In the ever-evolving financial market, investors are always on the lookout for the best US bank stock to buy. With numerous options available, it can be challenging to determine which bank stock offers the most potential for growth and profitability. This article aims to provide a comprehensive guide to help you identify the best US bank stock to invest in.

Understanding the Market

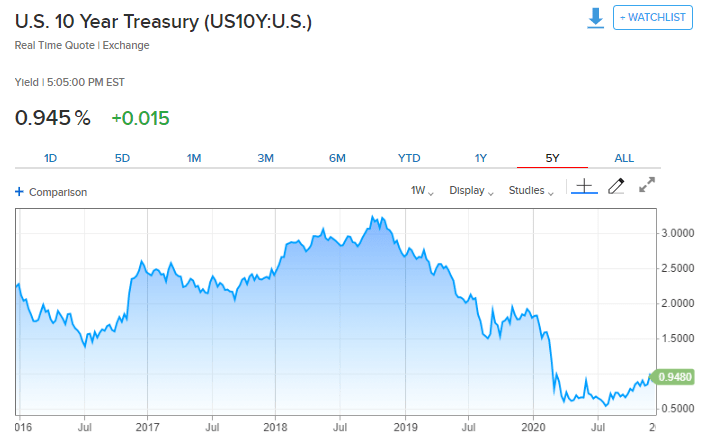

Before diving into the specifics of individual bank stocks, it's crucial to understand the broader market trends. The US banking sector has been experiencing steady growth over the past few years, driven by factors such as low interest rates, economic recovery, and technological advancements.

Key Factors to Consider

When evaluating the best US bank stock to buy, several key factors should be taken into account:

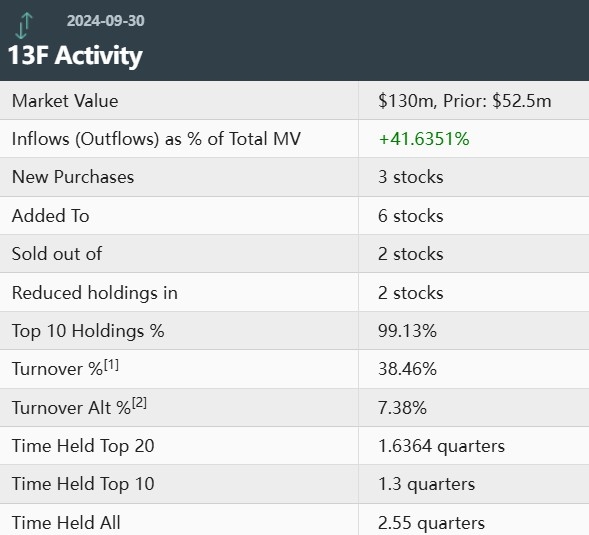

- Financial Health: Assess the bank's financial statements, including its revenue, profit margins, and capital adequacy ratios. A strong financial foundation is essential for long-term success.

- Growth Potential: Look for banks with strong growth potential, such as those expanding into new markets or offering innovative products and services.

- Dividend Yield: Consider the bank's dividend yield, as this can provide a steady stream of income for investors.

- Management Team: Evaluate the bank's management team, as their leadership and strategic vision can significantly impact the company's performance.

Top US Bank Stocks to Consider

Based on the above criteria, here are some of the top US bank stocks to consider:

- JPMorgan Chase & Co. (NYSE: JPM): As one of the largest banks in the US, JPMorgan Chase offers a diverse range of financial services, including retail banking, investment banking, and asset management. The company has a strong financial foundation and a history of consistent growth.

- Bank of America Corporation (NYSE: BAC): Bank of America is another leading US bank with a strong presence in retail, commercial, and corporate banking. The company has been investing in technology and digital banking, positioning it for future growth.

- Wells Fargo & Company (NYSE: WFC): Wells Fargo is a well-known retail bank with a significant presence in the US. The company has been working to improve its reputation and financial performance after facing regulatory challenges in the past.

- Goldman Sachs Group, Inc. (NYSE: GS): Goldman Sachs is a premier investment banking and financial services firm. The company has a strong track record of generating profits and offers a diverse range of services to its clients.

Case Study: JPMorgan Chase & Co.

To illustrate the potential of investing in a top US bank stock, let's take a closer look at JPMorgan Chase & Co. Over the past five years, the company has seen its revenue and profit margins grow consistently. Additionally, JPMorgan Chase has been investing in technology and digital banking, which is expected to drive future growth.

Conclusion

When searching for the best US bank stock to buy, it's essential to conduct thorough research and consider various factors. By focusing on financial health, growth potential, dividend yield, and management team, you can identify the most promising opportunities in the US banking sector. As always, it's important to consult with a financial advisor before making any investment decisions.