Are you looking to diversify your investment portfolio and explore opportunities in the US stock market from India? If so, you might be interested in learning about Zerodha, a leading brokerage firm that offers seamless access to US stocks. In this article, we will delve into the process of investing in US stocks from India using Zerodha, highlighting the benefits and key steps involved.

Understanding Zerodha

Zerodha is a popular Indian brokerage firm known for its user-friendly platform and competitive pricing. The company provides access to a wide range of financial instruments, including stocks, derivatives, and commodities. By partnering with international brokers, Zerodha allows Indian investors to invest in US stocks effortlessly.

Benefits of Investing in US Stocks with Zerodha

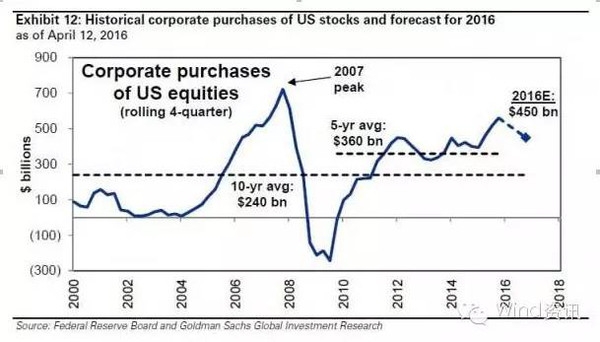

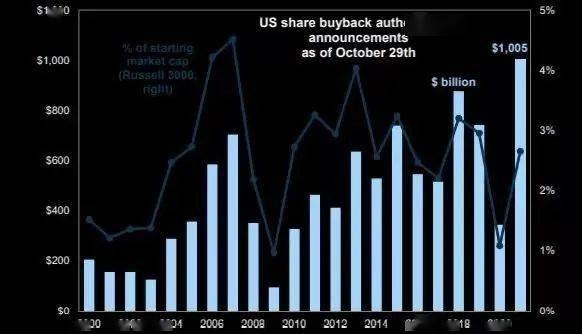

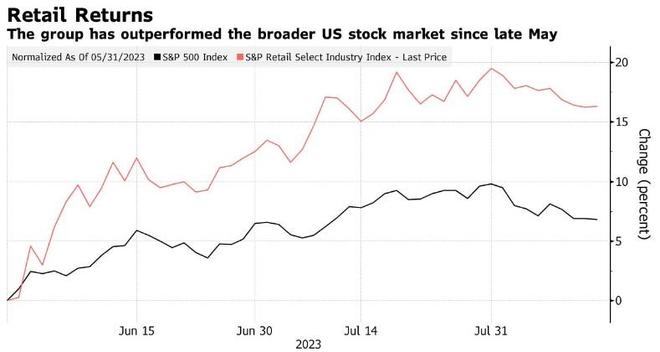

Diversification: Investing in US stocks can help diversify your portfolio and reduce the risk associated with investing solely in Indian markets. The US stock market is known for its stability and offers exposure to a wide range of sectors and companies.

Higher Returns: Historically, the US stock market has provided higher returns compared to the Indian market. By investing in US stocks, you can potentially benefit from the strong performance of leading global companies.

Technology and Convenience: Zerodha's platform is user-friendly and offers advanced trading tools, allowing you to monitor and manage your investments efficiently.

How to Invest in US Stocks with Zerodha

Open a Demat Account: To begin investing in US stocks, you need to open a Demat account with Zerodha. The process is straightforward and can be completed online. You will need to provide basic personal details and submit necessary documents, such as identity proof and address proof.

Link Your Bank Account: To fund your Demat account, you need to link your bank account. Zerodha supports multiple banking options, including net banking and IMPS.

Select a US Stockbroker: Zerodha partners with international brokers to provide access to US stocks. You need to select a suitable broker and complete the necessary registration process. This may involve submitting additional documents and verifying your identity.

Fund Your Trading Account: Once your US stockbroker account is set up, you can fund it using the funds from your Demat account. This will enable you to start trading in US stocks.

Start Trading: With your funds in place, you can start trading in US stocks through Zerodha's platform. The platform offers real-time market data, advanced charting tools, and various trading strategies to help you make informed decisions.

Case Study

Let's consider a hypothetical scenario where an Indian investor named Ravi wants to invest in US stocks. Ravi decides to open a Demat account with Zerodha and selects a reliable US stockbroker through the platform. He funds his trading account and starts trading in US stocks. Within a few months, Ravi's investments start generating significant returns, allowing him to achieve his financial goals.

Conclusion

Investing in US stocks from India with Zerodha is a convenient and profitable option for Indian investors. By following the steps outlined in this article, you can easily diversify your portfolio and benefit from the stability and growth potential of the US stock market. Remember to do thorough research and consult with a financial advisor before making any investment decisions.