In the world of finance, the "US stock" market holds a significant position, attracting investors from around the globe. This article delves into the key aspects of the US stock market, providing insights into its dynamics, trends, and investment opportunities. From the bustling exchanges to the latest market news, we'll explore what makes the US stock market a hub of activity and innovation.

The US Stock Market: A Brief Overview

The US stock market is a vast and diverse ecosystem that includes major exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. It's where companies list their shares to raise capital and where investors can buy and sell stocks. The market is a reflection of the economic health and growth potential of the United States.

Key Factors Influencing the US Stock Market

Several factors can impact the US stock market, including economic indicators, corporate earnings reports, geopolitical events, and technological advancements. Here are some of the key factors to consider:

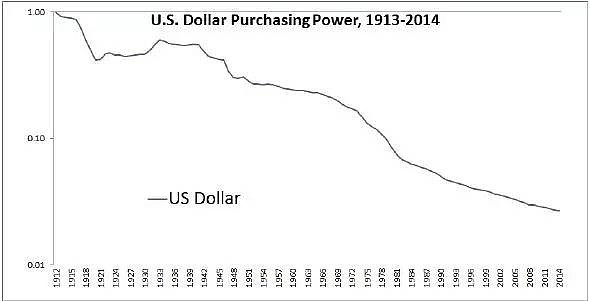

- Economic Indicators: Economic indicators such as unemployment rates, inflation, and GDP growth can significantly influence investor sentiment and market trends.

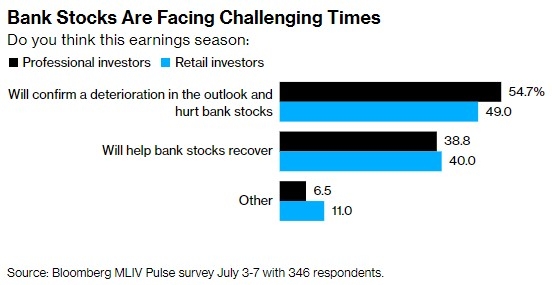

- Corporate Earnings: Companies' earnings reports provide insights into their financial health and performance, which can drive stock prices.

- Geopolitical Events: Global events, such as elections or trade wars, can create uncertainty and volatility in the market.

- Technological Advancements: The rapid pace of technological innovation can impact certain sectors, such as technology and healthcare, and drive market trends.

Investment Opportunities in the US Stock Market

The US stock market offers a wide range of investment opportunities, from blue-chip companies to emerging growth stocks. Here are some popular investment strategies:

- Dividend Stocks: Dividend stocks are shares of companies that pay regular dividends to their shareholders. These stocks are often considered less risky and can provide steady income.

- Growth Stocks: Growth stocks are shares of companies with high potential for growth. These stocks may not pay dividends, but they can offer significant capital gains.

- Value Stocks: Value stocks are shares of companies that are trading at a lower price relative to their intrinsic value. These stocks can offer attractive long-term investment opportunities.

Case Study: Apple Inc.

One of the most influential companies in the US stock market is Apple Inc. Since its initial public offering (IPO) in 1980, Apple has grown to become one of the world's most valuable companies. Its success can be attributed to several factors:

- Innovative Products: Apple's commitment to innovation has led to the development of groundbreaking products, such as the iPhone, iPad, and MacBook.

- Strong Brand Loyalty: Apple's strong brand loyalty has helped it maintain a competitive edge in the market.

- Effective Marketing: Apple's marketing strategies have been instrumental in promoting its products and creating a loyal customer base.

Conclusion

The US stock market is a dynamic and complex ecosystem that offers numerous investment opportunities. By understanding the key factors that influence the market and adopting sound investment strategies, investors can navigate the market with confidence. Whether you're a seasoned investor or just starting out, the US stock market is a place where you can potentially grow your wealth and achieve your financial goals.