In the ever-evolving world of finance, the stock market plays a pivotal role in reflecting the economic health of a nation. The United States stock market, in particular, has been a barometer of economic prosperity and investor sentiment. This article delves into a 10-year graph of the US stock market, analyzing its trends, performance, and the factors that have influenced it.

Understanding the 10-Year Graph

The 10-year graph of the US stock market provides a comprehensive view of its performance over a significant period. It showcases the ups and downs, the bull markets, and bear markets, giving investors and analysts valuable insights into the market's behavior.

Key Highlights of the 10-Year Graph

Bull Market Phase (2013-2019): The graph illustrates a strong bull market phase during this period. The S&P 500, a widely followed index, surged by over 300%, reflecting the robust economic growth and investor optimism.

COVID-19 Pandemic (2020): The graph shows a significant drop in the stock market in March 2020, following the outbreak of the COVID-19 pandemic. However, it quickly recovered, showcasing the resilience of the market.

Post-Pandemic Growth (2021-2023): The graph indicates a steady growth phase post-pandemic, with the stock market continuing to perform well despite the economic challenges.

Factors Influencing the Stock Market

Several factors have influenced the performance of the US stock market over the past 10 years. Some of the key factors include:

Economic Growth: The US economy has experienced steady growth during this period, driven by factors like low unemployment rates and strong consumer spending.

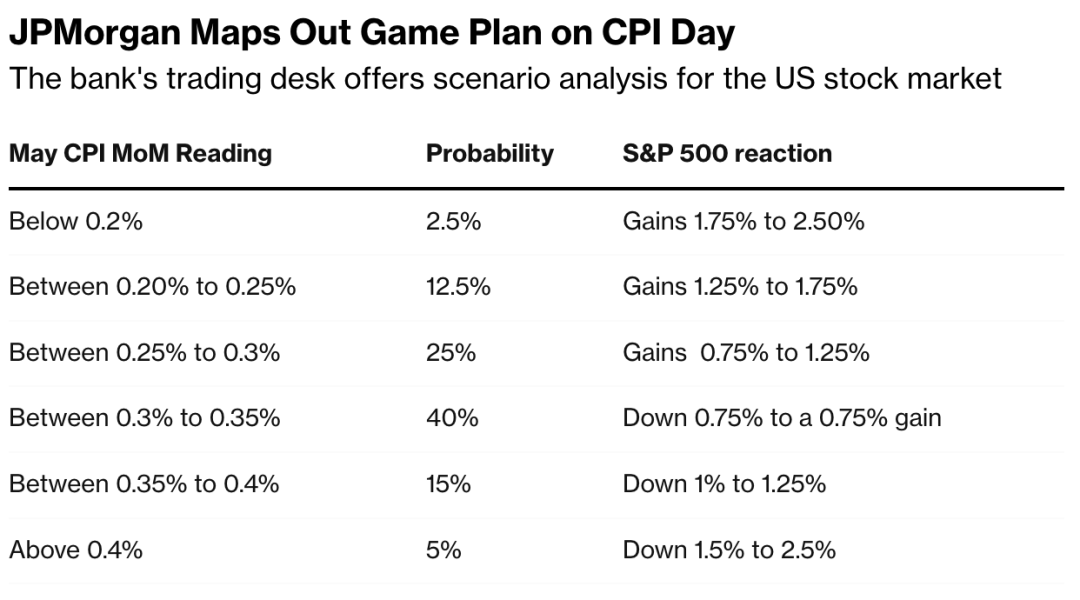

Monetary Policy: The Federal Reserve's monetary policy has played a crucial role in shaping the stock market. Lower interest rates have encouraged borrowing and investment, boosting market performance.

Technology Sector: The technology sector has been a significant driver of the stock market's growth. Companies like Apple, Microsoft, and Amazon have seen substantial growth, contributing to the overall market performance.

Geopolitical Events: Global events, such as trade wars and political tensions, have also influenced the stock market. These events have caused volatility, but the market has generally shown resilience.

Case Studies

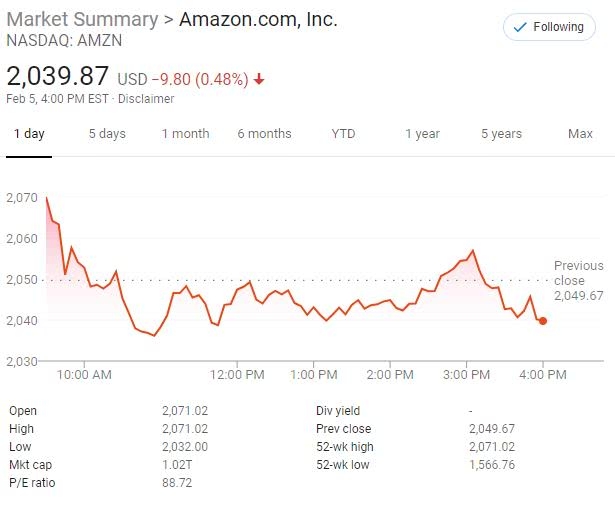

Amazon's Growth: Amazon's meteoric rise over the past decade has been a key driver of the stock market's growth. The company's market capitalization has increased significantly, reflecting its dominance in the e-commerce sector.

Tesla's Impact: Tesla's entry into the stock market has had a significant impact on the market's performance. The company's growth and innovation have captured investor attention, leading to increased market capitalization.

Conclusion

The 10-year graph of the US stock market offers valuable insights into its performance and the factors influencing it. While it has experienced ups and downs, the overall trend has been positive, reflecting the resilience and strength of the market. As investors and analysts continue to monitor the stock market, understanding its past performance and future potential remains crucial.