The US stock market, often referred to as the "American stock market," is the largest and most influential stock market in the world. It plays a crucial role in the global economy, attracting investors from around the globe. This comprehensive guide will delve into the intricacies of the US stock market, covering key aspects such as its history, major exchanges, trading hours, and investment strategies.

History of the US Stock Market

The US stock market has a rich history that dates back to the 17th century. However, it wasn't until the 19th century that the market began to take shape. The New York Stock Exchange (NYSE), the oldest and most well-known stock exchange in the United States, was established in 1792. Since then, the market has evolved significantly, with the advent of electronic trading and the rise of new exchanges.

Major Exchanges

The US stock market is dominated by three major exchanges: the New York Stock Exchange (NYSE), the NASDAQ, and the American Stock Exchange (AMEX). Each of these exchanges has its own unique characteristics and listings.

- NYSE: The NYSE is a physical exchange located in New York City. It is home to many of the world's largest and most well-known companies, including IBM, Microsoft, and General Electric.

- NASDAQ: The NASDAQ is an electronic exchange that lists more technology companies than any other exchange. It is home to giants like Apple, Amazon, and Google.

- AMEX: The AMEX is a smaller exchange that focuses on small-cap and mid-cap companies.

Trading Hours

The US stock market operates on a traditional trading schedule. The trading hours for the NYSE and AMEX are from 9:30 AM to 4:00 PM Eastern Time, while the NASDAQ operates slightly longer hours from 9:30 AM to 12:30 PM and from 1:00 PM to 4:00 PM Eastern Time.

Investment Strategies

Investing in the US stock market requires a well-thought-out strategy. Here are some key strategies to consider:

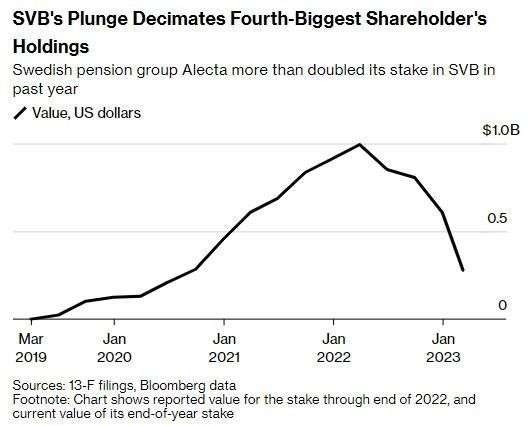

- Diversification: Diversifying your portfolio can help mitigate risk by spreading your investments across different sectors and asset classes.

- Long-term Investing: Investing for the long term can provide more stable returns and reduce the impact of short-term market fluctuations.

- Technical Analysis: Technical analysis involves analyzing past price and volume data to predict future market movements.

- Fundamental Analysis: Fundamental analysis involves analyzing a company's financial statements and business model to determine its intrinsic value.

Case Studies

Let's look at a few notable case studies to understand the dynamics of the US stock market:

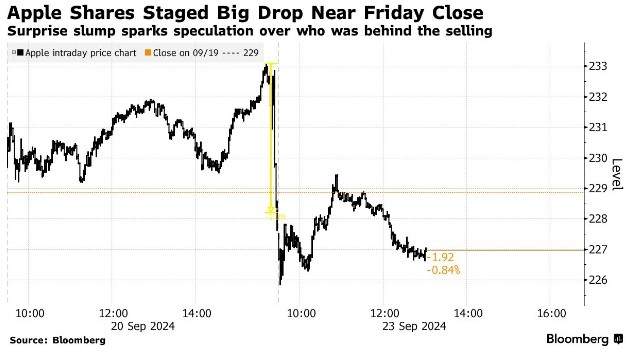

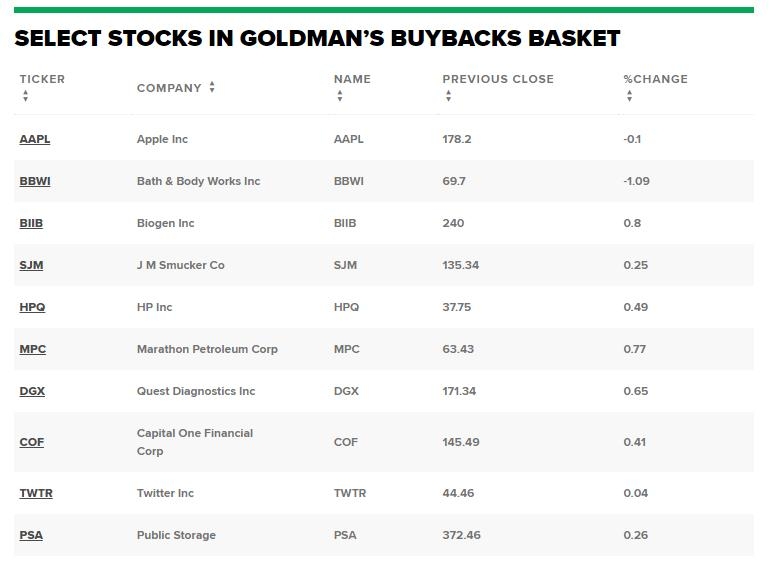

- Apple Inc. (AAPL): Apple, a technology giant, has been a major player in the US stock market. Since its initial public offering (IPO) in 1980, the company has grown exponentially, making it one of the most valuable companies in the world.

- Amazon.com Inc. (AMZN): Amazon, another technology giant, has revolutionized the retail industry. Since its IPO in 1997, the company has become a dominant force in e-commerce and cloud computing.

- Tesla, Inc. (TSLA): Tesla, an electric vehicle manufacturer, has seen a meteoric rise in the stock market. Since its IPO in 2010, the company has become a symbol of the shift towards sustainable transportation.

In conclusion, the US stock market is a complex and dynamic environment that requires careful analysis and strategic planning. By understanding its history, major exchanges, trading hours, and investment strategies, investors can make informed decisions and potentially achieve significant returns.