Investing in the stock market can be a daunting task, especially for beginners. With countless stocks and investment options available, it's crucial to have a clear strategy. One such strategy involves the use of sumo stocks, a term that has gained popularity among investors. In this article, we will explore what sumo stocks are, their benefits, and how to identify them in the United States.

What are Sumo Stocks?

Sumo stocks are shares of companies that exhibit strong growth potential and a high level of liquidity. They are often referred to as "sumo" due to their ability to overcome significant market challenges and continue to grow. These stocks are usually found in industries that are experiencing rapid technological advancements or have unique competitive advantages.

Benefits of Investing in Sumo Stocks

Investing in sumo stocks can offer several benefits, including:

- Strong Growth Potential: Sumo stocks have a proven track record of growth, making them an attractive investment option for those seeking substantial returns.

- High Liquidity: Sumo stocks are highly liquid, meaning they can be easily bought and sold without significantly impacting their price.

- Risk Mitigation: By investing in sumo stocks, investors can diversify their portfolios and mitigate risks associated with investing in a single stock or sector.

Identifying Sumo Stocks in the United States

To identify sumo stocks in the U.S., investors can follow these steps:

- Research Industries with Strong Growth Potential: Look for industries that are experiencing rapid technological advancements or have unique competitive advantages, such as technology, biotech, or renewable energy.

- Analyze Financial Ratios: Look for companies with strong financial ratios, such as a high return on equity (ROE), a low price-to-earnings (P/E) ratio, and a high revenue growth rate.

- Consider Management: Analyze the quality of the company's management team and their strategic vision for the future.

Case Studies

One example of a sumo stock in the U.S. is Tesla, Inc. (NASDAQ: TSLA). Tesla is a leader in the electric vehicle (EV) market and has a strong track record of growth. The company has a high market capitalization and is well-liquidated, making it an attractive investment for investors seeking substantial returns.

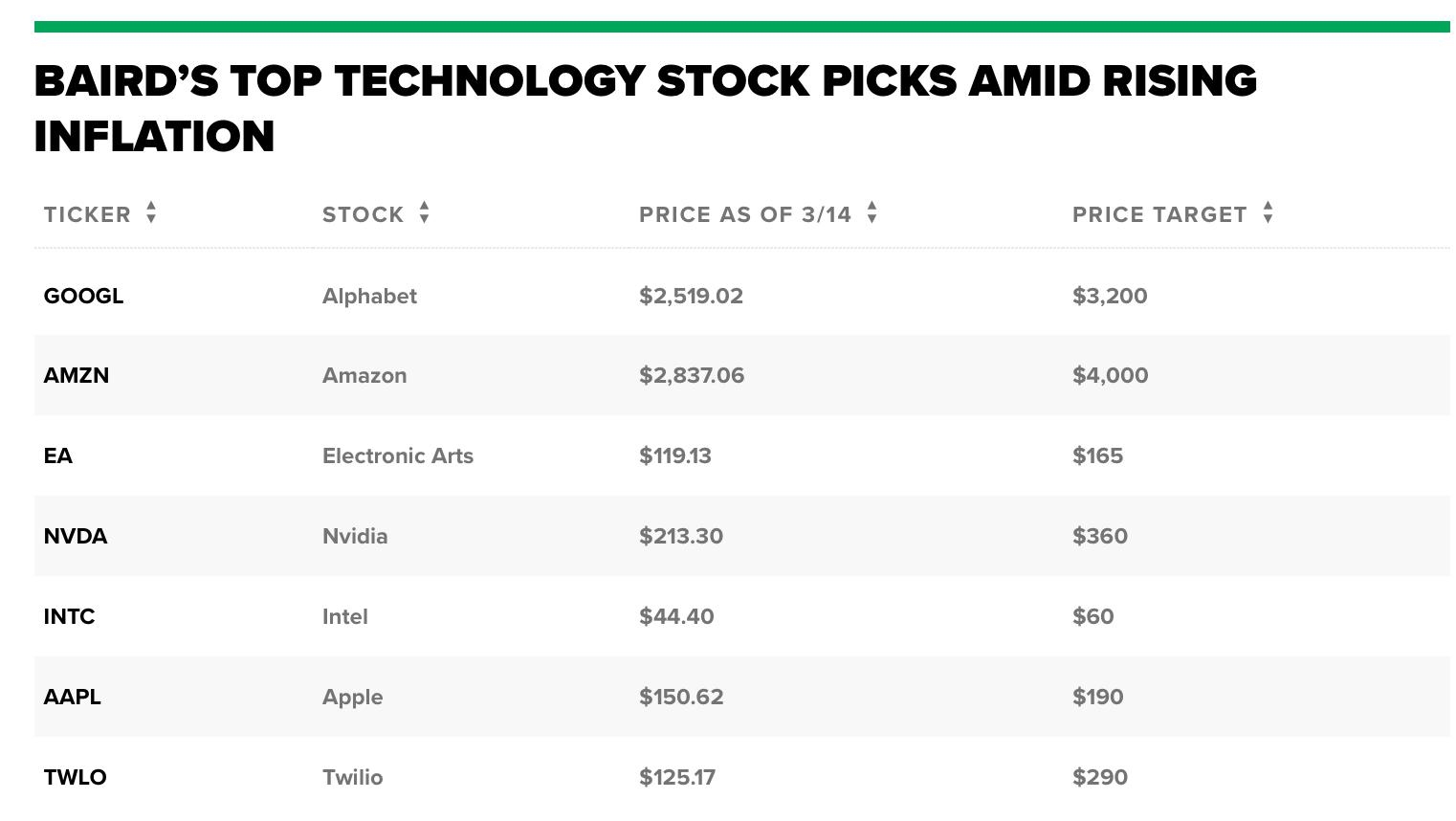

Another example is Amazon.com, Inc. (NASDAQ: AMZN). Amazon is a leader in the e-commerce market and has a high market capitalization. The company has demonstrated strong revenue growth and a low P/E ratio, making it an appealing sumo stock.

Conclusion

Sumo stocks can be an excellent investment option for those seeking substantial returns. By researching industries with strong growth potential, analyzing financial ratios, and considering management, investors can identify and invest in sumo stocks in the U.S. Keep in mind that investing always carries risks, and it's crucial to conduct thorough research before making any investment decisions.