Introduction:

The Government Shutdown: The government shutdown of 2018-2019 began on December 22, 2018, and lasted until January 25, 2019. It was triggered by a budgetary impasse between the Democratic-controlled House of Representatives and the Republican-controlled Senate, led by President Donald Trump. The shutdown was caused by a lack of agreement on funding for a border wall between the United States and Mexico.

Impact on the Stock Market: The 2018-2019 government shutdown had a considerable impact on the stock market. Here are some key points to consider:

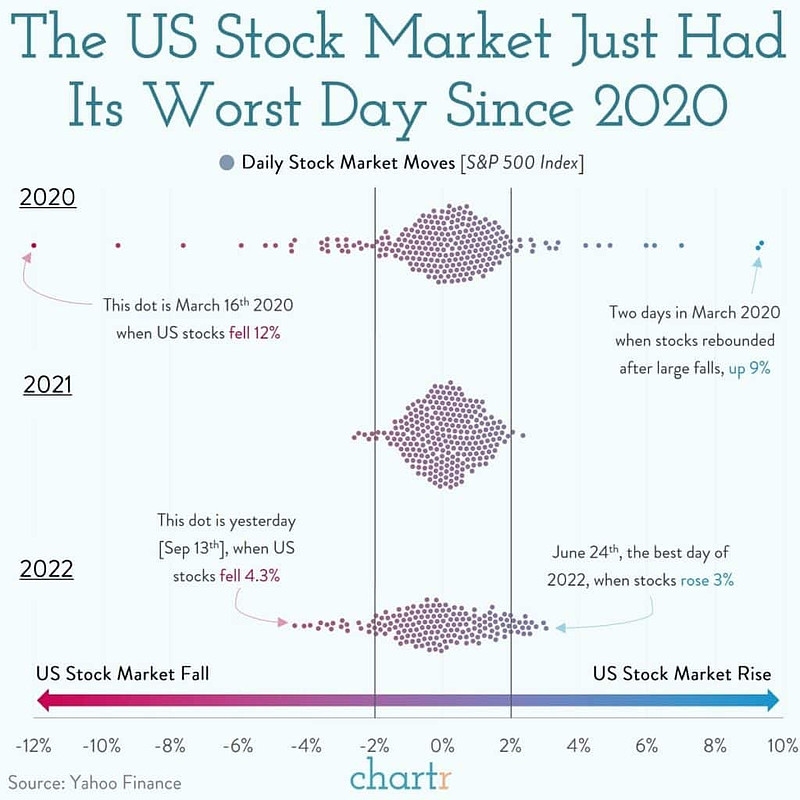

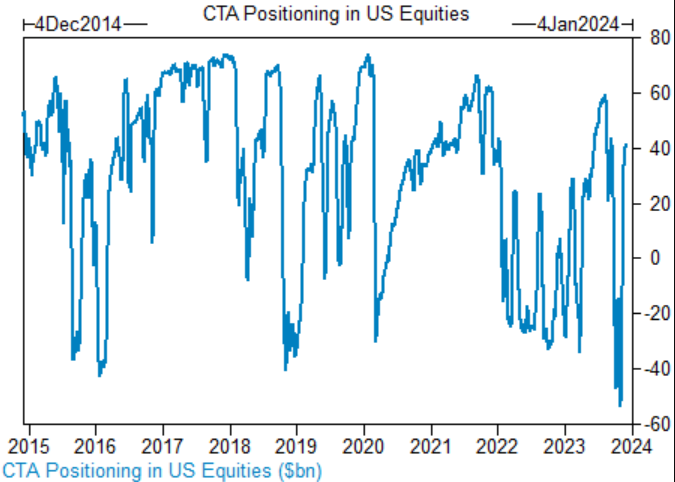

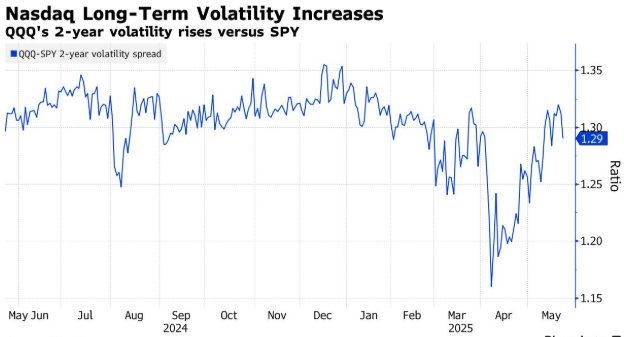

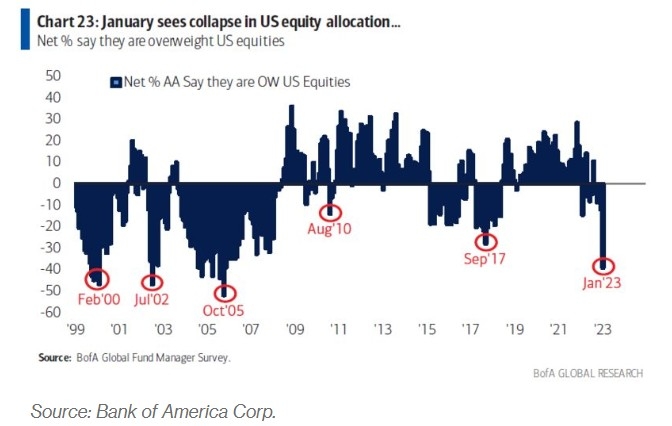

Market Volatility: The shutdown led to increased market volatility, as investors were uncertain about the future of the government and its policies. This uncertainty created a sense of caution among investors, resulting in a downward trend in the stock market.

Economic Uncertainty: The shutdown raised concerns about the government's ability to manage its finances and its impact on the economy. This uncertainty led to a decrease in consumer confidence, which in turn affected the stock market.

Government Contracts: Many government contracts were put on hold during the shutdown, which impacted companies that rely on these contracts. This led to a decline in the stock prices of companies involved in government contracts, such as defense contractors.

Consumer Spending: The shutdown also had a direct impact on consumer spending, as federal employees were furloughed or working without pay. This, in turn, affected companies that rely on government employees as customers, leading to a decline in their stock prices.

Case Study: Boeing: One notable example of the impact on the stock market was the situation with Boeing. During the shutdown, the Federal Aviation Administration (FAA) was unable to conduct inspections, which delayed the certification of Boeing's 737 Max aircraft. This caused a significant drop in Boeing's stock price, as investors worried about the long-term impact on the company.

Market Recovery: Despite the initial downturn, the stock market gradually recovered after the shutdown. This indicates that investors were optimistic about the government's ability to resolve its issues and restore economic stability.

Conclusion: The 2018-2019 government shutdown had a substantial impact on the stock market, causing increased volatility and economic uncertainty. While the market eventually recovered, the shutdown served as a reminder of the potential risks associated with political gridlock. Companies and investors must remain vigilant and be prepared to navigate such challenges in the future.