Are you interested in investing in the stock market but unsure of where to start? Opening a stock account in the US is a straightforward process that can open up a world of investment opportunities. In this article, we will guide you through the steps to open a stock account in the US and provide some valuable insights to help you get started.

Why Open a Stock Account in the US?

The US stock market is one of the largest and most diverse in the world, offering a wide range of investment options. By opening a stock account in the US, you can gain access to some of the most well-known and successful companies globally. Additionally, the US stock market is known for its liquidity, meaning it's easy to buy and sell stocks.

Steps to Open a Stock Account in the US

Choose a Brokerage Firm: The first step in opening a stock account is to choose a brokerage firm. There are many reputable brokerage firms in the US, each with its own set of fees, services, and tools. Some popular brokerage firms include TD Ameritrade, Charles Schwab, and E*TRADE.

Research and Compare Brokerage Firms: Before making a decision, research and compare different brokerage firms. Consider factors such as fees, trading platforms, customer service, and the types of investments they offer.

Gather Required Documentation: To open a stock account, you will need to provide some personal information and documentation. This may include your full name, address, Social Security number, date of birth, and proof of identity, such as a driver's license or passport.

Complete the Application Process: Once you have chosen a brokerage firm and gathered the necessary documentation, you can complete the application process. This typically involves filling out an online application form and providing your personal information.

Fund Your Account: After your application has been approved, you will need to fund your stock account. You can do this by transferring funds from your bank account or by using a credit card or debit card.

Start Investing: Once your account is funded, you can start investing in stocks. Research companies, analyze market trends, and use the tools provided by your brokerage firm to make informed investment decisions.

Tips for Successful Stock Investing

Start Small: If you are new to stock investing, it's a good idea to start small. This will allow you to gain experience without risking a significant amount of money.

Diversify Your Portfolio: Diversifying your portfolio can help reduce your risk. Consider investing in a mix of stocks, bonds, and other assets.

Stay Informed: Keep up-to-date with market news and trends. This will help you make informed investment decisions.

Use Stop-Loss Orders: Stop-loss orders can help protect your investments by automatically selling a stock if it reaches a certain price.

Stay Patient: Investing in the stock market can be unpredictable, so it's important to stay patient and avoid making impulsive decisions based on short-term market fluctuations.

Case Study: Investing in Tech Stocks

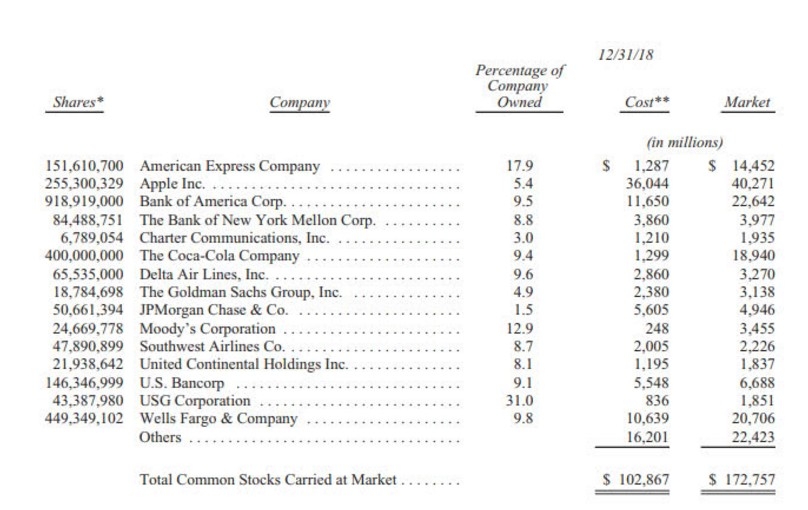

Imagine you have just opened a stock account in the US and are considering investing in tech stocks. One of the most successful tech stocks in recent years has been Apple Inc. (AAPL). By researching the company and analyzing its financials, you may determine that Apple is a good investment opportunity.

After opening your stock account and funding it, you can purchase Apple stock through your brokerage firm. Over time, as the company continues to grow and innovate, your investment in Apple stock could potentially appreciate in value.

Conclusion

Opening a stock account in the US is a straightforward process that can open up a world of investment opportunities. By following these steps and considering the tips provided in this article, you can start investing in the stock market and potentially grow your wealth over time.