As we delve into the second half of 2025, the United States stock market stands as a pivotal indicator of economic health and investor sentiment. This article aims to provide a comprehensive overview of the current US stock market valuation, analyzing key metrics and trends as of June 2025.

Market Overview

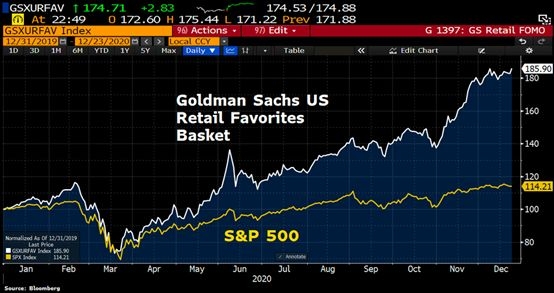

At the beginning of June 2025, the US stock market has experienced a mix of growth and volatility. The S&P 500, a widely followed benchmark index, has seen significant fluctuations over the past few months, reflecting both the economic recovery and the lingering uncertainties surrounding global events.

Key Metrics

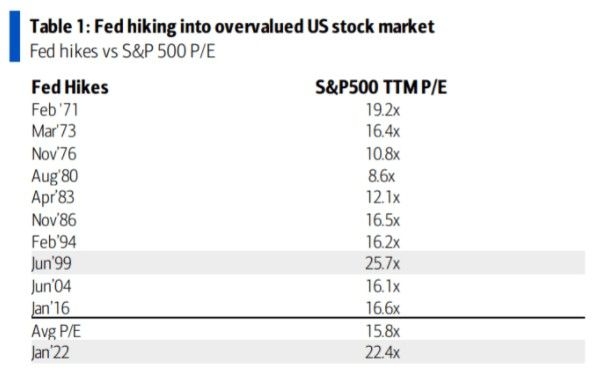

One of the primary metrics used to evaluate stock market valuation is the price-to-earnings (P/E) ratio. As of June 2025, the S&P 500 has a P/E ratio of approximately 20, which is slightly higher than the long-term average of 15. This indicates that the market is moderately valued, suggesting a balanced mix of optimism and caution among investors.

Another crucial metric is the cyclically adjusted price-to-earnings (CAPE) ratio, also known as the Shiller P/E. This ratio, which smooths out short-term fluctuations, shows that the S&P 500 is currently valued at around 26, which is still above its long-term average of 16. This suggests that the market may be slightly overvalued, but the overall outlook remains positive.

Sector Performance

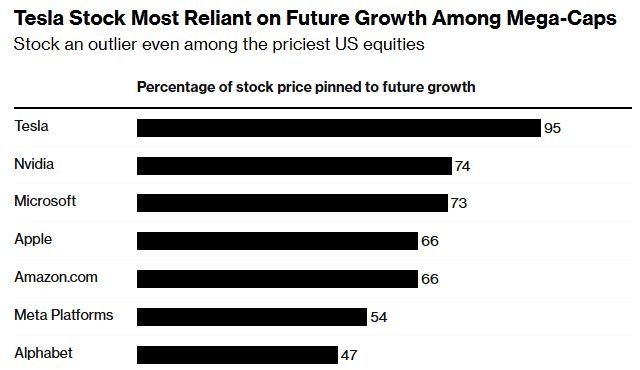

In June 2025, technology and healthcare sectors have emerged as the top performers, driven by strong earnings growth and innovation. The technology sector, which includes giants like Apple, Microsoft, and Google, has seen significant gains, with a P/E ratio of around 40. Meanwhile, the healthcare sector, led by pharmaceutical companies and biotech firms, has a P/E ratio of approximately 30.

On the other hand, energy and financial sectors have underperformed, with P/E ratios of around 15 and 12, respectively. This reflects the challenges faced by these sectors, including geopolitical tensions and regulatory changes.

Case Studies

To better understand the current market dynamics, let's examine a few notable case studies:

- Apple Inc. (AAPL): As one of the largest companies in the world, Apple has seen significant growth in its stock price over the past few months. The company's strong earnings performance and product innovation have driven investor optimism, resulting in a P/E ratio of around 40.

- Johnson & Johnson (JNJ): The healthcare giant has also performed well, with a P/E ratio of approximately 30. The company's diversified portfolio of products and strong brand reputation have contributed to its success.

- Exxon Mobil Corporation (XOM): The energy sector has faced challenges, with Exxon Mobil's P/E ratio of around 15 reflecting the broader issues in the industry. However, the company's strong financial position and commitment to innovation may lead to future growth.

Conclusion

In conclusion, the US stock market as of June 2025 is moderately valued, with a mix of optimism and caution among investors. Key metrics like the P/E ratio and CAPE ratio suggest that the market is balanced, with some sectors performing better than others. As we continue to navigate the complex economic landscape, it's essential to stay informed and adapt to the changing market dynamics.