Investing in the stock market can be a thrilling endeavor, but finding the right stocks can be a daunting task. With the countless options available, it can be challenging to identify those that are undervalued and have the potential to deliver substantial returns. In this article, we will delve into the world of undervalued stocks in the US market, exploring what makes a stock undervalued, how to identify them, and providing a few potential hidden gems to watch out for.

What is an Undervalued Stock?

An undervalued stock is one that is priced below its intrinsic value. This means that the stock is considered to be worth more than its current market price. Investors who believe in the company's long-term prospects may see this as an opportunity to purchase shares at a discounted price and benefit from the stock's potential appreciation.

Identifying Undervalued Stocks

To identify undervalued stocks, investors need to conduct thorough research. Here are a few key factors to consider:

- Financial Health: Analyze the company's financial statements, including revenue, earnings, debt, and cash flow. Look for signs of profitability, stability, and strong growth prospects.

- Valuation Metrics: Utilize various valuation metrics, such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and enterprise value-to-EBITDA (EV/EBITDA) ratio, to assess whether a stock is undervalued or overvalued.

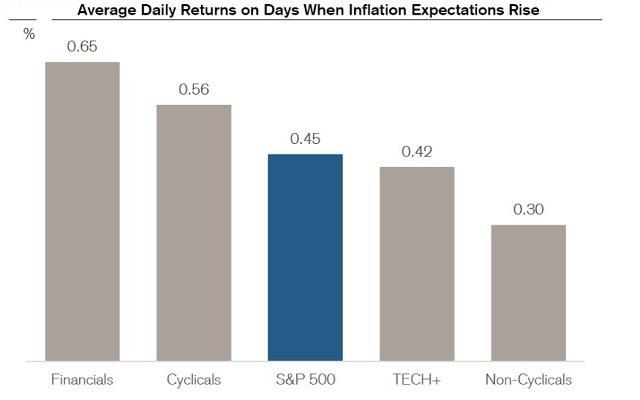

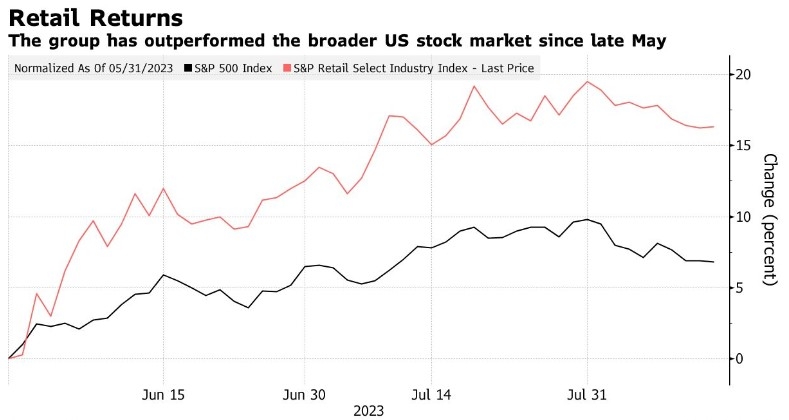

- Sector and Market Trends: Stay informed about industry trends and economic conditions that may impact the stock's performance.

- Management and Corporate Governance: Evaluate the company's management team, corporate governance practices, and reputation for transparency and integrity.

Undervalued Stocks to Watch

Company A: This technology company has seen a decline in its stock price due to recent market volatility. However, the company's strong revenue growth and innovative products make it a potential undervalued stock.

Company B: A healthcare company with a diverse portfolio of products and a strong pipeline of new drugs. The stock is currently trading at a low P/E ratio, suggesting it may be undervalued.

Company C: This real estate investment trust (REIT) has a solid track record of generating consistent cash flows and dividends. With a low P/B ratio, it may be an attractive undervalued investment.

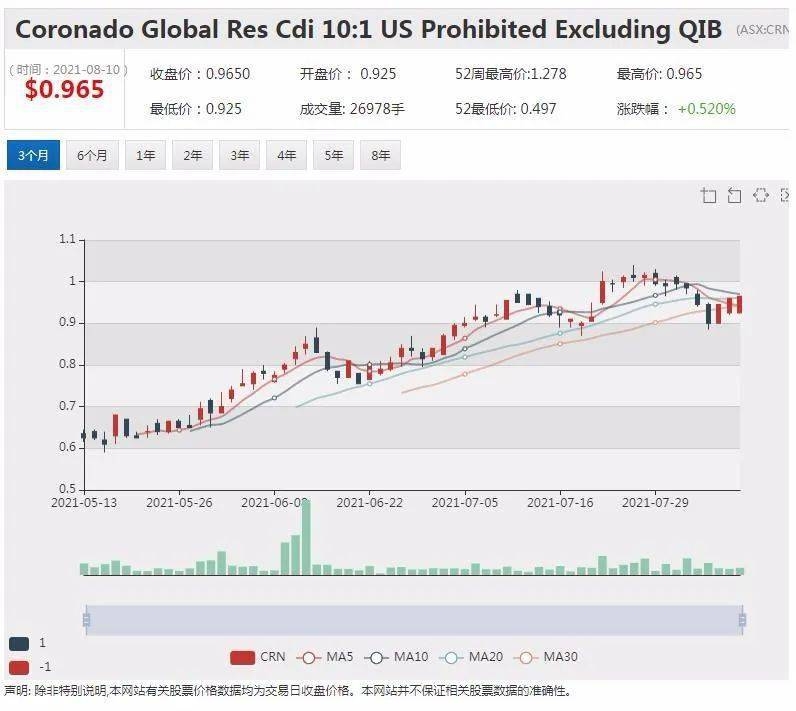

Case Study: Company D

Company D, a small-cap manufacturing company, was considered undervalued due to its struggling stock price. However, after a thorough analysis, it was discovered that the company had a strong order book, a highly skilled workforce, and a strategic partnership with a major player in the industry. This information was not fully reflected in the stock price, making it an attractive investment opportunity.

Conclusion

Finding undervalued stocks in the US market requires diligent research and analysis. By considering factors such as financial health, valuation metrics, and industry trends, investors can identify potential hidden gems that have the potential to deliver substantial returns. As always, it is important to conduct thorough due diligence and consider your own investment goals and risk tolerance before making any investment decisions.