In the ever-evolving world of technology and investment, Softbank is a name that stands out. The Japanese multinational conglomerate, known for its diverse portfolio of businesses, has been making waves in the global market. Among its holdings, the US Softbank stock has garnered significant attention. This article aims to provide a comprehensive guide to understanding the potential of this stock, including its performance, factors influencing its market value, and investment strategies.

Understanding Softbank's Portfolio

Softbank's US investments are spread across various sectors, including technology, finance, and telecommunications. Notable investments include a substantial stake in the US-based tech giant, Alphabet Inc. (parent company of Google), and a majority share in the Chinese e-commerce giant Alibaba Group. These strategic investments have not only helped Softbank diversify its portfolio but also enhanced its market presence in the US.

Performance of US Softbank Stock

The performance of US Softbank stock can be analyzed from different angles. Over the past few years, the stock has seen significant fluctuations, influenced by various factors, including market trends and global economic conditions.

In 2016, the stock experienced a surge after Softbank's CEO, Masayoshi Son, announced plans to invest $25 billion in US technology startups through the Vision Fund. This announcement sent the stock soaring, as investors anticipated the potential growth opportunities.

However, the stock faced challenges in the following years. The global economic slowdown and the trade tensions between the US and China impacted the stock's performance. Despite these challenges, the stock has shown resilience, reflecting the long-term potential of Softbank's investments.

Factors Influencing US Softbank Stock

Several factors influence the value of US Softbank stock. Here are some key factors to consider:

- Market Trends: The technology sector, where Softbank has a significant presence, is subject to rapid changes. Staying ahead of market trends and adapting to new technologies is crucial for the company's success.

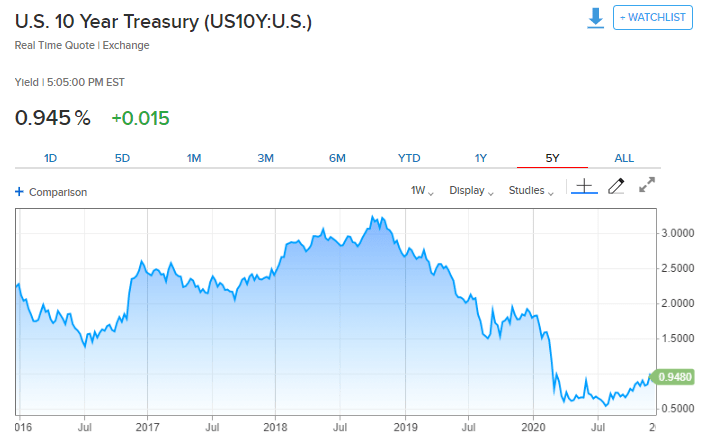

- Global Economic Conditions: The global economy plays a vital role in determining the stock's value. Economic downturns can impact the performance of Softbank's investments, particularly in the technology sector.

- Regulatory Changes: Regulatory changes in the US can affect Softbank's operations and investments. Staying informed about regulatory developments is essential for investors.

Investment Strategies

For investors considering US Softbank stock, here are some key strategies to keep in mind:

- Diversify Your Portfolio: Softbank's investments span across various sectors. Diversifying your portfolio with Softbank's stock can provide exposure to multiple industries.

- Monitor Market Trends: Keeping a close eye on market trends and economic indicators can help you make informed decisions about your investment.

- Research and Analyze: Conduct thorough research and analysis before making investment decisions. Understand the company's financial health, growth potential, and market positioning.

Case Studies

To illustrate the potential of US Softbank stock, let's consider a few case studies:

- Alphabet Inc.: Softbank's investment in Alphabet Inc. has been a significant success. The company has seen substantial growth in its revenue and market value since Softbank's involvement.

- WeWork: Softbank's investment in WeWork, the co-working space giant, was initially a controversial move. However, the company has since made strides in improving its operations and market positioning.

In conclusion, US Softbank stock presents a unique opportunity for investors looking to diversify their portfolios and capitalize on the global technology sector. By understanding the company's portfolio, performance, and investment strategies, investors can make informed decisions and potentially reap the benefits of Softbank's long-term growth potential.