As we edge closer to 2025, the financial landscape is evolving at a rapid pace. Investors are keen on identifying the top US bank stocks that hold promising prospects for the coming year. This article delves into the outlook for the top US bank stocks in 2025, analyzing factors that could impact their performance and potential growth opportunities.

Economic Factors Influencing Top US Bank Stocks

Several economic factors will play a pivotal role in shaping the outlook for top US bank stocks in 2025. Here are some key considerations:

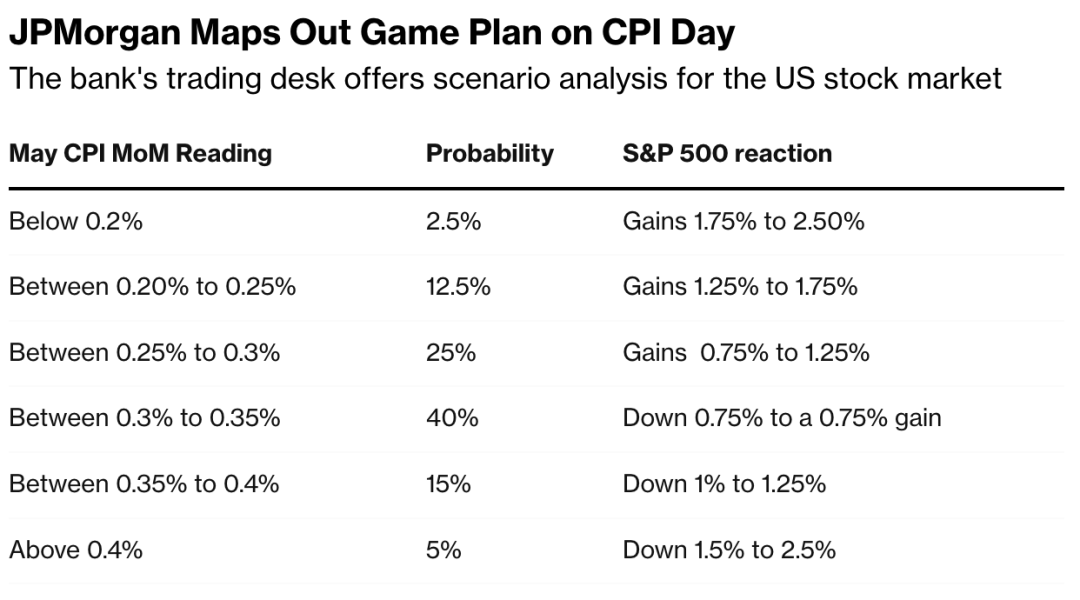

1. Interest Rates: The Federal Reserve's monetary policy, particularly interest rates, will significantly influence bank stocks. Higher interest rates can boost banks' net interest margins, while lower rates may have the opposite effect.

2. Economic Growth: A robust economic environment can lead to increased lending and higher profits for banks. Conversely, a slowdown in economic growth may put downward pressure on bank stocks.

3. Regulatory Changes: Changes in regulations can impact banks' profitability and growth prospects. It's essential to keep an eye on any new regulations that could affect the banking industry.

Top US Bank Stocks to Watch in 2025

Here are some of the top US bank stocks that investors should consider for their 2025 outlook:

1. JPMorgan Chase & Co. (NYSE: JPM)

JPMorgan Chase is one of the largest banks in the US and a leader in global finance. With a strong presence in investment banking, retail banking, and asset management, JPMorgan Chase is well-positioned to capitalize on various growth opportunities in 2025.

2. Bank of America Corporation (NYSE: BAC)

Bank of America is another major US bank with a diversified business model. The company has a strong presence in retail banking, commercial banking, and wealth management. Its strategic focus on digital banking and innovation could further enhance its competitive edge.

3. Wells Fargo & Company (NYSE: WFC)

Wells Fargo has been facing challenges in recent years but is making strides in improving its operations and reputation. The bank has a robust retail banking network and is working on expanding its wealth management and commercial banking segments.

4. Citigroup Inc. (NYSE: C)

Citigroup is a global financial institution with a strong presence in the US, Asia, and Europe. The company has been focusing on cost-cutting and improving efficiency, which should help it achieve better performance in 2025.

5. Goldman Sachs Group Inc. (NYSE: GS)

Goldman Sachs is a leading investment bank with a diverse range of financial services. The company has been successful in navigating the challenging market environment and is well-positioned to continue growing in 2025.

Case Study: JPMorgan Chase's Recent Initiatives

A recent example of JPMorgan Chase's efforts to enhance its performance is the launch of its "New Day" initiative. This initiative aims to drive innovation and growth in key areas such as technology, customer experience, and sustainability. By investing in these areas, JPMorgan Chase is aiming to stay ahead of the competition and achieve sustainable growth in 2025.

In conclusion, the top US bank stocks in 2025 will be influenced by various economic factors and industry trends. Investors should keep a close eye on the performance of major banks like JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Goldman Sachs as they navigate the evolving financial landscape. By considering factors such as interest rates, economic growth, and regulatory changes, investors can make informed decisions and identify promising opportunities in the top US bank stocks for 2025.