that the US market is more vulnerable to economic shocks due to its higher exposure to global events.

Risk Factors

European Stocks:

One of the primary risks associated with European stocks is political uncertainty. Issues like Brexit and the rise of nationalism have created a level of uncertainty in the region. Additionally, the interconnectedness of the European economies makes them more vulnerable to economic shocks.

US Stocks:

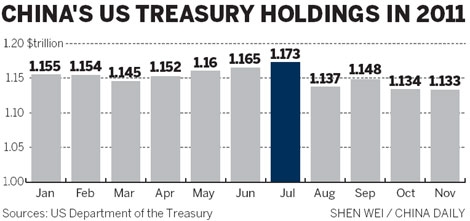

US stocks face a different set of risks. One of the biggest concerns is the trade war with China, which has created uncertainty in the market. Moreover, the US stock market's high valuation compared to its historical averages could be a cause for concern.

Case Studies

Let's consider two case studies to understand the differences between European and US stocks better.

Case Study 1: Volkswagen AG

Volkswagen AG is a German car manufacturer that has been a leader in the European market. Over the past few years, Volkswagen has seen impressive growth, especially in emerging markets. However, the company's stock has been volatile due to political and economic uncertainties in the region.

Case Study 2: Apple Inc.

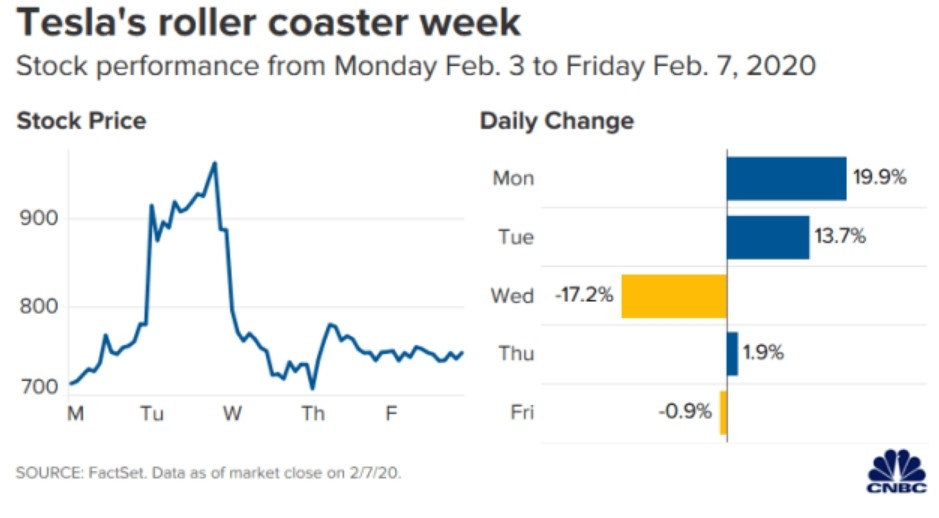

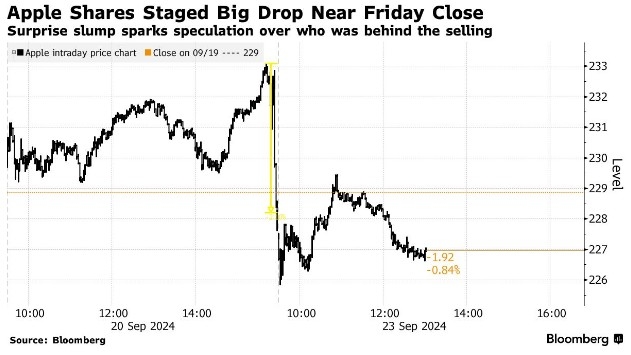

Apple Inc. is an American tech giant that has been a consistent performer in the US stock market. The company's strong performance in the technology sector has helped it deliver high returns to its investors. However, Apple's stock is more susceptible to global economic events and market volatility.

In conclusion, European stocks and US stocks offer unique opportunities and challenges. While European stocks have impressive growth potential, they are also subject to political and economic uncertainties. Conversely, US stocks offer a diverse range of sectors and strong performance, but they are vulnerable to global economic shocks. Investors should carefully consider their risk tolerance and investment goals before deciding where to invest their capital.