The stock market is often likened to a rollercoaster ride, with investors experiencing both exhilarating highs and stomach-churning lows. The burst of the US stock bubble, a phenomenon that has occurred multiple times throughout history, serves as a stark reminder of the volatility and unpredictability of the financial markets. This article delves into the aftermath of the latest stock bubble burst, analyzing its impact on investors and the lessons learned from this tumultuous period.

Understanding the Stock Bubble Burst

A stock bubble refers to a situation where the price of stocks rises to an unsustainable level, driven by excessive optimism and speculative trading. This bubble is often followed by a sharp decline, known as a bubble burst, where stock prices plummet, leading to significant financial losses.

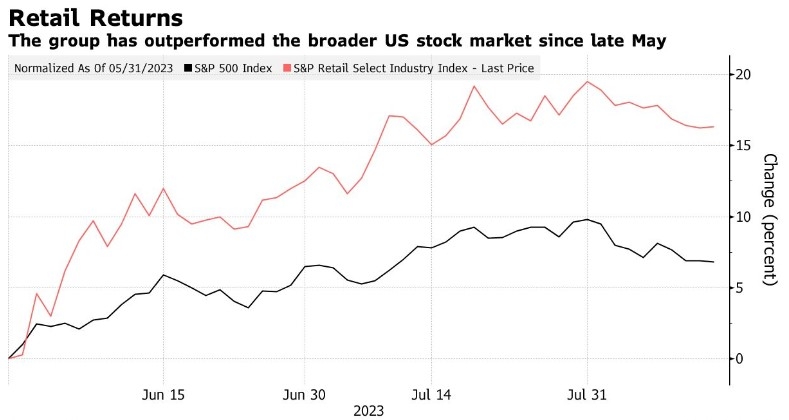

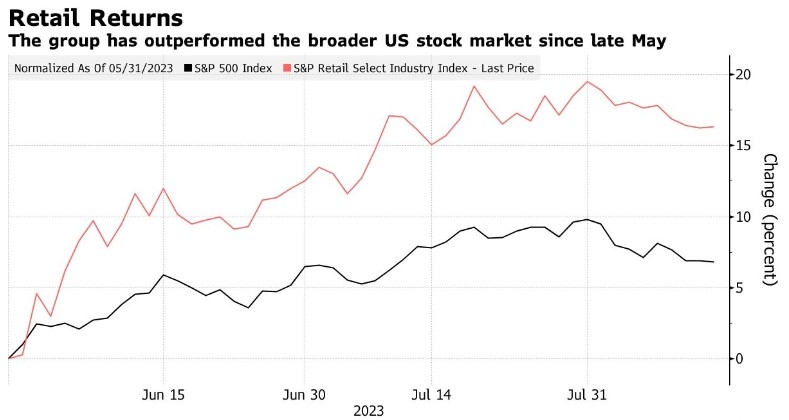

The most recent US stock bubble burst occurred in 2022, following a period of unprecedented growth and speculative trading. Investors, driven by low interest rates and the promise of economic recovery, poured massive amounts of capital into the stock market, pushing stock prices to record highs.

Impact on Investors

The stock bubble burst had a profound impact on investors, particularly those who had invested heavily during the bubble period. Many investors saw their portfolios dwindle significantly, leading to substantial financial losses. This situation highlighted the importance of diversification and risk management in investment strategies.

Lessons Learned

The burst of the US stock bubble offers several valuable lessons for investors and market participants:

- Diversification is Key: Investing in a diversified portfolio can help mitigate the impact of market downturns. By spreading investments across various asset classes, investors can reduce their exposure to market-specific risks.

- Risk Management is Essential: It is crucial to assess and manage risks associated with investments. This includes understanding the volatility of different assets and setting realistic investment goals.

- Avoid Speculative Trading: Speculative trading, driven by greed and excessive optimism, can lead to significant financial losses. Investors should focus on long-term investments and avoid chasing short-term gains.

- Stay Informed: Keeping up-to-date with market trends and economic indicators can help investors make informed decisions and avoid falling victim to market bubbles.

Case Study: The Dot-Com Bubble

One of the most notable stock bubble bursts in history was the dot-com bubble, which occurred in the late 1990s. This bubble was driven by the rapid growth of the internet and the belief that technology stocks would continue to soar. However, as the bubble burst in 2000, many technology stocks plummeted, leading to significant financial losses for investors.

The dot-com bubble serves as a powerful example of the consequences of speculative trading and the importance of diversification and risk management. It highlights the need for investors to conduct thorough research and avoid investing in sectors that are overvalued.

In conclusion, the burst of the US stock bubble in 2022 serves as a stark reminder of the volatility and unpredictability of the financial markets. By understanding the lessons learned from this event, investors can better navigate the stock market and avoid falling victim to future bubbles. Diversification, risk management, and informed decision-making are key to achieving long-term investment success.