The stock market has been experiencing a rollercoaster ride recently, but it appears that the tide might be turning for the better. The US stock futures have soared after a significant hint from Michael Lutnick, CEO of Two Trees Management, about potential tariff relief. This development has sparked optimism among investors, leading to a surge in futures.

The Background

Michael Lutnick is no stranger to the financial world. As the CEO of Two Trees Management, a real estate investment firm, he has been actively involved in the market. His recent statement about the possibility of tariff relief has sent shockwaves through the market, prompting a surge in futures.

What is Tariff Relief?

Tariffs are taxes imposed on imported goods. They are used to protect domestic industries and can have a significant impact on the global economy. Tariff relief refers to the reduction or elimination of these taxes, which can lead to lower prices for consumers and increased trade between countries.

Lutnick's Hint

Michael Lutnick recently hinted that there might be some progress in the negotiations regarding tariffs. In a speech at the National Association of Real Estate Investment Trusts (NAREIT) conference, he mentioned that he had seen a "good sign" from the White House about potential tariff relief.

Impact on Stock Futures

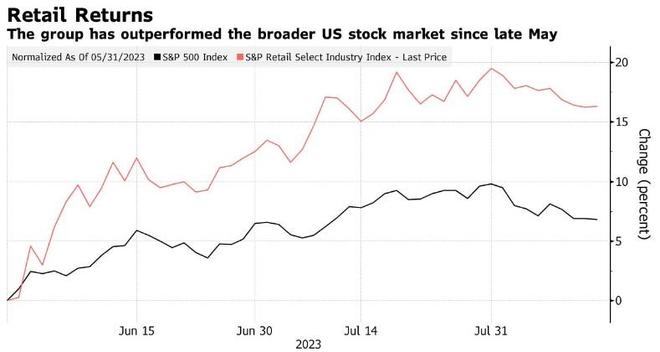

The hint from Lutnick has had a significant impact on the stock market. The S&P 500 futures have soared, and the Dow Jones Industrial Average futures have seen a similar trend. This surge in futures is a clear indication that investors are optimistic about the potential for tariff relief.

Why is Tariff Relief Important?

Tariff relief is crucial for the global economy. High tariffs can lead to higher prices for consumers, reduced trade, and a slower economic growth rate. By reducing or eliminating tariffs, countries can foster a more open and competitive global market, benefiting consumers and businesses alike.

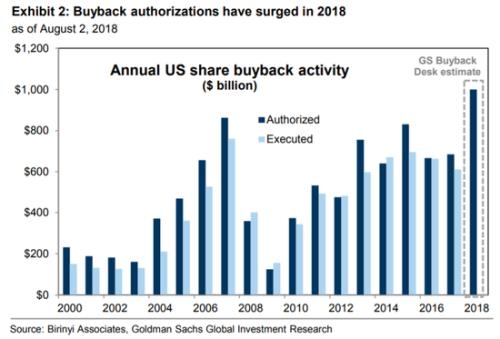

Case Study: China-US Trade War

One of the most notable examples of the impact of tariffs is the China-US trade war. In 2018, the United States imposed tariffs on Chinese goods, leading to a trade dispute between the two countries. This dispute has had a significant impact on the global economy, with companies and consumers feeling the pinch.

However, there have been recent signs of progress. In December 2019, China and the United States reached a preliminary trade deal, which could potentially lead to a reduction in tariffs. This development has been met with optimism, and the stock market has responded positively.

Conclusion

The hint of potential tariff relief from Michael Lutnick has sparked optimism in the stock market, leading to a surge in futures. With the potential for reduced tariffs, the global economy could see significant benefits. As investors continue to monitor the situation, the market will likely remain volatile. However, the recent surge in futures suggests that the outlook might be brighter than previously thought.