In the ever-evolving landscape of the US stock market, penny stocks have emerged as a trending investment option. These low-priced shares, typically trading for less than $5 per share, have been attracting the attention of both seasoned investors and novices alike. In this article, we will delve into the world of penny stocks, exploring their characteristics, risks, and potential for high returns.

Understanding Penny Stocks

Penny stocks are shares of small, often overlooked companies that trade on exchanges like the OTCBB or Pink Sheets. They are known for their low share prices, which can make them more accessible to retail investors. However, it's important to note that these stocks are also highly speculative and carry significant risks.

Characteristics of Penny Stocks

- Low Share Price: As mentioned earlier, penny stocks are characterized by their low share price, typically below $5.

- Small Market Capitalization: These companies often have a small market capitalization, making them less established than larger corporations.

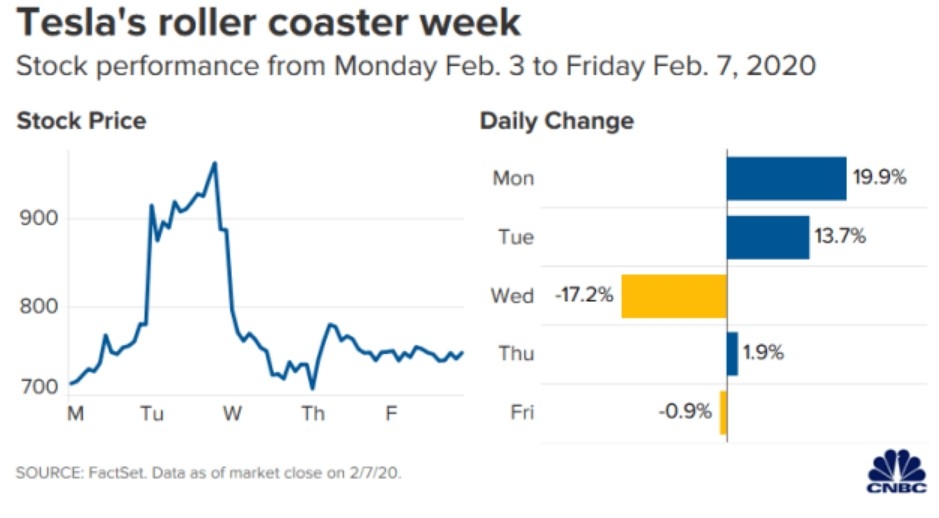

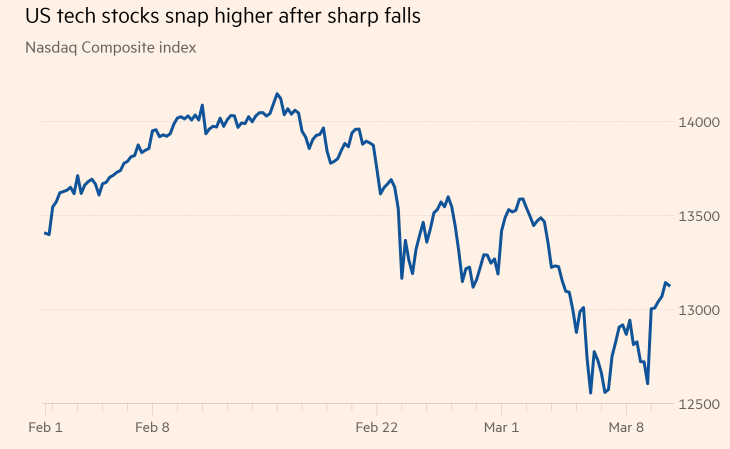

- High Volatility: Due to their speculative nature, penny stocks can experience significant price fluctuations in a short period of time.

- High Risk: Investing in penny stocks carries a higher risk of losing your investment compared to investing in larger, more established companies.

Risks of Investing in Penny Stocks

While penny stocks can offer high returns, they also come with significant risks. Here are some of the key risks to consider:

- Lack of Transparency: Many penny stocks are not subject to the same level of regulatory oversight as larger companies, which can make it difficult for investors to gather accurate and timely information.

- Market Manipulation: Penny stocks are often targeted by market manipulators, who may engage in fraudulent activities to drive up share prices.

- Liquidity Issues: Some penny stocks may have low trading volume, which can make it challenging to buy or sell shares at a fair price.

Potential for High Returns

Despite the risks, penny stocks can offer the potential for high returns. Here are a few factors that contribute to this potential:

- Growth Potential: Some penny stocks represent small companies with high growth potential, which can lead to significant returns.

- Market Speculation: The speculative nature of penny stocks can drive up share prices, even if the underlying company's fundamentals are weak.

- Dividends: While many penny stocks do not pay dividends, some may offer dividend payments, which can provide a source of income.

Case Studies

To illustrate the potential of penny stocks, let's look at a few case studies:

- Agora Inc. (NASDAQ: AGRX): Once a penny stock, Agora Inc. has seen its share price soar after successfully transitioning from a content provider to a financial technology company.

- Palantir Technologies (NYSE: PLTR): Palantir, another former penny stock, has become a leading provider of data analytics solutions, with its share price skyrocketing as a result.

Conclusion

Penny stocks can be a highly speculative and risky investment, but they also offer the potential for high returns. As with any investment, it's crucial to conduct thorough research and understand the risks involved before investing in penny stocks. By doing so, investors can make informed decisions and potentially reap the rewards of this trending segment of the US stock market.