Introduction

The financial markets are always on the edge of their seats, waiting for the next piece of economic data that could potentially sway the course of their investments. One such critical piece of data is the Personal Consumption Expenditures (PCE) inflation rate, which is set to be released shortly. As of now, US stock futures have stabilized ahead of this pivotal announcement. Let's delve into what this could mean for the markets and investors.

Understanding the PCE Inflation Rate

The PCE inflation rate is a key indicator of the health of the US economy. It measures the rate at which the prices of goods and services are rising, which is a significant factor in determining the Federal Reserve's monetary policy. A higher inflation rate can lead to higher interest rates, which can, in turn, affect the stock market.

Stabilization in Stock Futures

The stabilization of US stock futures ahead of the PCE inflation data release is a sign that investors are cautious but optimistic. The futures, which are contracts that allow investors to buy or sell a stock at a predetermined price at a future date, have shown a lack of significant movement. This suggests that investors are not overly bearish or bullish but are waiting for the data to make a more informed decision.

Potential Impacts of the PCE Inflation Rate

The PCE inflation rate can have a significant impact on the stock market. If the rate is higher than expected, it could lead to higher interest rates, which can make borrowing more expensive for companies. This could lead to a decrease in earnings and, consequently, a drop in stock prices. Conversely, if the rate is lower than expected, it could signal that the economy is not overheating, which could be seen as a positive sign for the stock market.

Case Studies

To illustrate the impact of the PCE inflation rate on the stock market, let's look at a couple of case studies.

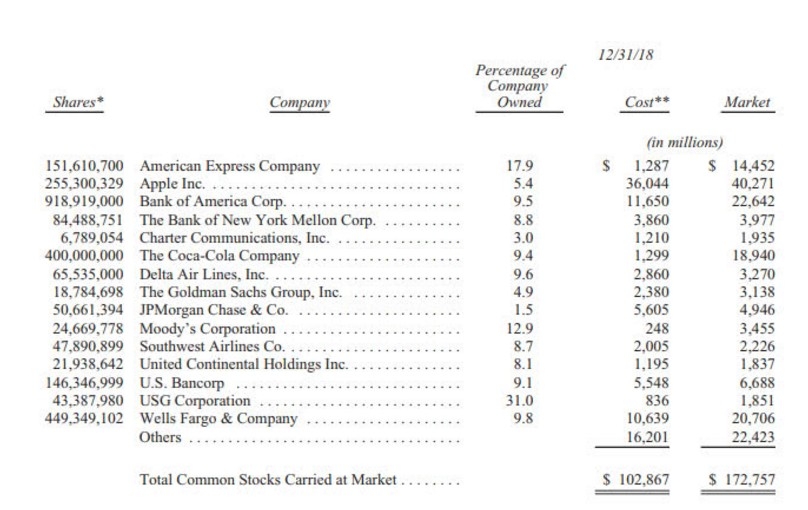

- In 2018, the PCE inflation rate was higher than expected, leading to a rise in interest rates. This resulted in a decline in stock prices, with the S&P 500 falling by nearly 6% in the following month.

- In 2020, the PCE inflation rate was lower than expected, signaling that the economy was not overheating. This led to a rally in the stock market, with the S&P 500 rising by over 15% in the following year.

Conclusion

The stabilization of US stock futures ahead of the PCE inflation data release is a sign that investors are cautious but optimistic. The PCE inflation rate is a critical indicator of the health of the US economy and can have a significant impact on the stock market. As we await the release of this data, investors will be closely watching for any signs of movement in the market.