The stock market in the United States has long been a cornerstone of the global financial system. For investors and traders alike, understanding how the US stock market operates is crucial for making informed decisions. This article delves into the intricacies of the US stock market, offering insights into its history, key players, and strategies for navigating its complexities.

A Brief History of the US Stock Market

The origins of the US stock market can be traced back to the early 18th century. However, it was the establishment of the New York Stock Exchange (NYSE) in 1792 that marked the beginning of a formalized stock market in the United States. Since then, the market has grown exponentially, becoming one of the most influential and liquid markets in the world.

Key Players in the US Stock Market

The US stock market is a bustling hub of activity, with a variety of players involved in its operation. These include individual investors, institutional investors, such as mutual funds and pension funds, and market makers. Each of these players plays a crucial role in the market's functioning.

Individual Investors

Individual investors are the backbone of the stock market. They include retail investors, who trade stocks on their own behalf, and day traders, who buy and sell stocks within a short period of time. These investors are responsible for driving the demand and supply of stocks, influencing their prices.

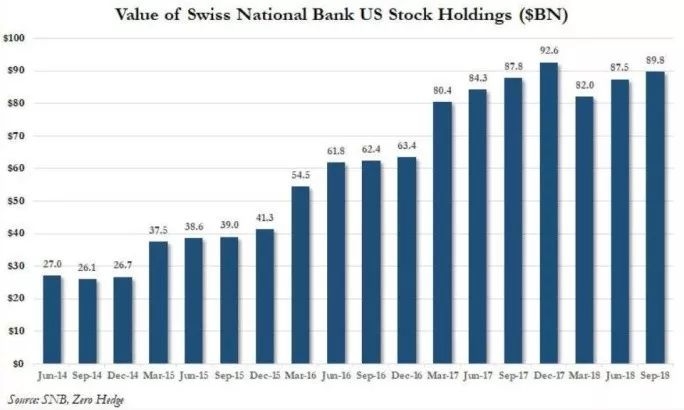

Institutional Investors

Institutional investors, such as mutual funds, pension funds, and insurance companies, are among the largest participants in the US stock market. They invest large sums of money on behalf of their clients and are known for their long-term investment strategies.

Market Makers

Market makers are individuals or firms that facilitate the trading of stocks by providing liquidity. They buy and sell stocks to ensure that there is a continuous flow of buying and selling, helping to maintain fair and efficient markets.

Navigating the US Stock Market

Understanding how to navigate the US stock market is essential for investors. Here are some key strategies:

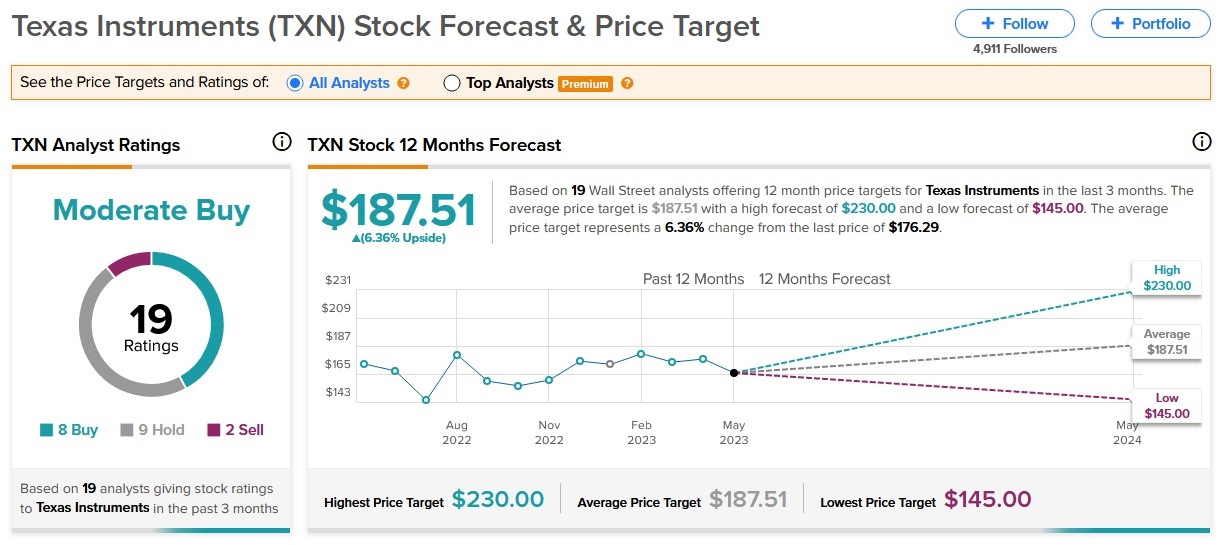

1. Research and Analysis

Before investing in the stock market, it is crucial to conduct thorough research and analysis. This includes analyzing financial statements, understanding the company's business model, and keeping an eye on market trends.

2. Risk Management

Investing in the stock market involves risk. It is important to manage these risks by diversifying your portfolio and setting realistic investment goals.

3. Patience and Discipline

The stock market can be volatile, and it is important to remain patient and disciplined. Avoid making impulsive decisions based on short-term market movements.

Case Studies

To illustrate the dynamics of the US stock market, let's consider a few case studies:

Case Study 1: Apple Inc.

Apple Inc. has been a dominant player in the technology sector for years. Its stock has seen significant growth over the years, making it a popular investment choice for both individual and institutional investors.

Case Study 2: Tesla, Inc.

Tesla, Inc. has gained immense popularity in the electric vehicle (EV) space. Its stock has experienced a rollercoaster ride, reflecting the company's rapid growth and the evolving nature of the EV market.

In conclusion, the US stock market is a dynamic and complex marketplace. Understanding its intricacies, key players, and strategies for navigating it is crucial for investors looking to achieve their financial goals.