In the bustling world of commodities, palladium has emerged as a key player, often overshadowed by its more prominent cousin, platinum. But why is it that investors are increasingly looking towards US palladium stocks? This article delves into the significance of these stocks, their market dynamics, and what makes them a compelling investment opportunity.

The Significance of Palladium

Palladium is a rare and precious metal, known for its high catalytic activity. Unlike gold and silver, palladium is not often used for investment purposes. However, its importance in various industrial applications makes it a crucial component of the global commodities market. Here are some key points to consider:

- Automotive Industry: Approximately 80% of palladium demand comes from the automotive industry, particularly in the production of catalytic converters. As environmental regulations tighten, the demand for palladium is expected to rise further.

- Electronics and Chemicals: Palladium is also used in various electronic devices and in the chemical industry for its unique properties.

The US Palladium Market

The US palladium market has seen significant growth over the years, thanks to the country's robust industrial sector. Here are some key aspects to consider:

- Production: The US is one of the largest palladium producers in the world, with mines located in states like Montana and Idaho.

- Imports: The US also imports palladium from other countries, with Russia and South Africa being the primary suppliers.

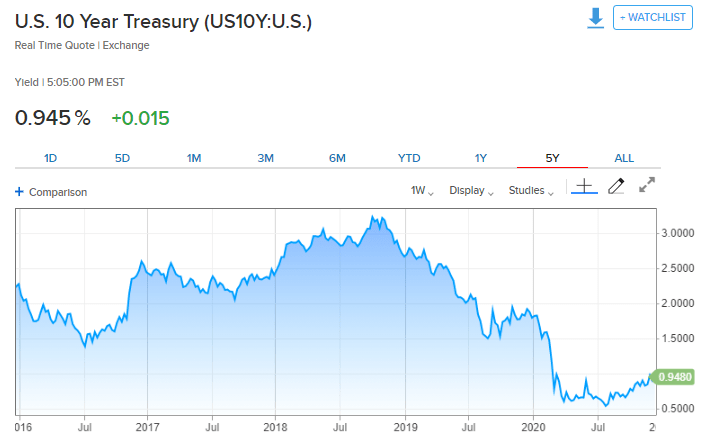

- Price Volatility: The price of palladium is highly volatile, often influenced by factors such as supply and demand, geopolitical events, and changes in the automotive industry.

Investing in US Palladium Stocks

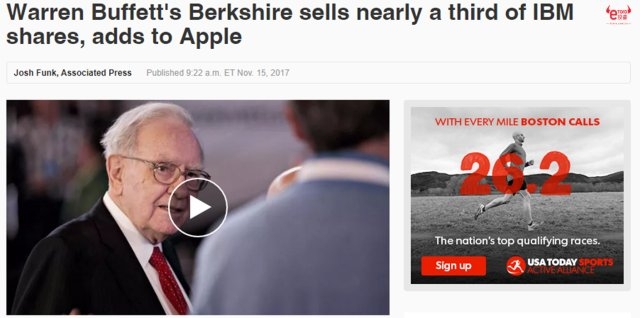

Investing in US palladium stocks can be a lucrative opportunity for investors looking to diversify their portfolios. Here are some key reasons to consider these stocks:

- Growth Potential: With the increasing demand for palladium, companies involved in its production and supply are expected to see significant growth.

- Market Leaders: The US has several leading palladium producers and refiners, such as Stillwater Mining and North American Palladium.

- Market Dynamics: Understanding the market dynamics and the factors influencing palladium prices is crucial for making informed investment decisions.

Case Studies: Successful US Palladium Stocks

- Stillwater Mining: A leading palladium producer, Stillwater Mining has seen consistent growth in its revenue and market capitalization over the years.

- North American Palladium: Another key player in the US palladium market, North American Palladium has demonstrated strong performance in terms of production and profitability.

Conclusion

In conclusion, US palladium stocks offer a compelling investment opportunity for those looking to capitalize on the growing demand for palladium. With a strong industrial base and market leaders in the field, the US palladium market is set to thrive in the coming years. By understanding the market dynamics and the factors influencing palladium prices, investors can make informed decisions and potentially reap substantial returns.