In the dynamic world of stock trading, staying ahead of the curve is crucial. The past five days have seen a surge in momentum for several large-cap stocks in the United States. This article delves into the top performers and analyzes the factors contributing to their recent rise.

Understanding Large Cap Stocks

Large-cap stocks refer to shares of companies with a market capitalization of over $10 billion. These companies are typically well-established and have a strong track record of performance. They often dominate their respective industries and are considered to be less risky compared to smaller companies.

Top Performing Stocks

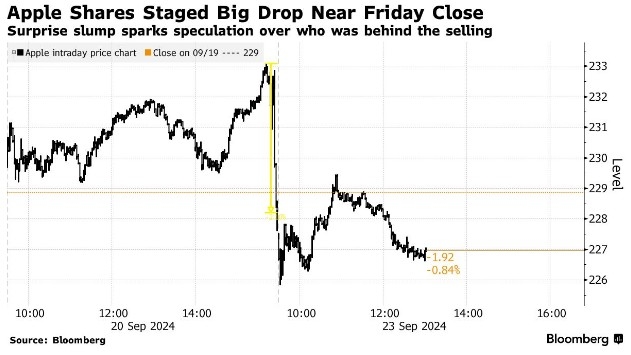

- Apple Inc. (AAPL)

Apple has been a top performer over the past five days, with its stock price surging on strong earnings reports and positive market sentiment. The tech giant's robust product lineup, including the iPhone 14 and MacBook Air, has fueled investor confidence.

- Microsoft Corporation (MSFT)

Microsoft has also seen significant momentum, driven by its cloud computing division and strong performance in the enterprise market. The company's recent acquisition of Nuance Communications has further bolstered its position in the AI and healthcare sectors.

- Amazon.com, Inc. (AMZN)

Amazon has been on a roll, with its stock price reaching new highs. The e-commerce giant's expansion into new markets, such as cloud computing and healthcare, has contributed to its impressive performance.

- Facebook, Inc. (META)

Once known as Facebook, the social media giant has been making a comeback, with its stock price rising on strong user growth and increased ad revenue. The company's focus on metaverse and virtual reality technologies has also caught investors' attention.

Factors Contributing to Momentum

Several factors have contributed to the recent surge in momentum for these large-cap stocks:

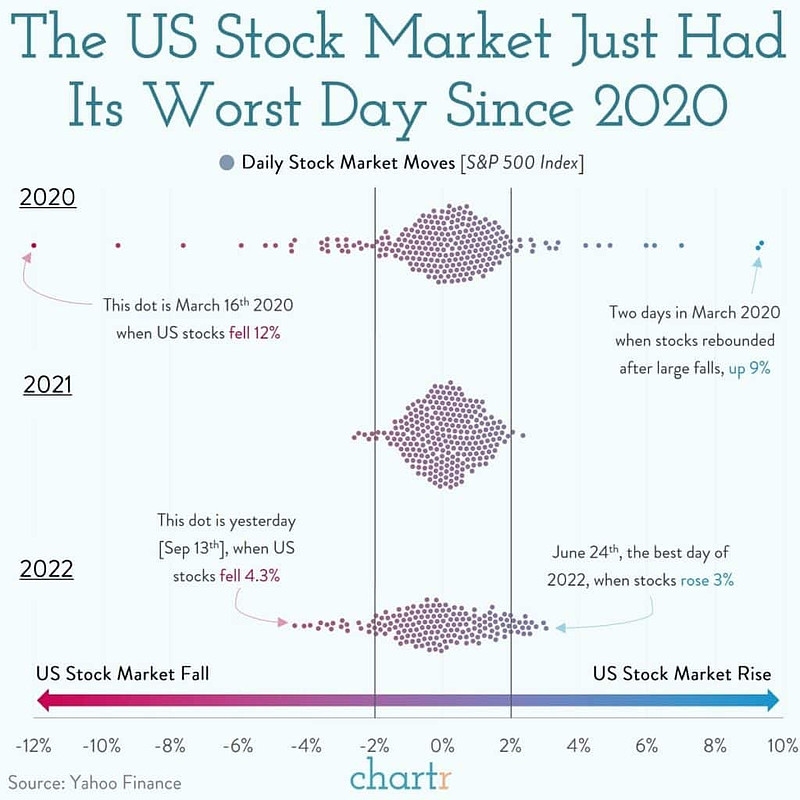

Economic Recovery: The global economy is gradually recovering from the COVID-19 pandemic, leading to increased consumer spending and corporate earnings.

Low Interest Rates: The Federal Reserve's low-interest-rate policy has made borrowing cheaper, allowing companies to invest in growth opportunities and expand their operations.

Technological Advancements: The rapid pace of technological innovation has created new opportunities for large-cap companies to diversify their revenue streams and expand their market presence.

Increased Investor Confidence: The strong performance of these stocks has led to increased investor confidence, with many investors opting for large-cap stocks as a safe haven.

Case Study: Apple Inc.

To illustrate the impact of momentum on large-cap stocks, let's take a closer look at Apple:

Apple has seen its stock price surge by over 10% in the past five days. This surge can be attributed to several factors:

Strong Earnings Reports: The company reported strong earnings for the fiscal first quarter, with revenue and profit beating market expectations.

Product Launches: The launch of the iPhone 14 and MacBook Air has generated excitement among consumers and investors alike.

Global Supply Chain: Apple has been able to navigate the global supply chain challenges, ensuring a steady supply of its products.

Investor Sentiment: The strong performance of Apple has bolstered investor sentiment, leading to increased buying pressure on the stock.

In conclusion, the past five days have seen a surge in momentum for several large-cap stocks in the United States. Understanding the factors contributing to this momentum can help investors identify potential opportunities in the market. As always, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.