Understanding the Basics

What Does "Own Us Stock as a Canadian Resident" Mean?

Are you a Canadian resident looking to invest in US stocks? If so, you're in luck! Investing in US stocks as a Canadian resident can be a great way to diversify your portfolio and potentially benefit from the strong performance of American companies. But what does it mean to "own Us stock as a Canadian resident"?

In simple terms, it refers to purchasing shares of US-based companies from the Canadian market. This process may seem straightforward, but there are important considerations to keep in mind to ensure a smooth and successful investment experience.

Key Considerations for Canadian Residents Investing in US Stocks

1. Understanding the Tax Implications

One of the most crucial aspects of owning US stocks as a Canadian resident is understanding the tax implications. While you will be subject to Canadian taxes on any dividends received from US stocks, you may also be required to pay U.S. taxes as well. This dual taxation can be complex, so it's essential to consult with a tax professional or financial advisor to ensure compliance.

2. Currency Conversion

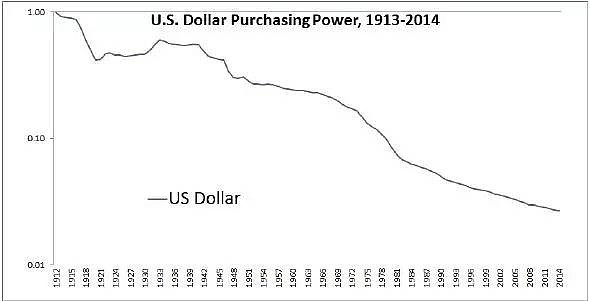

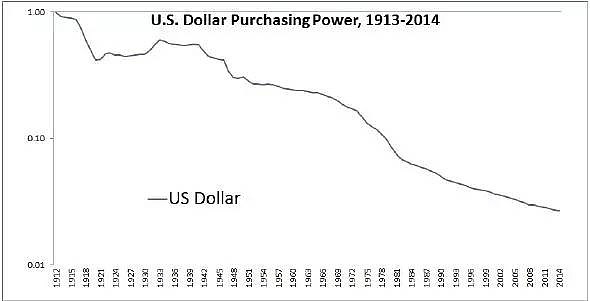

When purchasing US stocks, you will be dealing with currency conversion. This means that your returns will be affected by the exchange rate between the Canadian dollar and the US dollar. It's important to keep an eye on exchange rates and consider how they might impact your investment returns.

3. Accessing US Stocks from Canada

To purchase US stocks as a Canadian resident, you will need to open a brokerage account with a Canadian brokerage firm that offers access to U.S. markets. This will allow you to trade US stocks just as easily as Canadian stocks.

4. Research and Due Diligence

As with any investment, it's crucial to conduct thorough research and due diligence before purchasing US stocks. This includes analyzing the financial health of the company, its industry position, and any potential risks.

Case Study: Investing in Apple Stock as a Canadian Resident

Let's say you're interested in investing in Apple, one of the world's most valuable companies. As a Canadian resident, you can purchase Apple stock through a Canadian brokerage firm that offers access to U.S. markets. However, before making this investment, you should research the company's financials, industry trends, and any potential risks.

Conclusion

Owning Us stock as a Canadian resident can be a valuable part of your investment strategy. By understanding the tax implications, considering currency conversion, and conducting thorough research, you can make informed decisions and potentially benefit from the strong performance of US companies. Always consult with a financial advisor or tax professional to ensure compliance and maximize your investment returns.