In the ever-fluctuating landscape of the financial markets, investors often find themselves navigating through turbulent waters. One such phenomenon that has caught the attention of many is the "oversold bounce," which refers to a sudden surge in the stock market after a prolonged period of decline. This article delves into the concept of oversold bounce, its implications for US stock markets, and the potential for a resurgence.

Understanding Oversold Bounce

To comprehend the concept of oversold bounce, it's essential to understand the term "oversold." In trading, an asset is considered oversold when its price has fallen significantly below its intrinsic value, as indicated by various technical indicators. This often occurs during a bear market, where investors are excessively pessimistic about the future of the market.

The oversold bounce, on the other hand, occurs when the market starts to recover after reaching these oversold levels. This sudden surge can be attributed to a variety of factors, including investor sentiment, economic indicators, or even unexpected news that reverses the negative sentiment.

The Significance of Oversold Bounce in US Stock Markets

The US stock market, often considered a benchmark for global markets, has experienced several instances of oversold bounce. One notable example is the dot-com bubble of the late 1990s, where the market crashed before experiencing a strong rebound.

In recent years, the US stock market has faced numerous challenges, including the 2008 financial crisis, the COVID-19 pandemic, and geopolitical tensions. Despite these challenges, the market has often shown resilience and bounce back from oversold levels.

Factors Contributing to Oversold Bounce

Several factors can contribute to an oversold bounce in the US stock market:

- Investor Sentiment: Negative sentiment can drive the market down, leading to oversold levels. However, as investors start to regain confidence, the market can experience a sudden surge.

- Economic Indicators: Positive economic indicators, such as GDP growth, employment rates, and inflation, can boost investor confidence and lead to an oversold bounce.

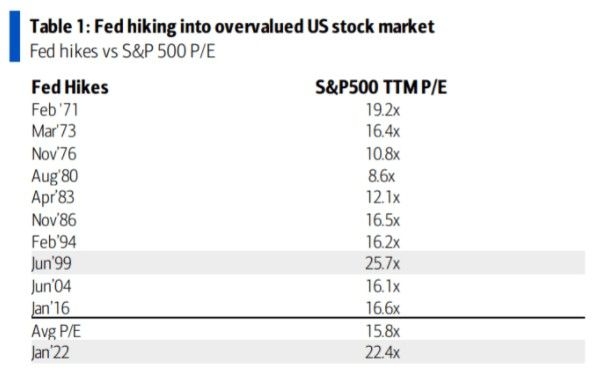

- Central Bank Policies: Central banks, particularly the Federal Reserve, play a crucial role in shaping the market. By adjusting interest rates and implementing other policies, central banks can influence investor sentiment and drive the market.

Case Studies of Oversold Bounce in US Stock Markets

- Dot-Com Bubble: In the late 1990s, the dot-com bubble burst, leading to a significant decline in the stock market. However, the market eventually recovered and experienced a strong rebound, marking one of the most notable instances of an oversold bounce.

- COVID-19 Pandemic: The COVID-19 pandemic caused a massive sell-off in the stock market. However, as the situation improved and vaccines were developed, the market started to recover, showcasing the potential for an oversold bounce.

Conclusion

The concept of oversold bounce in the US stock market is a significant phenomenon that investors should be aware of. By understanding the factors contributing to an oversold bounce and keeping an eye on economic indicators and investor sentiment, investors can better navigate the turbulent waters of the stock market and potentially capitalize on opportunities for a resurgence.