Understanding the Market

In the United States, the stock market is a vital component of the economy, offering individuals and institutions the opportunity to invest and potentially grow their wealth. The question "Could the US buy stocks?" may seem straightforward, but it encompasses various aspects that need to be considered. This article will delve into the possibility of the US purchasing stocks, examining the potential benefits and risks involved.

Government Ownership of Stocks

The U.S. government, through various agencies and funds, does indeed own stocks. For instance, the Federal Reserve, a government agency, owns a significant portion of U.S. Treasury bonds, which are effectively a form of stock in the government. Additionally, the Social Security Trust Fund, which is a federal government program, holds a substantial amount of stocks.

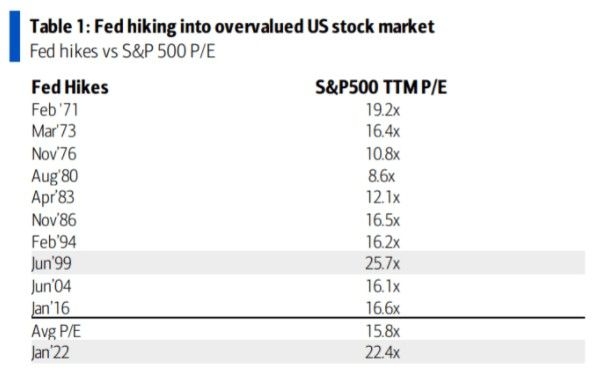

Investment by the Federal Reserve

The Federal Reserve, also known as the central bank of the United States, has the authority to buy and sell stocks. In the past, the Fed has engaged in quantitative easing, which involves purchasing government securities, including stocks, to stimulate the economy. This action is aimed at increasing liquidity in the financial markets and lowering interest rates.

Benefits of Government Stock Ownership

- Economic Stabilization: By owning stocks, the government can influence market stability. In times of economic downturn, the government can use its holdings to support the market and prevent further declines.

- Potential for Profit: Over time, stocks tend to appreciate in value. By owning stocks, the government can potentially profit from this appreciation, which can be used to fund various programs and initiatives.

Risks of Government Stock Ownership

- Market Manipulation: There is a concern that government stock ownership could lead to market manipulation. Critics argue that the government might use its holdings to drive up stock prices or manipulate market trends.

- Political Influence: Some individuals worry that government stock ownership could create conflicts of interest, as the government might prioritize its own interests over those of investors.

Individual Stock Ownership

Individuals in the United States can also buy stocks. This process involves opening a brokerage account, depositing funds, and purchasing shares of companies they believe will grow in value. Here are some key points to consider:

- Risk vs. Reward: Stocks can be volatile, and there is always a risk of losing money. However, with proper research and strategy, individuals can potentially earn significant returns.

- Diversification: To mitigate risk, it is important to diversify your stock portfolio by investing in various sectors and industries.

- Long-Term Investing: Historically, long-term investing in stocks has proven to be a successful strategy. Patience and discipline are crucial for long-term success.

Case Study: The Federal Reserve's Quantitative Easing

One notable example of the U.S. government's involvement in the stock market is the Federal Reserve's quantitative easing programs during the 2008 financial crisis. By purchasing government securities, including stocks, the Fed aimed to stabilize the market and stimulate economic growth. While the program faced criticism, it ultimately helped to stabilize the financial system and contributed to the recovery of the U.S. economy.

In conclusion, the U.S. government and its citizens can indeed buy stocks. While there are risks and potential conflicts of interest, government stock ownership can offer economic stability and the potential for profit. For individuals, stock investing requires careful research, diversification, and a long-term perspective.