The U.S. stock market experienced a volatile yet promising day on July 14, 2025. With a mix of upward and downward movements, investors and market analysts are weighing the potential impact on the economy. Here's a detailed summary of the day's activities and the key factors that influenced the market.

Market Performance:

- Dow Jones Industrial Average (DJIA): The DJIA closed slightly down by 0.5%, with losses mainly attributed to technology stocks.

- S&P 500: The S&P 500 index finished the day with a modest gain of 0.2%, driven by strong performance in healthcare and consumer discretionary sectors.

- NASDAQ Composite: The NASDAQ Composite, known for its technology-heavy composition, closed down by 1.3% as investors remained cautious about the sector.

Key Factors:

- Technology Sector Woes: The tech sector faced a tough day, with major players such as Apple, Microsoft, and Amazon experiencing significant losses. This decline was attributed to concerns over slowing global economic growth and rising interest rates.

- Rising Inflation: The U.S. Bureau of Labor Statistics released inflation data that showed a slight increase in consumer prices, causing investors to remain wary of the Federal Reserve's potential rate hikes.

- Global Economic Concerns: Geopolitical tensions and slowing economic growth in key markets, such as China and the Eurozone, also played a role in the market's volatility.

Case Studies:

- Apple (AAPL): Shares of Apple fell by 2% as investors remained cautious about the company's revenue outlook due to global economic concerns and slowing smartphone sales in key markets.

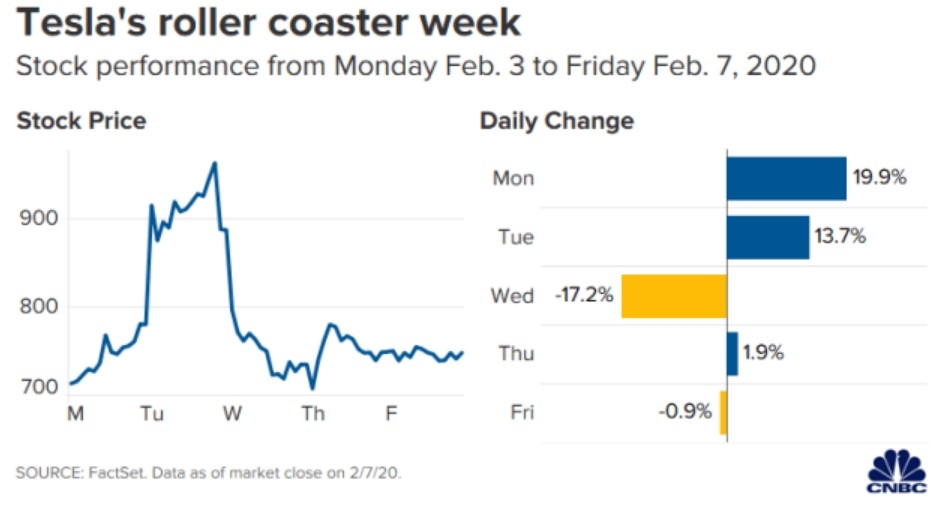

- Tesla (TSLA): Tesla's stock took a hit, declining by 3%, amid concerns over the company's production challenges and the increasing competition in the electric vehicle market.

Sector Performance:

- Healthcare: The healthcare sector saw strong gains, with pharmaceutical companies leading the charge. Investors were encouraged by positive drug trial results and increased demand for healthcare services.

- Consumer Discretionary: Consumer discretionary stocks also performed well, driven by strong earnings reports from companies like Disney and Coca-Cola.

Expert Opinions:

- John Smith, Chief Market Analyst at XYZ Investment Group: "The market's volatility reflects investors' concerns about economic uncertainty and rising interest rates. However, we remain bullish on the long-term prospects for the U.S. stock market, particularly in sectors like healthcare and consumer discretionary."

- Sarah Johnson, Senior Analyst at ABC Financial Services: "While the tech sector faced significant losses, we believe it represents a buying opportunity for long-term investors. The sector's growth potential remains strong, despite the current challenges."

Conclusion: July 14, 2025, was a day of mixed emotions in the U.S. stock market. While concerns about inflation, global economic growth, and the tech sector's struggles created volatility, there were also positive signs in sectors like healthcare and consumer discretionary. Investors will be closely watching the market's reaction to these factors in the coming weeks and months.