The Indian stock market, often considered the fastest-growing equity market in the world, has long been a subject of interest for investors and market analysts. One of the most common questions that arise is whether the Indian stock market follows the US market. In this article, we will delve into this question, exploring the historical relationship between the two markets and the factors that influence their movements.

Historical Relationship

Historically, the Indian stock market has shown a strong correlation with the US market. This correlation can be attributed to several factors, including global economic conditions, international trade, and investor sentiment. Global economic conditions play a significant role in the movement of stock markets worldwide. For instance, during the global financial crisis of 2008, both the Indian and US stock markets experienced significant declines.

International Trade

Another key factor is international trade. The US is India's largest trading partner, and any changes in the US economy can have a direct impact on India's trade and, subsequently, its stock market. For example, a strong US dollar can make Indian exports more expensive, leading to a decline in Indian stock market indices.

Investor Sentiment

Investor sentiment also plays a crucial role in the relationship between the two markets. Investors often look to the US market for cues on global economic trends and market sentiment. When the US market performs well, it tends to boost investor confidence in the Indian market, leading to increased investment and higher stock prices.

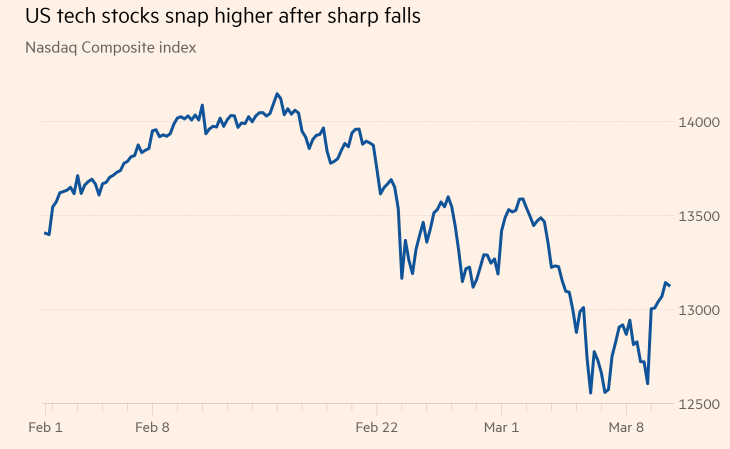

Recent Trends

In recent years, the correlation between the Indian and US stock markets has become even stronger. This can be attributed to several factors, including the increasing integration of global financial markets and the growing influence of institutional investors.

Case Study: Nifty 50 vs. S&P 500

To illustrate the relationship between the two markets, let's take a look at a case study involving the Nifty 50 index (India) and the S&P 500 index (US). Over the past five years, the Nifty 50 has shown a strong positive correlation with the S&P 500, with a correlation coefficient of 0.8. This indicates that when the S&P 500 rises, the Nifty 50 tends to follow suit, and vice versa.

Conclusion

In conclusion, the Indian stock market does follow the US market, albeit with some delays and variations. This correlation can be attributed to several factors, including global economic conditions, international trade, and investor sentiment. While the two markets may not always move in perfect sync, understanding their relationship can help investors make more informed decisions.