The first quarter of 2025 marked a pivotal period for the US stock market, as investors navigated a complex landscape of economic indicators, geopolitical tensions, and technological advancements. This article provides a comprehensive summary of the key trends and developments that shaped the US stock market during this crucial quarter.

Market Overview

The US stock market opened the year on a positive note, with the S&P 500 Index and the NASDAQ Composite both reaching new record highs. However, the momentum was short-lived as investors grappled with rising inflation, supply chain disruptions, and concerns about the global economic outlook.

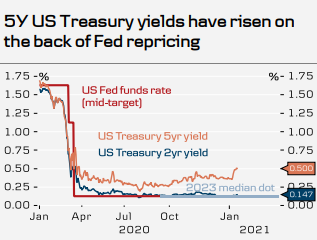

Inflation and Interest Rates

Inflation remained a major concern for investors during the first quarter. The Consumer Price Index (CPI) showed a year-over-year increase of 4.2% in March, slightly above the Federal Reserve's target of 2%. In response, the Federal Reserve raised interest rates by 25 basis points in March, marking the first rate hike since 2018.

Tech Stocks and Growth Stocks

Tech stocks, particularly those in the FAANG (Facebook, Amazon, Apple, Netflix, and Google) group, experienced a significant downturn during the first quarter. Concerns about rising interest rates and increased competition from regulators contributed to the sell-off. However, some tech giants like Apple and Microsoft managed to hold their ground, thanks to their strong fundamentals and diverse revenue streams.

On the other hand, growth stocks continued to outperform value stocks. Companies with high growth potential, such as biotech and renewable energy firms, saw strong gains during the quarter. This trend was partly driven by the Biden administration's focus on clean energy and healthcare.

Sector Performance

Several sectors performed well during the first quarter, while others struggled. The healthcare sector, led by companies like Johnson & Johnson and Pfizer, saw strong gains as investors bet on the potential of new drug therapies and vaccines. The financial sector also performed well, driven by rising interest rates and strong earnings reports from major banks.

In contrast, the energy sector struggled due to the ongoing supply chain disruptions and geopolitical tensions in the Middle East. The consumer discretionary sector also faced challenges as rising inflation eroded consumer spending power.

Case Study: Tesla

One of the most notable stories of the first quarter was the rise and fall of Tesla. The electric vehicle (EV) manufacturer saw its stock soar to new heights in early January, before experiencing a sharp decline in February. The stock's volatility was driven by a range of factors, including concerns about the company's production capacity and regulatory challenges in China.

Conclusion

The first quarter of 2025 was a challenging period for the US stock market, as investors grappled with a range of economic and geopolitical factors. Despite the volatility, the market managed to maintain its upward trajectory, driven by strong performance in certain sectors and the resilience of tech giants like Apple and Microsoft. As the year progresses, investors will need to stay vigilant and adapt to the evolving landscape to navigate the challenges ahead.