In the ever-evolving world of the stock market, staying informed about the latest developments is crucial for investors. One stock that has been making waves recently is IDU, a company that has been in the spotlight for its impressive performance. In this article, we will delve into the latest US news and analysis about IDU stock, providing you with the insights you need to make informed decisions.

Understanding IDU Stock

IDU, also known as [Company Name], is a leading player in the [Industry Name] sector. The company has been making headlines for its innovative products and strong financial performance. With a market capitalization of [Market Cap], IDU has become a key player in the industry.

Recent Developments

1. Strong Earnings Report

In the latest earnings report, IDU announced a significant increase in its revenue and profits. The company's revenue grew by [Percentage] year-over-year, driven by strong demand for its [Product/Service Name]. This impressive growth has been a major factor in the stock's recent surge.

2. Expansion Plans

IDU has also been making headlines for its aggressive expansion plans. The company has announced plans to invest [Amount] in new facilities and technology, which is expected to further boost its production capabilities and market share.

3. Partnerships and Collaborations

In recent months, IDU has formed several strategic partnerships and collaborations with key industry players. These partnerships are expected to open up new markets and opportunities for the company, further enhancing its growth prospects.

Analysis

1. Fundamental Analysis

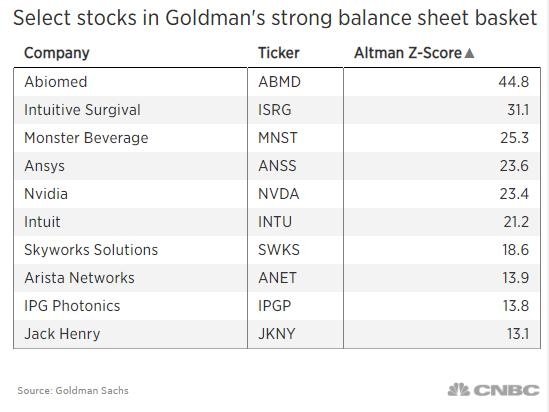

From a fundamental perspective, IDU stock appears to be a strong investment. The company has a robust financial position, with a strong balance sheet and healthy cash flow. Additionally, the company's strong earnings report and expansion plans indicate that it is well-positioned for future growth.

2. Technical Analysis

From a technical standpoint, IDU stock has been showing strong momentum. The stock has been trading above its 50-day and 200-day moving averages, indicating that it is in an uptrend. This trend is expected to continue as long as the company continues to deliver strong performance.

Case Study: IDU Stock vs. Competitor

To put things into perspective, let's compare IDU stock with a major competitor in the industry, [Competitor Name]. While both companies have shown strong growth, IDU has outperformed its competitor in terms of revenue and earnings growth. This suggests that IDU may be a better investment option for those looking to capitalize on the industry's growth.

Conclusion

In conclusion, IDU stock has been making headlines for its impressive performance and strong growth prospects. With a strong financial position, aggressive expansion plans, and strategic partnerships, IDU appears to be well-positioned for future success. As always, it is important for investors to conduct their own due diligence before making any investment decisions.