In the ever-evolving world of financial markets, the US OTC (Over-the-Counter) market has become a popular destination for investors seeking alternative investment opportunities. One such company that has gained attention is Ntiof. This article aims to provide an in-depth understanding of Ntiof stock, its presence in the US OTC market, and what it means for investors.

What is the US OTC Market?

The US OTC market is a decentralized market where securities are traded without a centralized exchange. It provides a platform for companies that are not listed on major exchanges like the New York Stock Exchange (NYSE) or NASDAQ. The OTC market is divided into two segments: the OTCQB and the OTCQX. Companies listed on the OTCQB have to meet certain financial and disclosure requirements, while OTCQX companies have stricter criteria.

Ntiof: A Brief Overview

Ntiof is a company that operates in the technology sector, specializing in innovative solutions for various industries. Its stock is traded on the OTCQB, indicating that it meets the necessary requirements for transparency and financial reporting.

Why Invest in Ntiof Stock?

Investing in Ntiof stock offers several advantages:

- Innovation and Growth Potential: Ntiof's focus on technological innovation positions it for significant growth, especially as the technology sector continues to expand.

- Access to Alternative Investment Opportunities: The US OTC market provides investors with access to companies that may not be listed on major exchanges, allowing for diverse investment portfolios.

- Potential for High Returns: While investing in the OTC market comes with higher risks, it also offers the potential for high returns, particularly if a company achieves significant growth.

Understanding the Risks

Investing in Ntiof stock, like any other investment, carries certain risks. These include:

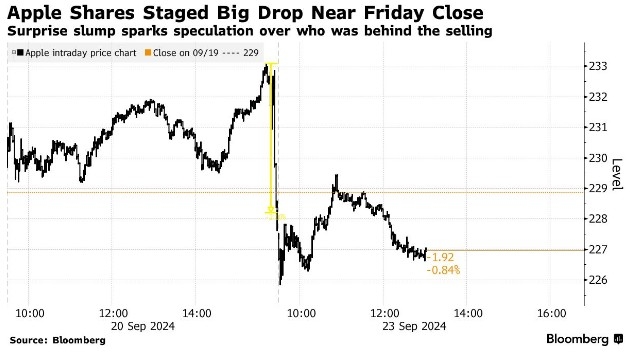

- Volatility: The OTC market can be highly volatile, leading to significant price fluctuations.

- Lack of Regulation: Companies listed on the OTC market are subject to less stringent regulations compared to those listed on major exchanges.

- Liquidity Issues: Some OTC stocks may have limited liquidity, making it difficult to buy or sell shares without impacting the stock price.

Case Study: Ntiof's Recent Acquisition

One notable example of Ntiof's growth potential is its recent acquisition of a leading technology company. This acquisition has expanded Ntiof's product portfolio and strengthened its market position. Such strategic moves can significantly boost the company's value and attract investors.

Conclusion

Ntiof stock presents an intriguing opportunity for investors interested in the technology sector and the US OTC market. While it comes with its own set of risks, the potential for growth and innovation makes it a compelling investment choice. As always, it's crucial for investors to conduct thorough research and consider their own risk tolerance before making investment decisions.